Free Masterclass Reveals 5 Key Money Moves Before 2026 Arrives

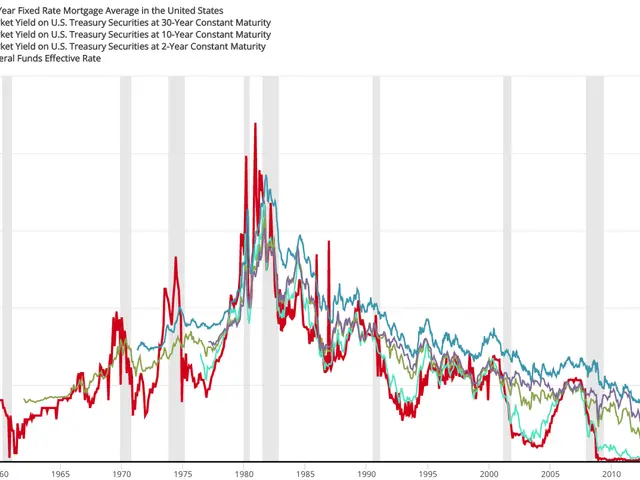

Mills Wealth Advisors, LLC, a Southlake, Texas-based SEC-registered investment adviser, is hosting a free online masterclass on Friday, November 14, 2025. The event, 'Mortgages and Money: 5 Money Tips to Finish Out 2025 and Where We Think Rates are Headed in 2026', will be co-presented by Stephen Nelson, CFP®, CEPA®, AIF®, and Tracy On, PMP®, CSM®.

As of December 31, 2024, Mills Wealth Advisors managed approximately $440 million in assets, including $402 million in discretionary and $38 million in non-discretionary client assets, plus $3.27 million under advisement. The masterclass will discuss practical steps households can take before December 31 to strengthen their 2026 financial position. This includes aligning retirement plan deferrals with 2025 limits and considering required minimum distributions (RMDs) for those aged 73 and above.

The event will also cover the timing rules for charitable gifts and capital-loss realization by year-end. Additionally, it will provide guidance on building a simple planning cadence around mortgage rate dynamics. The IRA contribution limit for 2025 remains $7,000, with a $1,000 catch-up for those aged 50 and older. The employee deferral limit for 401(k), 403(b), and similar workplace plans is $23,500, with a $1,000 catch-up for those aged 50 and older. Qualified charitable distributions from IRAs remain available beginning at age 701⁄2, subject to annual limits indexed for inflation.

Join Mills Wealth Advisors' free online masterclass on November 14, 2025, to gain insights into year-end financial planning, IRA contributions, RMDs, charitable gifts, and mortgage rate dynamics. The event is designed to help attendees strengthen their financial position as they head into 2026.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting