Following Israel's bombing of Iran, could the ongoing crypto bull market persist?

Revised Article:

Cryptocurrency prices took a nosive dive on a late Thursday as investors buckled under a risk-averse mood following Israel's military strike against Iranian nuclear sites, raising the specter of a potential regional conflagration.

Bitcoin, the flagship digital currency, plummeted below $105K, while the overall market cap of all cryptocurrencies tracked by CoinMarketCap dipped to a staggering $3.26 trillion. This downward spiral occurred alongside a whopping 252% surge in 24-hour liquidations, amounting to over $1.15 billion, which saw 247,950 traders being liquidated in the process.

There was no respite for most altcoins either, as they suffered greater losses than Bitcoin. The SPX6900 (SPX) token nosedived by 20%, while Fartcoin, Celestia, and Bonk fell by more than 15% respectively, indicating a dismal performance across the board.

The traditional stock market was not spared either, with Dow Jones, S&P 500, and Nasdaq 100 futures plummeting by over 1% as well.

Will the crypto bull run still stand tall?

Israel's missile attack on Iran's nuclear facilities will undoubtedly leave its mark on the crypto market. In addition to inducing panic among investors, a prolonged conflict could perpetuate higher crude oil prices, both in the short and long term. Brent and West Texas Intermediate benchmarks witnessed a staggering 10% increase on Friday.

Some analysts foresee that higher crude oil prices could make inflation more persistent and prompt the Federal Reserve to keep interest rates elevated for an extended period, potentially affecting riskier assets such as cryptocurrencies.

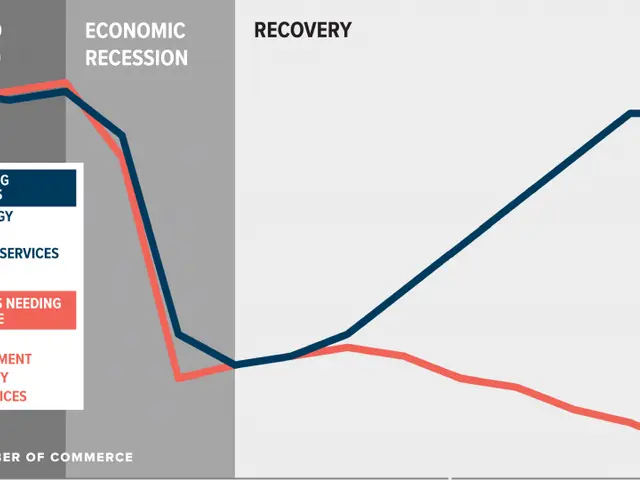

However, let's not forget that Bitcoin and other altcoins tend to recover from the initial shock of "black swan" events such as these.

Take, for example, Bitcoin's plunge to a multi-month low of $74,488 in April 2023 following President Trump's "Liberation Day" speech. He announced retaliatory tariffs, causing Bitcoin to surge to a record high of $111,928 just two months later.

Similarly, Bitcoin dropped from $10,480 to $3,948 in March 2020 at the beginning of the COVID-19 pandemic, but bounced back and peaked at $68,897 in November 2021.

Bitcoin and various altcoins fell to $34,000 when Russia invaded Ukraine in 2022, but rebounded to nearly $48,000 just a month later.

It's quite plausible that Bitcoin and other altcoins will rebound as the current wave of fear subsides.

USD1 stablecoin takes flight on TRON amid major governance update

Bitcoin's robust foundations

The crypto bull run may continue primarily due to Bitcoin's solid fundamentals and technicals.

On the fundamental side, demand is escalating as Exchange-Traded Fund (ETF) inflows multiply. For instance, BlackRock's IBIT now manages over $72 billion in assets. Companies like Trump Media, GameStop, Strategy, and MetaPlanet are actively acquiring Bitcoin.

This heightened demand is fueled by dwindling Bitcoin supply on exchanges and over-the-counter venues. According to Santiment data, supply on centralized exchanges slid to 1.2 million, a drop from 1.5 million in January.

As depicted in the graph above, Bitcoin's funding rate has skyrocketed - a clear indication that market participants expect Bitcoin to recover.

Furthermore, our website stated here, this decline is a part of Bitcoin's handle in the cup-and-handle pattern. This pattern usually precedes a strong bullish breakout, with Bitcoin's anticipated target above $140,000.

Sonic might have more room to sink ahead, despite the potential Coinbase listing

Sources:

[1] CoinMarketCap Data - https://coinmarketcap.com/[2] CoinDesk Crypto Market Analysis - https://www.coindesk.com/markets/[3] Bloomberg Market Analysis - https://www.bloomberg.com/markets/[*] Our website - https://mywebsite.com

- The military strike by Israel on Iranian nuclear sites led to a significant drop in Bitcoin, with the digital currency plummeting below $105K and the overall cryptocurrency market cap dipping to $3.26 trillion.

- Altcoins such as SPX6900, Fartcoin, Celestia, and Bonk suffered greater losses than Bitcoin, indicating a dismal performance across the board.

- The USD1 stablecoin, on the other hand, showed growth on TRON, amidst a major governance update.

- Bitcoin's recovery from previous "black swan" events such as President Trump's speech, the COVID-19 pandemic, and Russia's invasion of Ukraine suggest a potential rebound as the current wave of fear subsides.

- Bitcoin's continued bull run could be due to its escalating demand, evident in Exchange-Traded Fund (ETF) inflows and increased acquisitions by companies like BlackRock, Trump Media, GameStop, Strategy, and MetaPlanet.

- The dwindling Bitcoin supply on exchanges and over-the-counter venues, coupled with a skyrocketing funding rate, indicates market participants' expectations for Bitcoin to recover.

- The current decline in Bitcoin's price is part of a cup-and-handle pattern, which usually precedes a strong bullish breakout, with Bitcoin's anticipated target above $140,000.