Five Below’s Bold Strategy Sends Stock Soaring 79% in 2025

Discount retailer Five Below has seen a sharp rise in sales and stock value under new leadership. The company’s latest pricing strategy and store expansion plans have driven strong financial results in 2025. Shareholders have already reaped significant rewards from the changes.

Winnie Park took over as CEO of Five Below around a year before January 2026, bringing experience from her previous role at Forever 21. Since her arrival, the company’s stock valuation has climbed steadily.

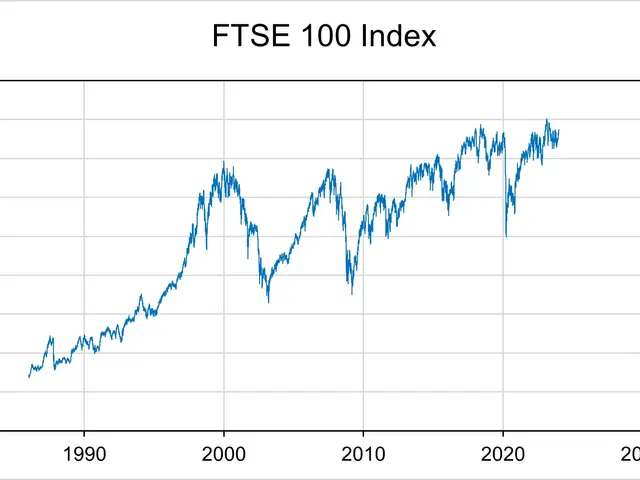

The retailer abandoned its separate Five Beyond concept, which sold higher-priced items in dedicated sections. Instead, it began integrating more expensive products across all stores. This shift boosted both sales and profit margins. Same-store sales are projected to surge by 12.5% in 2025, a major improvement over previous years. Earnings per share (EPS) are also set to rise, reaching at least $6.10 compared to $4.60 in 2024. The company’s stock delivered a 79% return for shareholders in 2025, far exceeding the S&P 500’s 16% gain. With over 1,900 stores already open, Five Below plans to expand further. New locations recover their investment in roughly a year, making expansion a cost-effective way to grow. The long-term goal is to operate more than 3,500 stores nationwide.

The company’s revised pricing approach and rapid store openings have strengthened its financial position. Investors have benefited from a near-80% return in 2025, while higher earnings and sales growth point to continued momentum. Five Below’s strategy appears to be paying off as it pushes toward its expansion targets.