Financial Markets Face New Risks from Complex Securitisations

Financial markets are grappling with complex circularities and risks tied to credit securitisations. These practices, involving banks like PNC Bank and private credit funds, can rapidly spread losses and shocks, as highlighted by author Satyajit Das, known for his books 'Traders, Guns & Money', 'Extreme Money', and 'Banquet of Consequences'.

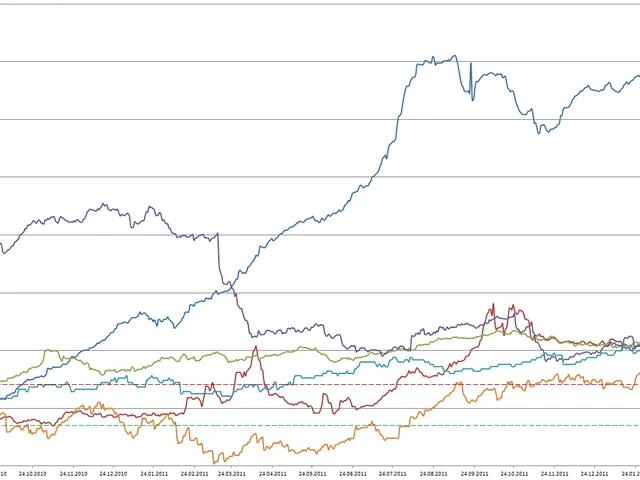

Securitisations, once seen as a way to diversify risks, now involve riskier assets like leveraged loans and subprime debt. This shift, coupled with potential mispricing of risks and underestimation of leverage, could fuel instability in a new crisis. AAA and AA-rated securities, used as collateral for borrowings, could suffer mark-to-market writedowns and trigger margin calls in case of defaults. Historical default probabilities may underestimate current risks due to factors like increased lending against intangible assets and potential underestimation of default correlations.

Banks like Capital One benefit from reduced capital requirements through securitisations, allowing for increased lending and improved return on capital. However, this also leads to a reduction in systemic capital available against default, as credit risk moves from regulated entities to unregulated shadow banks. The IMF has identified structured credit products like synthetic risk transfers (SRTs) and collateralised loan obligations (CLOs) as potential sources of vulnerabilities.

The complex interplay of banks, private credit funds, and securitisations poses significant risks to the financial system. As markets navigate these challenges, regulators and investors must remain vigilant to prevent a repeat of past crises.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting