Wall Street's Mixed Bag: Oracle Shines, Boeing Tumbles, and Gold Gains

Financial entities, including private investors, manage to stabilize Wall Street amid economic turbulence

The vibe on Wall Street was a rollercoaster on Thursday. While gold was in high demand, the dollar wasn't. Yet, the US indices closed in the green, thanks to stocks like Oracle and Curevac.

Oracle's Cloud Demand Shines, Stock Jumps 13%

The SAP rival's outstanding cloud demand helped Oracle beat market expectations in its quarterly results. This skyrocketed its stock by 13%. On the other hand, Tübingen-based biotech company, Curevac, was also in the limelight. Its shares soared nearly 40% due to a promising acquisition bid from Biontech for around $1.25 billion. Biontech's stock, however, was volatile, swinging between a 1.4% loss and a 2.4% gain, and finally closing down half a percent.

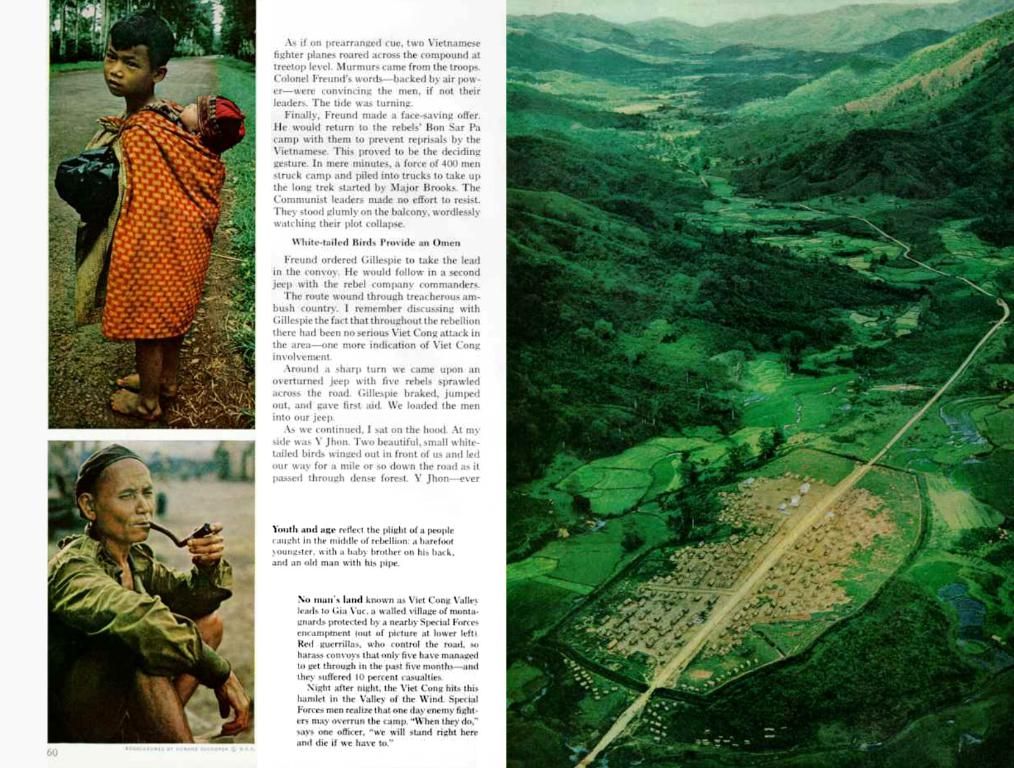

Boeing's Stock Plummets After Tragic Crash

In stark contrast, Boeing's shares took a nosedive, falling nearly 5%. The reason? A tragic plane crash involving a Boeing 787-8 Dreamliner. The plane, carrying 242 people, crashed into a residential area in India shortly after takeoff[5]. Although the exact cause of the crash is yet to be determined, Sam Stovall, chief strategist at CFRA Research, suggested it could be more related to maintenance issues rather than original equipment problems[5].

Gamestop's Stock Plunges After New Bond Offering

Another big headline was Gamestop, which announced a new bond offering, causing its stock to plunge more than 20%.

Investors Keep an Eye on Geopolitics

The geopolitical landscape was also a hot topic, with the International Atomic Energy Agency (IAEA) accusing Iran of violating its nuclear non-proliferation commitments[5]. Additionally, Iran's military started military maneuvers earlier than planned, according to state media[5]. This led experts like Kim Forrest, chief investment officer at Bokeh Capital Partners, to predict turbulent times ahead[5].

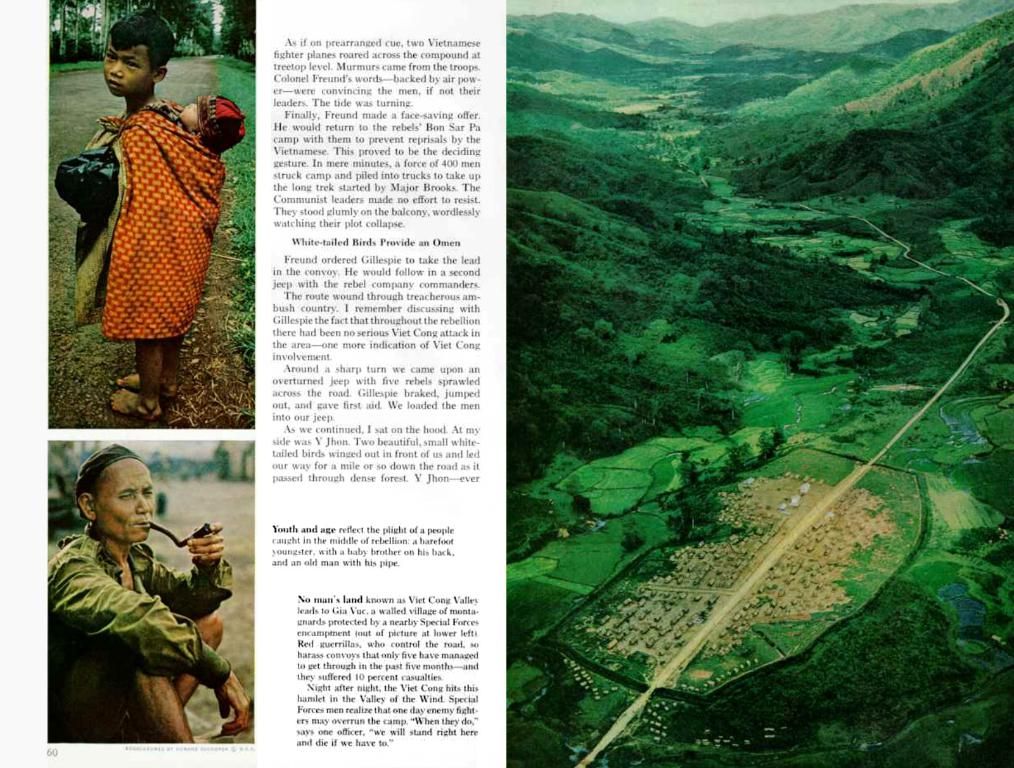

Gold Demand Soars, Dollar Dips, and Bitcoin Falters

Investor uncertainty was reflected in the commodity market. Gold, considered a safe haven in times of crisis, jumped nearly 1% to $3,385 per ounce[5]. Prices for Brent crude and US WTI oil both dipped by about half a percent to $69.30 and $67.85 per barrel, respectively[5].

The Dollar Index, which has lost around 10% this year, fell as much as one percent to 97.921 points, its lowest level since March 2022[5]. Interestingly, bitcoin also came under pressure, falling by around 2% to $106,638[5]. Timo Emden of the analysis firm Emden Research pointed out this could be due to investors' disappointment with the US-China trade agreement announced on Wednesday[5]. "Even if there weren't high expectations beforehand, market participants might have hoped for more specific details," said the expert[5]. Commerzbank analyst Thu Lan Nguyen described the "deal" reached between the US and China as "nothing more than hot air"[5]. "The likelihood increases that the other US trading partners will also struggle to secure any concessions regarding the reciprocal tariffs announced in early April, no matter how hard they try, by the end of the 90-day moratorium."

- Wall Street

- Dow Jones

- Stock prices

- Stock trading

- Geopolitics

- Commodities

- Cryptocurrencies

In the realm of Wall Street, the community policy regarding the impact of geopolitics on stock trading was under scrutiny, as geopolitical tensions with Iran led experts to predict turbulent times ahead. Additionally, the employment policy within the finance sector was seemingly affected by a significant event: the promising acquisition bid by Biontech for Curevac, causing Curevac's shares to soar.