Fed's Workforce to Shrink Approximately 10% over Coming Years

Heads Up! The Federal Reserve is Trimming Down

Get ready, folks! The Federal Reserve (Fed), the powerful institutional ally of your hard-earned bucks, is about to shed some weight. On a recent Friday, its president had the guts to announce they're chopping up to 10% of their workforce over the coming years, just like a well-oiled machine shedding excess baggage.

In an internal memo, Federal Reserve Chair Jerome Powell, dripping with candor, shared this revelation with the Associated Press. You know, because the whole world needs to know. The catalyst? Apparently, reviewing teams and resources periodically is an essential, healthy practice for any organization, even one as crucial and influential as the Fed.

Powell mentioned that the Fed has historically slimmed down when its work, priorities, or environment have shifted. This is nothing new, folks. It's like a cat trimming its fur when it gets too long—natural, right? He even brought up examples from the '90s and the present day—classic sensationalism, much like our reality TV stars.

These plans are unfolding at a time when the Trump administration is waging a war on excess federal workforce and Elon Musk, Trump's pet efficiency commissioner, has raised eyebrows with his accusations that the Fed is hoarding funds and filling up its offices with an excessive amount of staff. Musk, known for his sharp tongue, slammed the Fed for its costly renovations at their Washington headquarters, calling it "ridiculously overstaffed."

But don't feel sorry for the Fed chair yet. Trump, ever the critic, has been relentless in his criticism of the central bank and Powell, specifically for refusing to lower interests.

The Fed, impressively, is an independent agency that secures funding from financial securities it holds rather than relying on Congress. With over 23,000 employees across the U.S. in 2023, it'll take a significant cut for them to really feel the squeeze. Most of their staff, over 20,000 strong, are based outside Washington, at the regional banks. The projected 10% reduction, equivalent to about 2,400 jobs, will primarily target employees nearing retirement in Washington, D.C.

For those who decide to call it a career early, a tempting retirement package will be on offer. So, if you're an eligible employee, it's time to start polishing up your résumé and envisioning that golden retirement in the sun.

All in all, this workforce reduction is part of a strategic effort to streamline operations and align staff with the Fed's responsibilities as priorities and external conditions evolve. So, while some may see it as a lean-down, others see it as a lean-in—an opportunity to make the Fed more efficient, responsive, and ready for whatever future comes its way. We'll have to keep a close eye on this one, folks!

The upcoming workforce reduction at the Federal Reserve (Fed) could have a significant impact on the finance sector, given the Fed's influence on the nation's economy.

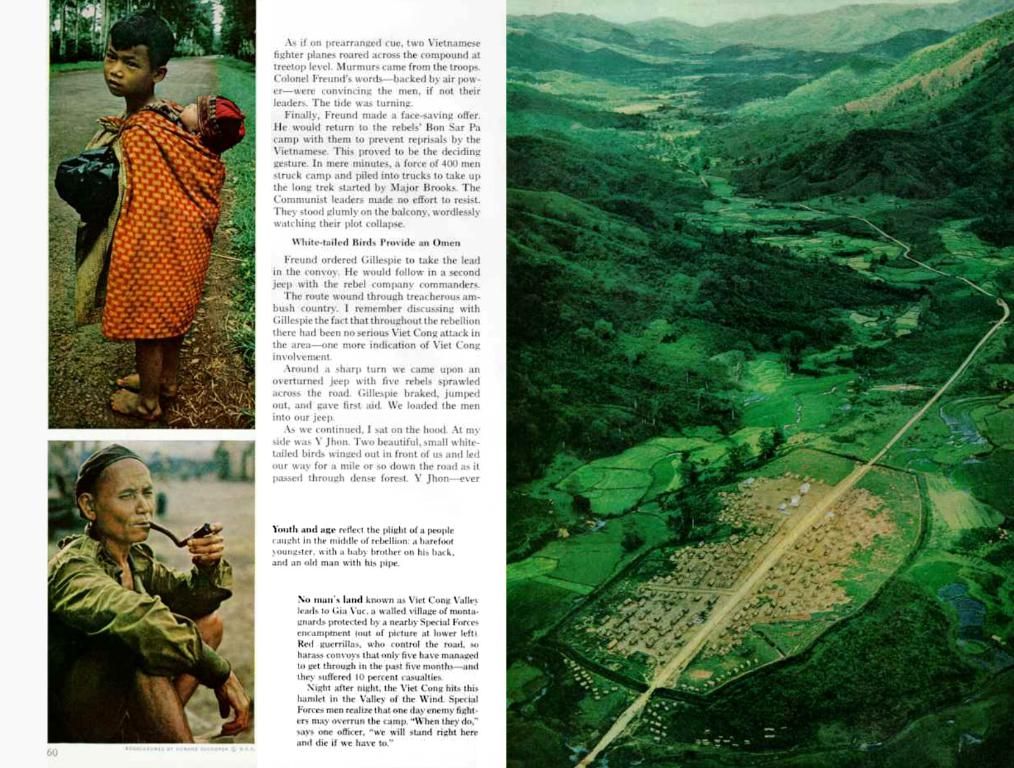

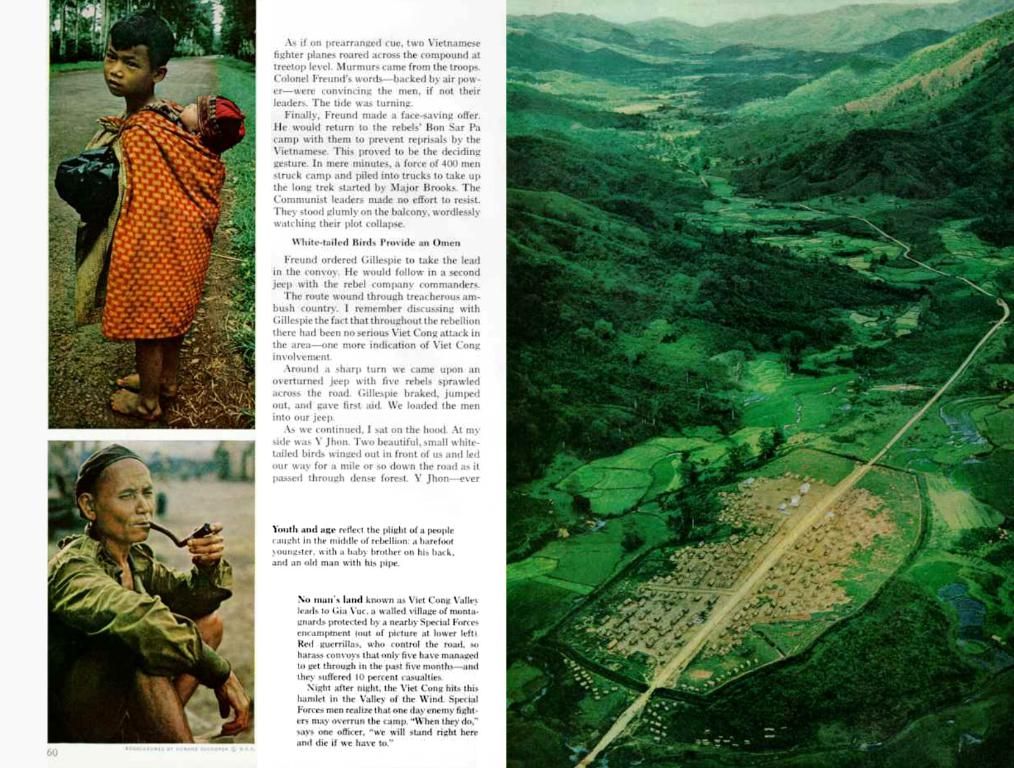

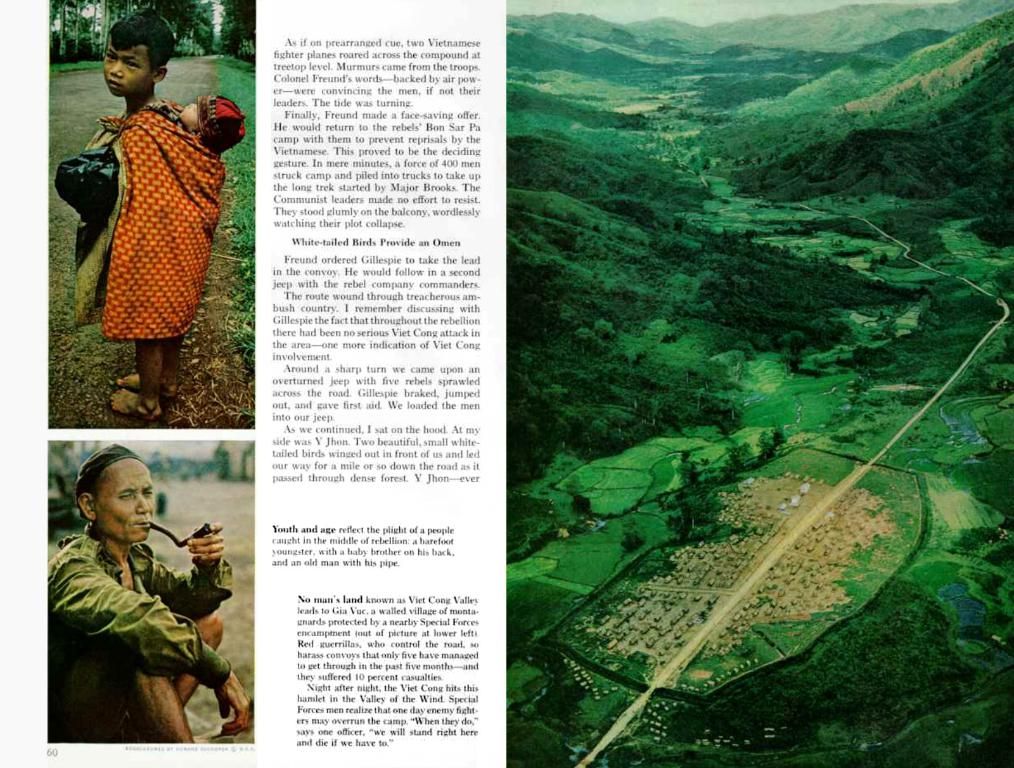

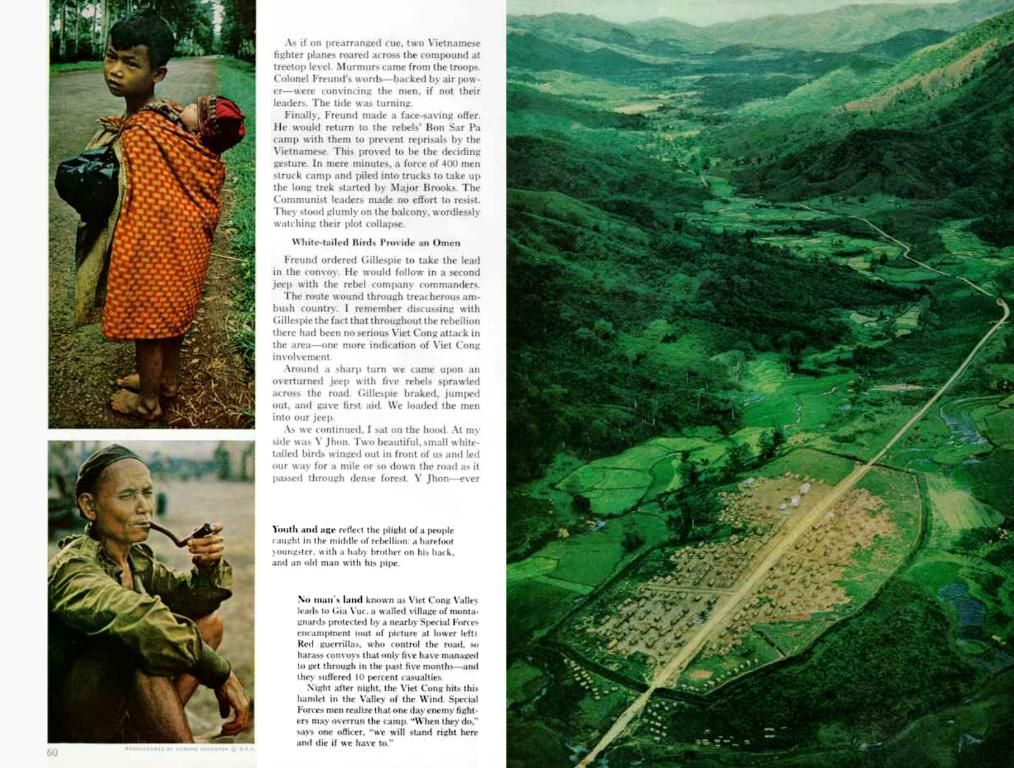

This downsizing, coinciding with the Trump administration's push to reduce federal workforce and ideas about the Fed's excessive staffing, may prompt discussions in the realm of politics and business. Keeping abreast of general-news developments related to this personnel adjustment could provide valuable insights.