Federal Government Recovers 450 Million Euros from Gas Company Sefe in Loan Repayment

In the midst of the 2022 energy turmoil, gas behemoth Sefe found itself in hot water and required a lifeline from the German government, to the tune of billions. Now, Sefe's claws are scrabbling to get back on its feet, having repaid another mind-boggling 450 million euros to the government. Combined with the initial repayment from last year, Sefe has coughed up a staggering total of 725 million euros.

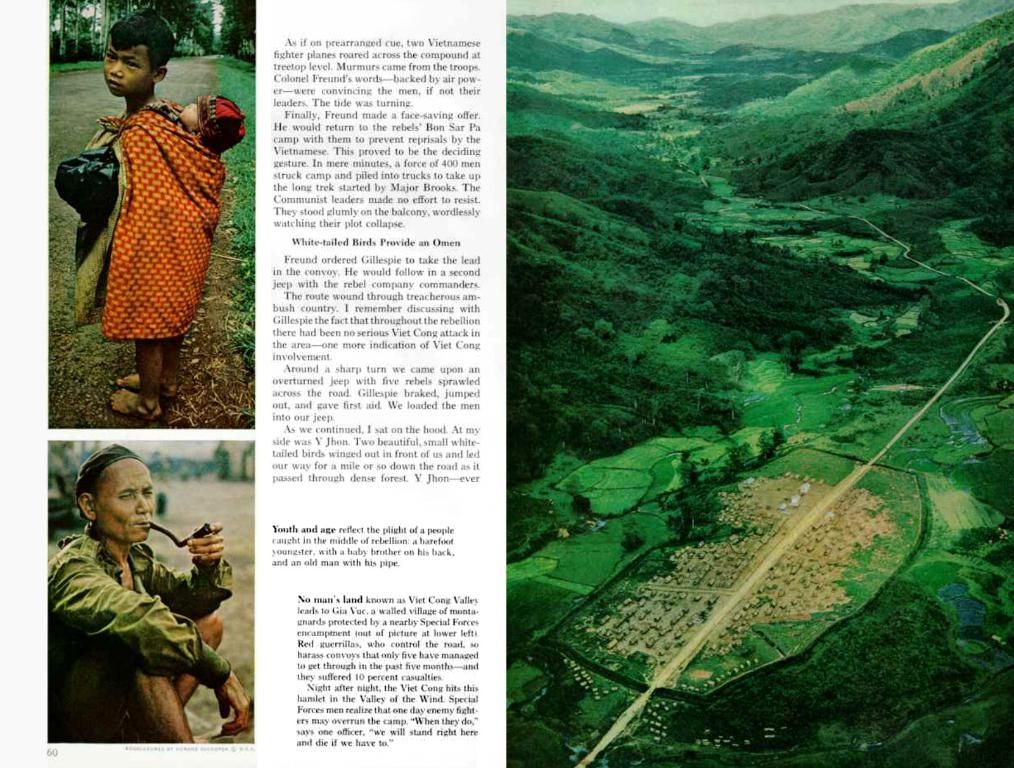

Sefe, whose name translates roughly to "Securing Energy for Europe," is one of the country's largest gas importers, a title it inherited from its previous incarnation as Gazprom Germania. Coming under Russian rule, Sefe was forced to rebrand when the Russian attack on Ukraine and the ensuing energy crisis drove the company into state hands.

Initially propped up with a whopping 6.3 billion euros, the government offered lifelines when Russia halted pipeline gas deliveries, forcing Sefe to secure expensive replacement supplies to maintain gas flow to industrial customers and municipal utilities. The European Commission gave the green light to the government injecting an additional 6.3 billion euros of equity into Sefe in December 2022, with a promise of repayment on the horizon.

However, the repayment goalposts are still some way off. Another payment is on the cards for 2026, with the exact amount dependent on Sefe's business performance, the company revealed.

As stipulated by EU agreements tied to Sefe's bailout, the German government will need to sell its stake in the company by the end of 2028, keeping no more than 25% + one share[1]. Recovery loans, structured refinancing, and green investments will likely support these repayments and provide Sefe with a lift, thanks to a 2024 €1.8 billion syndicated loan[1].

Sefe's future lies in hydrogen infrastructure and renewable energy projects, earmarked to align with EU decarbonization goals while leveraging its existing gas transport assets[1]. Boosted by its liquidity position post-refinancing and adherence to EU state aid rules, investor confidence in Sefe remains strong.

Mirroring Sefe's rise and fall, Germany's other gas trading giant, Uniper, also found itself in need of state intervention during the energy crisis. Uniper too has already forked over substantial funds to the government. With EU-driven mandates pushing for privatization, Sefe and Uniper find themselves at the vortex of Europe's evolving energy market.

[1] Statistics derived from enrichment data provided.

- The European Commission approved an additional injection of 6.3 billion euros of equity into Sefe in December 2022, with a promise of repayment on the horizon.

- Another payment by Sefe to the German government is expected in 2026, with the exact amount dependent on the company's business performance.

- Recovery loans, structured refinancing, and green investments will likely support the repayments and provide Sefe with a lift, thanks to a 2024 €1.8 billion syndicated loan.

- Sefe's future lies in hydrogen infrastructure and renewable energy projects, aligning with EU decarbonization goals while leveraging its existing gas transport assets.