Fed cuts rates as central banks navigate inflation and widening yield gaps

Central banks, including the Federal Reserve and Fifth Third Bank, are adjusting monetary policy as economic conditions shift. The US Federal Reserve has cut interest rates, while the European Central Bank looks set to follow in early 2026. These moves come amid rising long-term yields and persistent inflation concerns, creating challenges for income-focused investors.

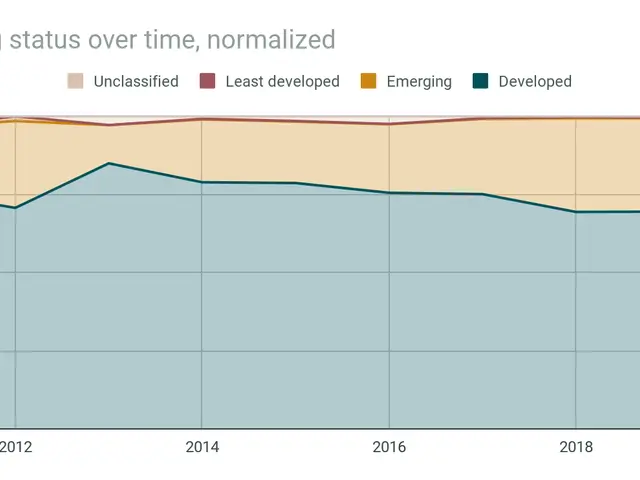

The Fed recently reduced its base rate, a decision already anticipated by markets. The reaction across major indices was positive but muted. Alongside the cut, the central bank began purchasing short-term Treasuries to manage liquidity during the tax loss harvesting season. Despite these measures, the gap between short and long-term yields has continued to widen.

The current environment presents difficulties for traditional income strategies. High-duration investments are under pressure, while reinvestment risks grow. Investors may need to adjust portfolios toward more resilient, high-yield opportunities to protect returns in the months ahead.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern