Fast-casual stocks crash, then roar back—what changed in 2026?

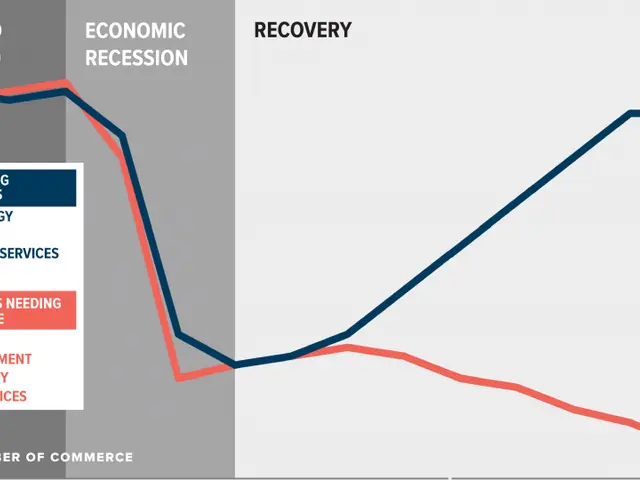

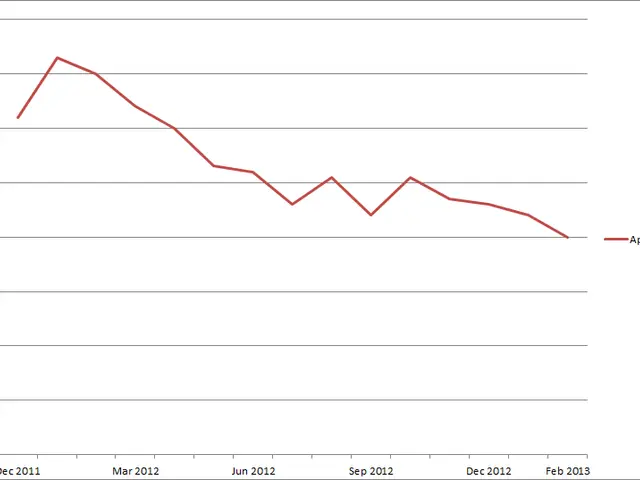

Fast-casual restaurant stocks faced a sharp decline in 2025, with major chains like Wingstop, Chipotle, Cava, and Sweetgreen losing between 15% and 78% of their stock market value. The drop followed a period of high valuations and shifting consumer habits, as more shoppers turned away from eating out.

Now, in the early months of the new year, these same stocks have bounced back strongly, with double-digit gains across the sector.

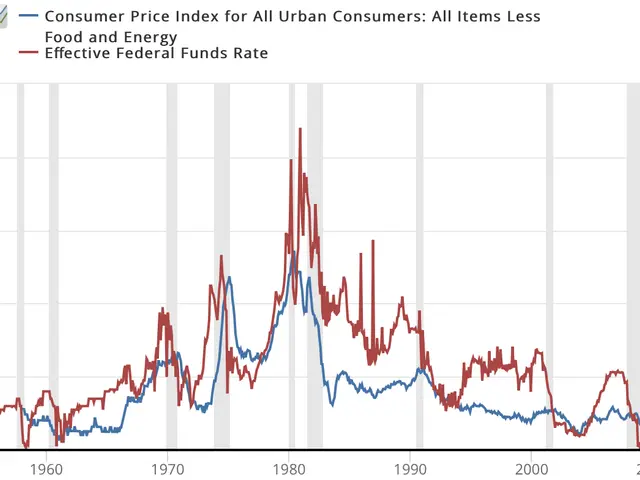

The troubles began in 2025 when fast-casual chains struggled under several pressures. High stock market valuations, inflation pushing diners toward cheaper options, and a broader shift in consumer behaviour all played a role. By that point, the gap between fast-casual and traditional casual dining had narrowed, making the pricier fast-casual meals less appealing.

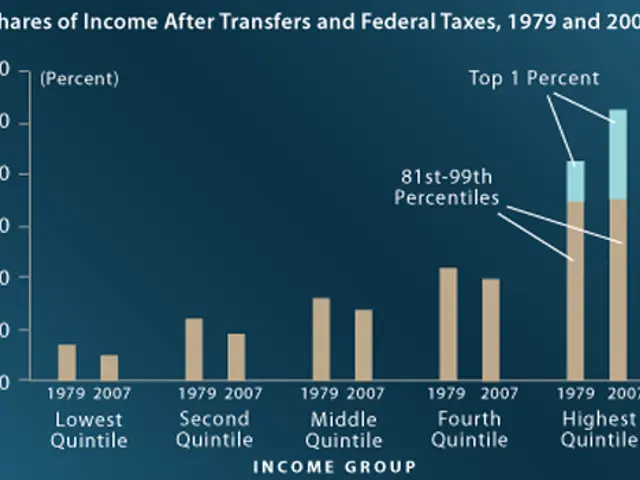

Data showed that 23% of consumers were cutting back on visits to fast-food and fast-casual restaurants. Instead, they opted for prepared meals from supermarkets—a trend that had been growing for years. Since 2017, the share of shoppers choosing deli-prepared foods over restaurant meals had more than doubled, rising from 12% to 28%.

Even when sales grew, the increases came mostly from higher prices rather than more customers walking through the door. Same-store sales figures reflected this pattern, with traffic remaining weak while menu prices climbed.

The turnaround arrived in early 2026. Stocks like Wingstop, Chipotle, Cava, and Sweetgreen surged, posting double-digit percentage gains. Wingstop, in particular, stood out as a top pick among investors. Its focus on delivery and takeaway—along with an expanded menu beyond wings to include chicken sandwiches—helped drive its recovery.

The rebound suggests renewed confidence in fast-casual brands, though the sector still faces challenges from changing consumer preferences. With more shoppers now buying prepared meals from grocery stores, restaurants must continue adapting to hold onto their customer base. The latest gains, however, indicate that investors see potential in the industry's ability to recover.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now