Scrutinizing the roadblock: Insights into the StaRUG evaluation

Evaluation of StaRUG Process Within Holding Pattern

By Sabine Reifenberger, Frankfurt

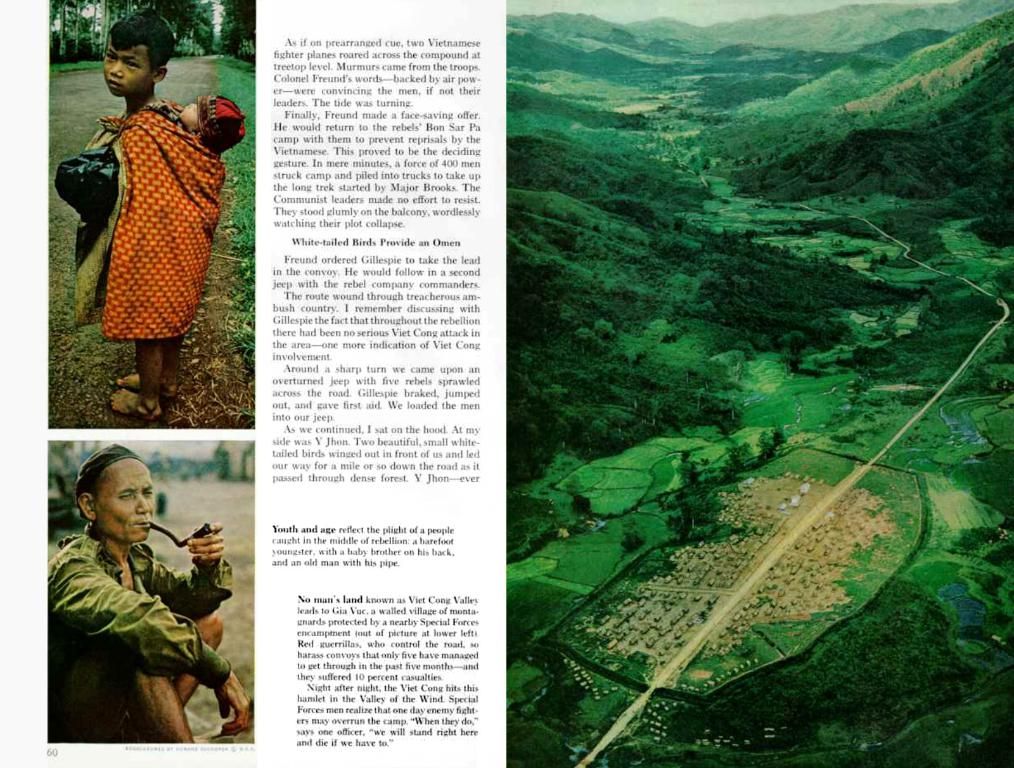

The COVID-19 pandemic's aftermath has sent waves through German corporate restructuring, with StaRUG stepping up as a crucial lifeline amid rising insolvencies. Yet, questions linger in a recently initiated evaluation - what works, and what needs fine-tuning? The assessment was primarily designed to run internally within the Ministry of Justice, allowing market participants to weigh in through their input.

However, the coalition disbanded, leaving the StaRUG evaluation's future unclear. Dorothee Prosteder, partner at Noerr and Restructuring Association TMA Germany's chairwoman, shared that some preliminary topics have been identified based on real-world scenarios. But what does this mean for StaRUG's evolution?

Frank Grell, TMA board member and partner at Latham & Watkins, questions the impact on the evaluation process due to the political shake-up. After all, the StaRUG's fate is as unpredictable as the stock market these days.

Enrichment Data:

The StaRUG landscape: With critical decisions from Germany's highest courts and refined regulations, StaRUG's role in corporate restructuring has shifted:

- Judicial intervention: The Federal Constitutional Court's 2025 ruling on VARTA sparked discussions about StaRUG's balance between creditor protection and shareholder rights. While it validated StaRUG's procedures, concerns over perceived inequitable outcomes in cases like VARTA and LEONI AG linger[1].

- Regulatory clarity: The February 2025 IDW draft standard (ES 16) provided guidance on Section 1 StaRUG requirements, emphasizing early crisis detection, board oversight, and standardized reporting[2]. Although not legally binding, these best practices stipulate management standards during insolvency-prone periods.

- Cross-border recognition: StaRUG finds parallels with international frameworks such as the UK Scheme of Arrangement and Dutch WHOA, showcasing its applicability in multi-jurisdictional insolvencies[4].

- Practical challenges: Recent cases, like Grover, demonstrate StaRUG's adaptability to complex financing structures, underscoring ongoing tensions between debt restructuring and equity preservation[3]. Despite this, StaRUG provides flexibility, enabling debt-equity swaps and subordination without mandatory haircuts[3], contingent upon credible restructuring plans.

Political disruptions: No direct legislative changes related to StaRUG have surfaced due to the coalition's breakup. However, the operational framework persists, with judicial interpretations and IDW standards leading StaRUG's evolution[1][2]. Political shake-ups could potentially influence future amendments, though existing StaRUG procedures remain largely unaffected, as of April 2025.

- The evaluation of StaRUG, initiated in response to the surge in insolvencies due to the COVID-19 pandemic, aims to determine what aspects are effective and which require restructuring.

- The assessment, primarily intended for internal review within the Ministry of Justice, also invites market participants to share their insights and experiences.

- The uncertainty surrounding the StaRUG evaluation's future, following the coalition's disbandment, has been raised by industry professionals, such as Frank Grell, a TMA board member.

- Despite the potential political influence on future amendments, the operational framework of StaRUG, shaped by critical court rulings, refined regulations, and best practices, continues to guide its evolution in the corporate restructuring landscape.