Grafters Flex Their Fiscal Muscles: The Brawl Over Budget deficits in the EU

EU Authority Initiates Fiscal Discipline Procedure Towards Austria

Brussels - The European Commission's fiscal police force has its sights set on Austria over their excessive deficit. Austrian officials have their eyes wide open, as the government had frequently hinted at the possibility of disciplinary actions. Last year, Austria's state deficit breached the 3% EU ceiling with a whopping 4.7%, giving the Commission good reason to step in[1].

The Commission, tasked with overseeing EU countries' adherence to debt rules, is ready to start the disciplinary proceedings[1]. The European debt obligations consist of a max limit on new debt, capped at 3% of GDP[2]. The sole objective of these proceedings is to compel member states to adopt prudent fiscal policies[1].

Austria’s Economic Stumble

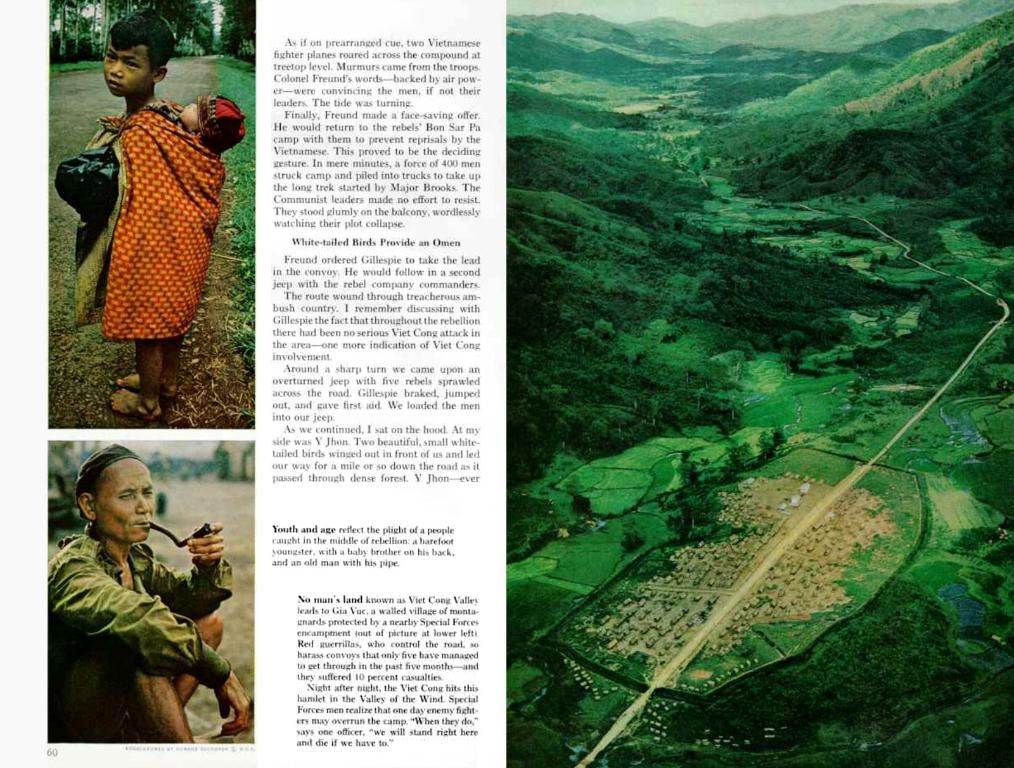

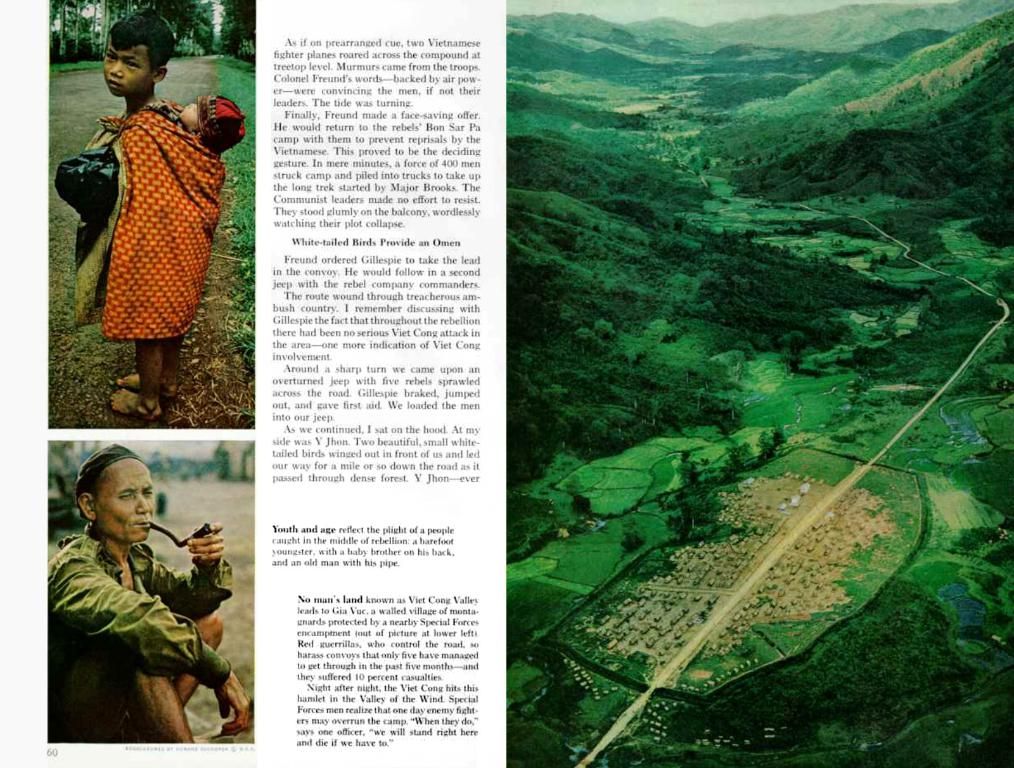

Austria is slogging through an economic crisis reeling from high inflation, weak consumer demand, and continuous recession. The European Commission predicts that Austria is the lone EU member anticipating a contraction in their economy this year[1]. With plans to chop state expenditures by a colossal €54 billion by 2029, Austria is ready to tighten its fiscal belt[1].

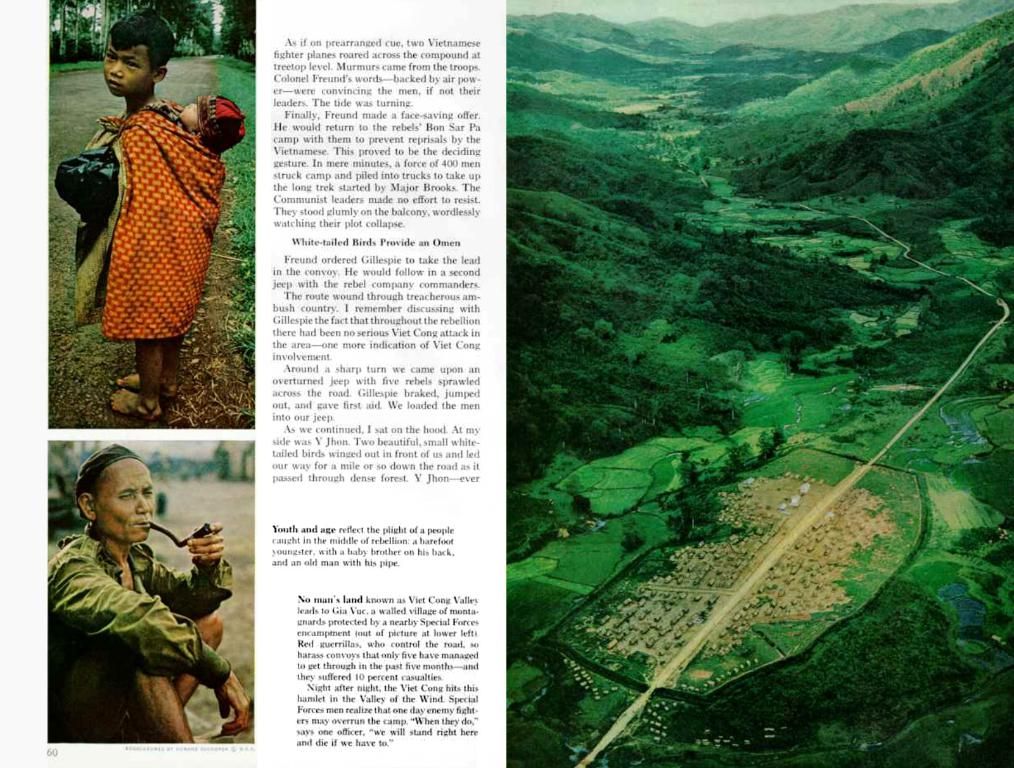

Escalation Procedure Against Austria

Once the Commission confirms Austria's excessive deficit, they will propose deficit reduction recommendations to the EU finance ministers[1]. The process will entail statements from the Economic and Monetary Affairs Committee, followed by a declaration of the existence of an excessive deficit[1].

The Rules of the Road

The Stability and Growth Pact (SGP) is the bedrock of the EU's fiscal policies, aimed at ensuring sound public finances across its members[3]. Some notable rules under the SGP include:

- Budget Deficit: Deficits should not exceed 3% of GDP.

- Public Debt: Debt-to-GDP ratios must not go beyond 60%.

These rules foster fiscal discipline, maintain stability, and promote convergence across the EU[3].

A Changing Landscape

The SGP has undergone recent alterations, with Germany reforming its constitutional "debt brake" to boost defense spending[2]. The adjustments alter Germany's upper deficit limit according to defense expenditure and include a substantial spending package for infrastructure and climate protection[2]. However, this change may violate the SGP since it does not guarantee a reduction in Germany's public debt-to-GDP ratio, which already exceeds 60%[2].

Portugal is one of the countries utilizing the national escape clause (2025-2028), giving them leeway to adjust public spending or enhance revenue to meet EU fiscal rules over an extended period[3]. Such flexibility is essential in times of economic duress or significant policy shifts.

Future Forecasts in the Fiscal Landscape

Several EU countries, such as Belgium and France, are predicted to breach the EU's 3% deficit threshold in 2025. Belgium's deficit is projected to reach a staggering 5.4% of GDP, while France anticipates an even higher deficit[4].

Tensions and twists in the EU fiscal landscape persist as member states juggle national priorities, economic pressures, and the demands of fiscal discipline.

The Commission, tasked with overseeing EU countries' adherence to debt rules, is ready to start disciplinary proceedings against Austria due to its excessive deficit exceeding the 3% EU ceiling, as outlined in the Stability and Growth Pact (SGP), a key rule that ensures fiscal discipline among EU members. Austria, in the midst of an economic crisis, plans to reduce its state expenditures significantly in an attempt to adhere to the SGP's deficit rules.