Escalating trade disputes present opportunities, but Philippines' readiness remains questionable

Whilst the United States boosts tariffs on major Asian economies, this shift could bring both perks and hurdles for the Philippines, believes industry exec Leslie Lim.

Lim, the prez of the Federation of Ecozone Service Providers - Visayas Chapter, noted that the Philippines, with its 17% tariff under the proposed policy, seemingly has an edge over Asian countries such as China, Thailand, Vietnam, and South Korea. However, Lim warned that long-term consequences could linger across intricately woven regional supply chains.

"Initially, the Philippines may profit from lower tariffs, but in the long haul, we might still feel the ripple effects," stated Lim.

Lim explained that many Philippine exports, particularly in electronics and semi-finished goods, typically end up being shipped to countries like Japan and South Korea for final processing before being exported to the US. If these destinations curb exports due to steeper US tariffs, demand for intermediate goods from the Philippines could plummet.

On the brighter side, Lim pointed out a glimmer of hope. The US tariff strategy could prompt manufacturers in hard-hit nations like Vietnam and Indonesia to shift their operations to the Philippines, exploiting the country's more favorable trade position.

This strategic opening presents an opportunity for Cebu in particular to reclaim its prominence as a competitive hub in the global manufacturing sector, notably in furniture and home decor. "This could attract significant manufacturing investments, primarily in Cebu," said Lim, referring to the city's legacy in high-end furniture exports prior to the 2008 US recession.

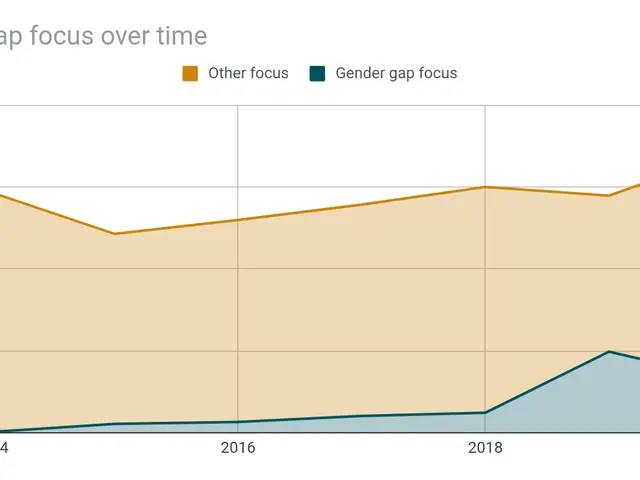

That being said, Cebu's rise in the global market could encounter a critical hiccup. An infrastructure gap could thwart the country from fully capitalizing on the opportunity, as limited and aged logistics infrastructure, including warehouse space, threatens to obstruct or delay potential investments.

"We see genuine interest from manufacturers, especially from China, who are scrutinizing the Philippines as a strategic alternative," noted CBRE during its Pagtanaw Q1 2025 Market Briefing in Cebu on April 22, 2025. "However, what they discover on the ground doesn't quite align with their expectations."

CBRE, a global commercial real estate services and investments firm, observed that while 18,000 sqm of new warehouse space came online this quarter, only 30% of available space is in modern facilities with adequate capacity. Furthermore, a total of 92,000 sqm in new warehouse developments is due to roll out over the next 18 months, yet this still falls short of catering to the needs of a large-scale manufacturer.

These factors have led to hesitation among manufacturers that would otherwise transfer their operations to the Philippines.

"There's intent to invest," said CBRE. "But the challenge lies in procuring sufficient warehouse space in the market today."

CBRE advocates for expedited investment in modern warehousing and logistics infrastructure that aligns with global standards to seize the opportunity.

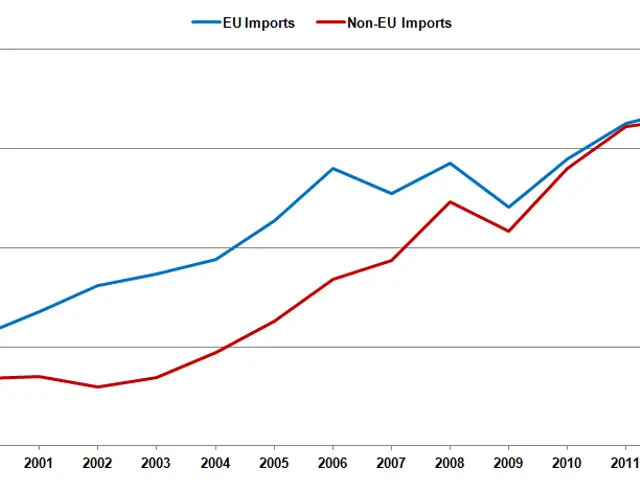

Trump's proposed tariff hike forms part of a broader goal to narrow the U.S. trade deficit and boost domestic industries. Nevertheless, its sweeping nature has provoked worries across Asia, stirring doubts in regional trade.

Meanwhile, Special Assistant to the President for Investment and Economic Affairs Secretary Frederick Go displays optimism that Manila and Washington D.C. will arrive at a trade agreement that benefits both parties amid the new US tariff policy. Go has announced plans to travel to the US for a tariff dialogue, although the specific date remains undisclosed. "We are hopeful that, through our strong economic and diplomatic ties, we can arrive at arrangements that are mutually advantageous," Go said. The Department of Trade and Industry shared its commitment to engage in dialogues with stakeholders and address their concerns regarding the 17% levy for the Philippines under the US reciprocal tariffs.

- Industry executive Leslie Lim believes that the Philippines, with a 17% tariff under the proposed policy, could have an edge over countries like China, Thailand, Vietnam, and South Korea due to lower tariffs in the United States.

- However, Lim warns that long-term consequences could impact regional supply chains, especially for countries that typically export intermediate goods to Japan and South Korea for final processing before being exported to the US.

- Lim suggests that the US tariff strategy could encourage manufacturers in hard-hit nations like Vietnam and Indonesia to shift their operations to the Philippines, taking advantage of the country's more favorable trade position.

- Cebu, in particular, could reclaim its prominence as a competitive hub in the global manufacturing sector, particularly in furniture and home decor, if it can address infrastructure gaps in its logistics and warehouse facilities.

- CBRE, a global commercial real estate services and investments firm, notes that while new warehouse space is being developed, it falls short of catering to the needs of large-scale manufacturers, causing hesitation among potential investors.

- Special Assistant to the President for Investment and Economic Affairs Secretary Frederick Go is planning to travel to the US for a tariff dialogue with the aim of reaching a trade agreement that benefits both the Philippines and the US, addressing concerns about the 17% levy for the Philippines under the US reciprocal tariffs.