Navigating the Storm: A Look at India's Stock Market Volatility

Escalating India-Pakistan tensions could trigger market volatility: Three critical elements to monitor

Strap in, folks, it's gonna be a bumpy ride! The Indian stock market is riding the waves of uncertainty, thanks to a cocktail of factors. Here's the lowdown on what's shaking up the markets:

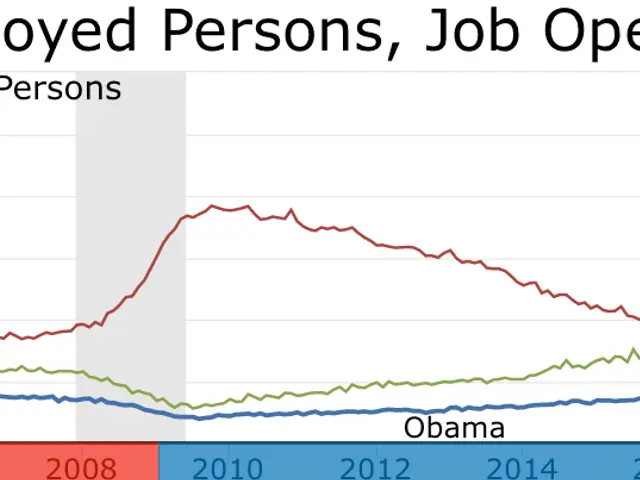

Geopolitical Dance-off: India vs. Pakistan

- Market Shake-up: Have you ever had a hangover from a fight you weren't even in? That's kinda how investors feel when geopolitical tensions spike. The latest dramatic escalation between India and Pakistan might nudge some investors to play it safe, sending sell-off signals across the markets[2].

Crude Price Swings

- Inflation Fears: Here's a wild guess: when the price of oil goes up, everything costs more, right? That's because crude oil is a major component of goods and services we consume. These fluctuations can spook the Reserve Bank of India (RBI) into adjusting their policies to keep inflation under control[4].

RBI's Monetary Policy Jive

- Moving the Rates: When it comes to the RBI's interest rate decisions, the stock market treads carefully. Higher rates can drag down growth by making borrowing more expensive, while lower rates might fuel growth but potentially stoke inflation[4]. The RBI's latest stance isn't explicitly clear, but expect them to keep an eye on both growth and inflation[4].

More Factors in the Mix

- Economic Optimism: Deloitte sees India's economic growth soaring to 6.3% to 6.5% in the fiscal year 2024 to 2025. A bright economic outlook like that could push the stock market to new heights, providing growth indicators continue to sail smoothly[4].

- Corporate Earnings: Good earnings report can boost a company's valuation and make shareholders happy, while disappointing earnings could send a bloodcurdling scream through the market[3].

Market Movers and Shakers

- BSE Sensex and NSE Nifty: The tussle between geopolitical tensions and other global factors like US Federal Reserve's interest rate decisions have put a damper on India's leading stock indexes, both the Sensex and Nifty. But it ain't all bad news. Sectors like Tata Motors have managed to stay afloat, thanks to positive domestic cues[2].

Final Thoughts

The Indian stock market is smack-dab in the middle of a storm, with geopolitical tensions, skewed crude price trends, and RBI's interest rate decisions as the tempests. Even with these challenges, India's economy's growth prospects and corporate earnings remain crucial for market performance. So, play it cool, keep your eyes on the prize, and consult your financial advisor before making moves in the stock market!

[1] Geopolitical tensions and their impact on financial markets: https://www.scmp.com/markets/article/3111633/geopolitical-tensions-impact-financial-markets[2] Sensex, Nifty face selling pressure due to geopolitical tensions, other global factors: https://www.moneycontrol.com/news/business/stock-market-india-bse-sensex-nifty-50-index-live-updates-21st-may-2021-9325481.html[3] How Disappointing Corporate Earnings Can Impact the Stock Market: https://www.investopedia.com/terms/d/disappointingearnings.asp[4] Overview of the Indian Economy: https://www.deloitte.com/in/en/pages/economy/articles/india-economy-forecast-outlook.html

- Despite the ongoing geopolitical tensions between India and Pakistan, some investors may still prioritize trading stocks, with general news and political developments serving as crucial factors to consider.

- Liquidity in the market can become a concern during periods of increased volatility, as the prices of stocks in India oscillate due to factors such as geopolitical conflicts, global crude prices, and the Reserve Bank of India's monetary policy.

- In terms of finance and business, the agreement on stabilizing the market becomes paramount for long-term investors, who seek to build a balanced and diverse portfolio while navigating the challenges presented by war-and-conflicts and other global issues.

- As economic optimism gains traction, focusing on factors like a bright growth outlook and promising corporate earnings becomes essential for weighing the investment risks and opportunities in India's stock market.

- In the context of India's stock market, the trading strategies of investors may fluctuate in response to various economic policy decisions made by the Reserve Bank of India, with interest rate adjustments impacting both growth and inflation levels.

- Companies' earnings reports can significantly influence stock prices, as good earnings can instill confidence among investors and boost a company's valuation, while discouraging earnings can create market turbulence and uncertainty.

- Despite challenges like geopolitical tensions and fluctuating crude oil prices, the performance of key stock indexes in India, such as the BSE Sensex and NSE Nifty, remains significant indicators of the overall health and stability of the Indian stock market.

- To make informed investment decisions and potentially weather the storm in India's stock market, seeking guidance from financial advisors and monitoring general news, political developments, corporate earnings, and global market trends is essential in striking a balance between risk and reward.