Ed Yardeni Predicts S&P 500 Surge to 10,000 and Gold Hitting $10,000 by 2030

Ed Yardeni, a renowned capital markets expert, has shared his latest predictions for U.S. stocks and gold. Despite recent economic challenges, he remains optimistic about market performance. His forecasts suggest strong gains in the coming years, with gold also set for a sharp rise.

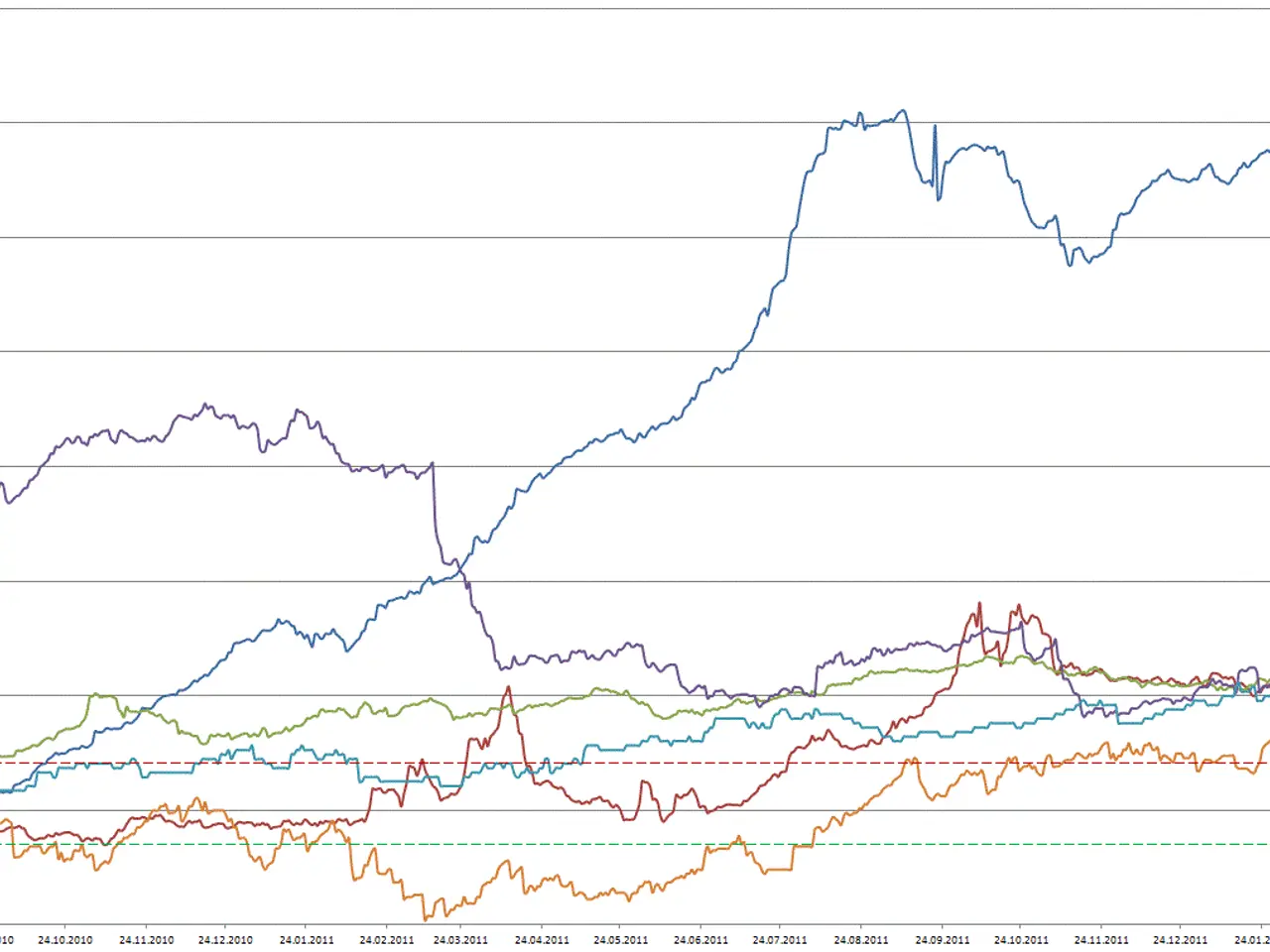

Yardeni expects the S&P 500 to climb by roughly 10 percent in 2023. This year's growth, however, may come from different sectors than in previous years, when tech companies led the way. He also sees geopolitical crises that shake markets as potential buying opportunities rather than threats.

Looking further ahead, his predictions grow bolder. By 2029, he forecasts the S&P 500 to hit 10,000 points. His optimism extends to gold, which he believes could reach $6,000 per troy ounce by the end of 2023. Over the longer term, he even suggests gold might climb to $10,000 per troy ounce by 2030.

Yardeni's views come through his firm, Yardeni Research, which he founded to analyze market trends and economic shifts. His track record in capital markets has made his forecasts closely watched by investors.

If Yardeni's predictions hold, the S&P 500 could see steady growth in 2023, followed by a major surge by 2029. Gold prices may also experience significant increases, reaching levels far above current values. Investors will likely monitor these projections as they plan their strategies for the years ahead.