Drop in oil prices as Trump's diplomatic efforts towards Ukraine stir up optimism

The peace push by US President Donald Trump is gaining momentum, with key meetings scheduled with Russian President Vladimir Putin, Ukrainian President Volodymyr Zelensky, and European leaders [1]. The objective is not just a ceasefire, but a comprehensive peace agreement that requires concessions from both Russia and Ukraine.

The latest development came with Trump's meeting with Zelenskyy on Monday, and the announcement of a potential face-to-face meeting between Putin and Zelenskyy, as well as another trilateral summit involving Trump [1]. If successful, this peace deal could significantly reduce geopolitical risks that currently contribute to oil price volatility.

The Russia-Ukraine conflict has strained global energy markets, with supply uncertainties pushing prices higher. A lasting peace agreement could stabilize crude oil markets by easing sanctions, normalizing Russian energy exports, and restoring confidence in supply chains. This could lead to lower or more stable prices, but the specifics would depend on the details of the agreement and continued compliance by all parties involved [1].

Meanwhile, the Energy Information Administration projects global inventories to build by 2.10 million barrels per day in the fourth quarter. This could add to the current oversupply in the market, potentially offsetting any price reductions due to the peace deal.

Investors foresee a possibility of the war ending soon, which could ease Western sanctions and allow Russia to trade freely. This could also mean that countries buying oil from Russia could potentially avoid Western sanctions. However, Trump has previously threatened Russia with sanctions on its oil exports and "penalty sanctions" on countries buying oil from Russia, including India and China [1].

The Federal Reserve's decision on interest rates, scheduled for September 17, is of significant importance. The keynote address by US Fed Chair Jerome Powell at the upcoming Jackson Hole Economic Symposium could provide insights on the direction of monetary policy and the potential movement of the US Dollar [1]. As a dollar-denominated commodity, traders feel that the trajectory of crude oil in the coming weeks depends on the Fed's decision next month.

The Jackson Hole Economic Symposium, where the world's leading central bankers and economists convene, begins this Thursday. OPEC+ supply is rising with the accelerated unwinding of the 2.2 million barrels per day in voluntary cuts by its member nations. The International Energy Agency expects stronger production growth from non-OPEC nations at 1.3 million barrels per day this year and 1 million barrels per day next year.

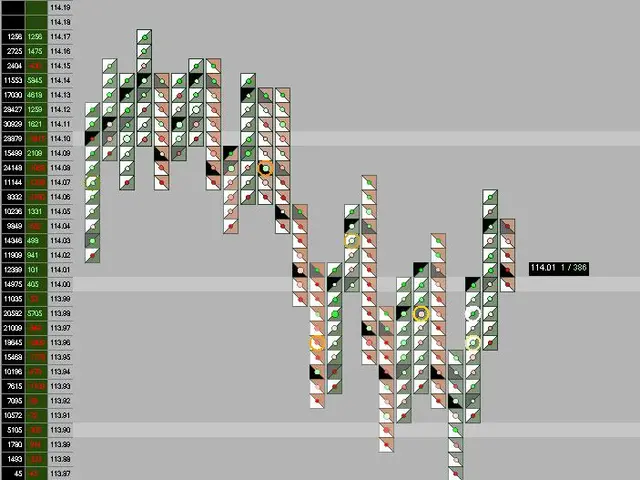

WTI Crude Oil for September delivery is currently trading down by $1.07 (or 1.69%) at $62.35 per barrel. The latest developments in the peace efforts and the upcoming Fed decision are likely to influence the price of crude oil in the coming weeks.

[1] Source: Various news reports and press releases.