Sounding the Alarm: Corporate Insolvencies Spike Up In Q1, 2025

Significant financial turnaround: A notable decrease in bankruptcy cases, marking a two-year absence in insolvency incidences - Decrease in Insolvencies Resurfaces After Two-Year Absence

Gear up, folks! The stats are in, and they're not looking good. For the first time in two years, corporate insolvencies are on the rise – and we ain't talking about a slight uptick. This early indicator means applications for regular insolvency have climbed by approximately 13.1% compared to Q1 2024.

The fine folks at the Federal Statistical Office have crunched the numbers, and according to local courts, a whopping 5,891 corporate insolvency applications were filed in Q1, 2025. That's the highest value for the first quarter since 2011, folks!

Let's hear it from the horse's mouth, shall we? Volker Treier, the chief analyst of the German Chamber of Industry and Commerce, calls it a "clear warning sign for our economic location." And why's that, you ask? Blame it on dwindling orders and weaker demand, hand in hand with skyrocketing energy, labor, and bureaucracy costs. Oh, and let's not forget about the "considerable uncertainty" courtesy of U.S. trade policy- dried-up cash flows and increased risks for businesses, y'all.

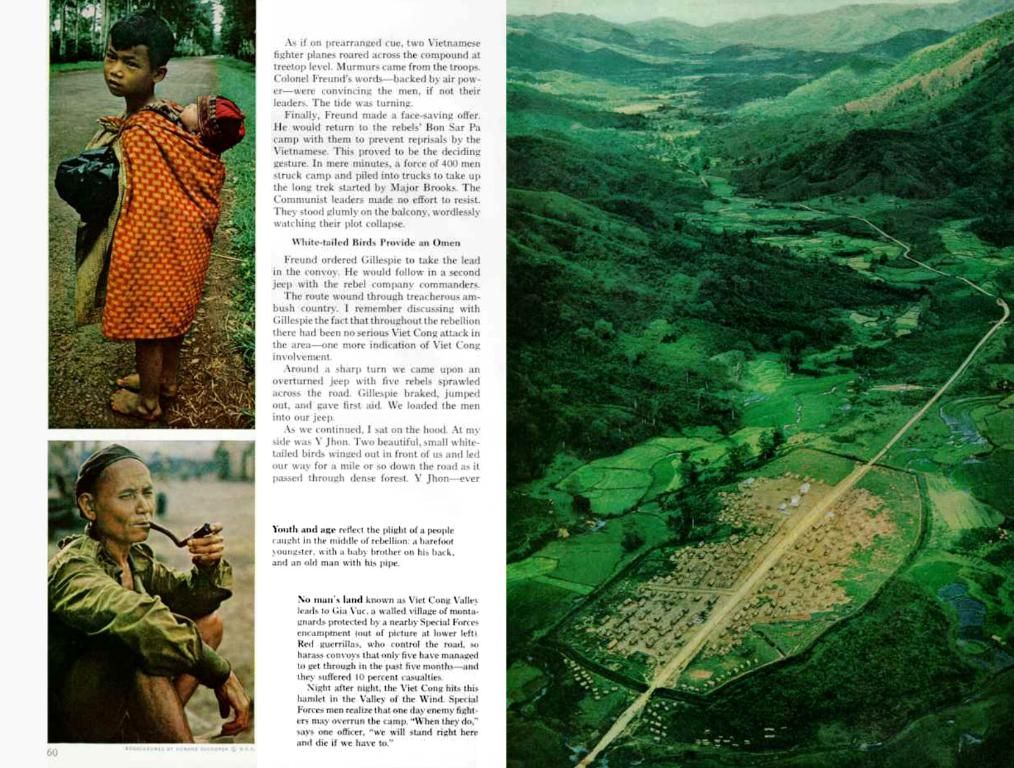

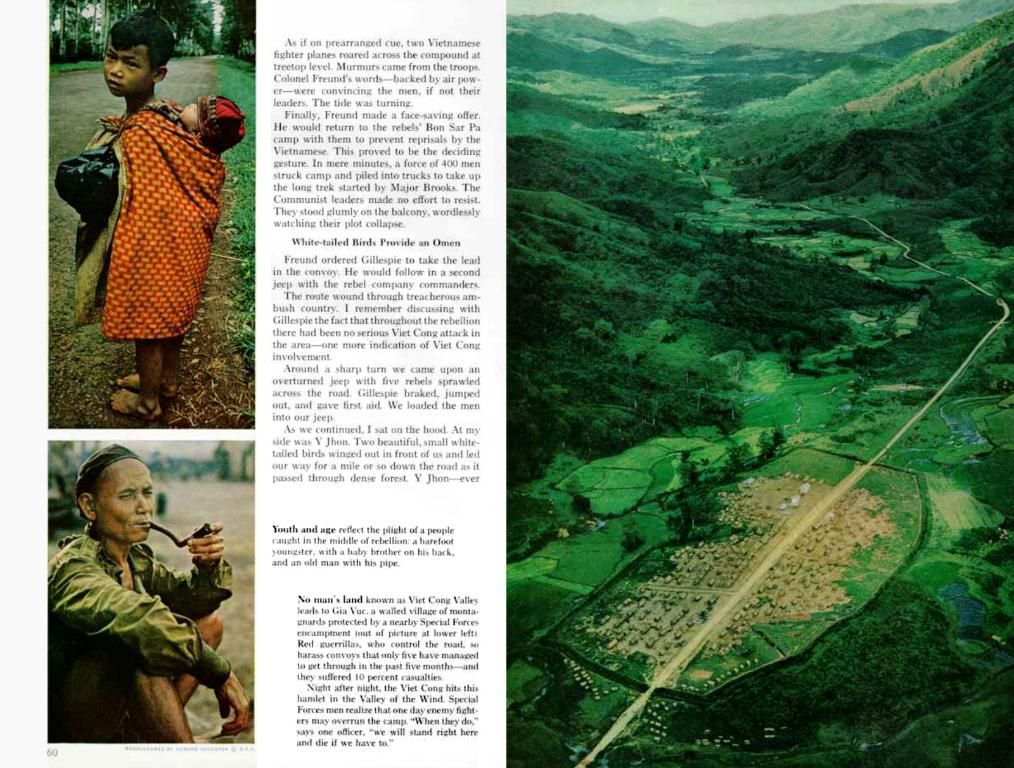

Here's a quick breakdown on the sectors hit the hardest:

- Transport and logistics: 29.4 insolvencies per 10,000 companies

- Other economic services: Runner-up with 26.7 cases per 10,000 companies

- Construction industry: Clocking in at 26 cases per 10,000 companies

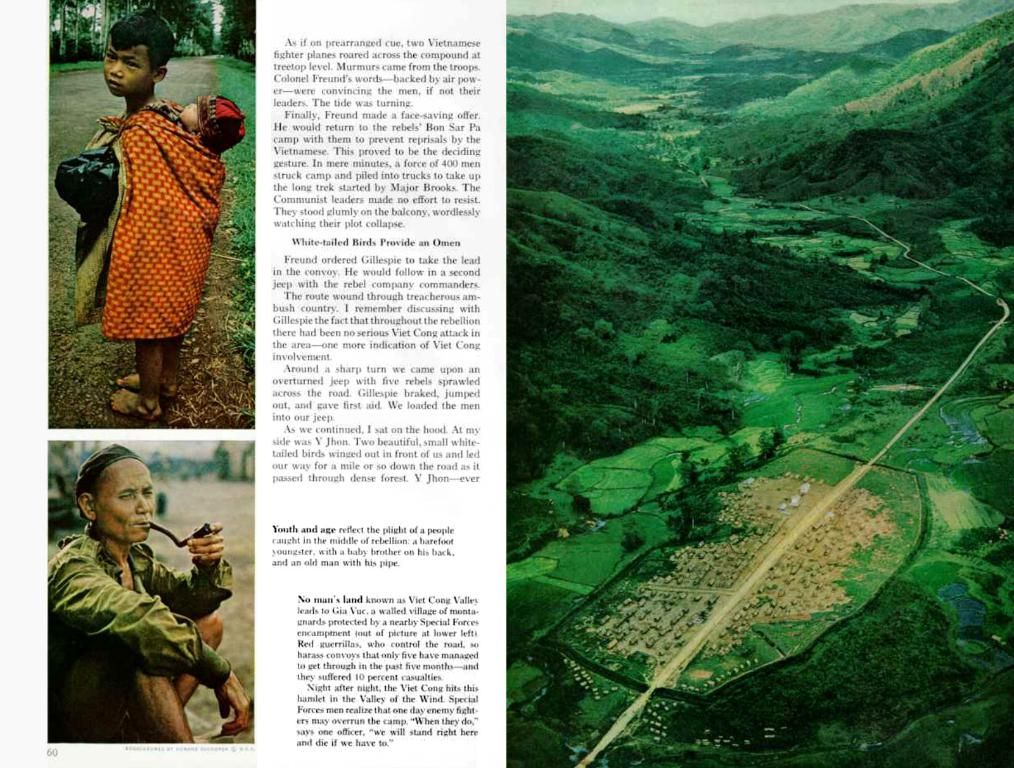

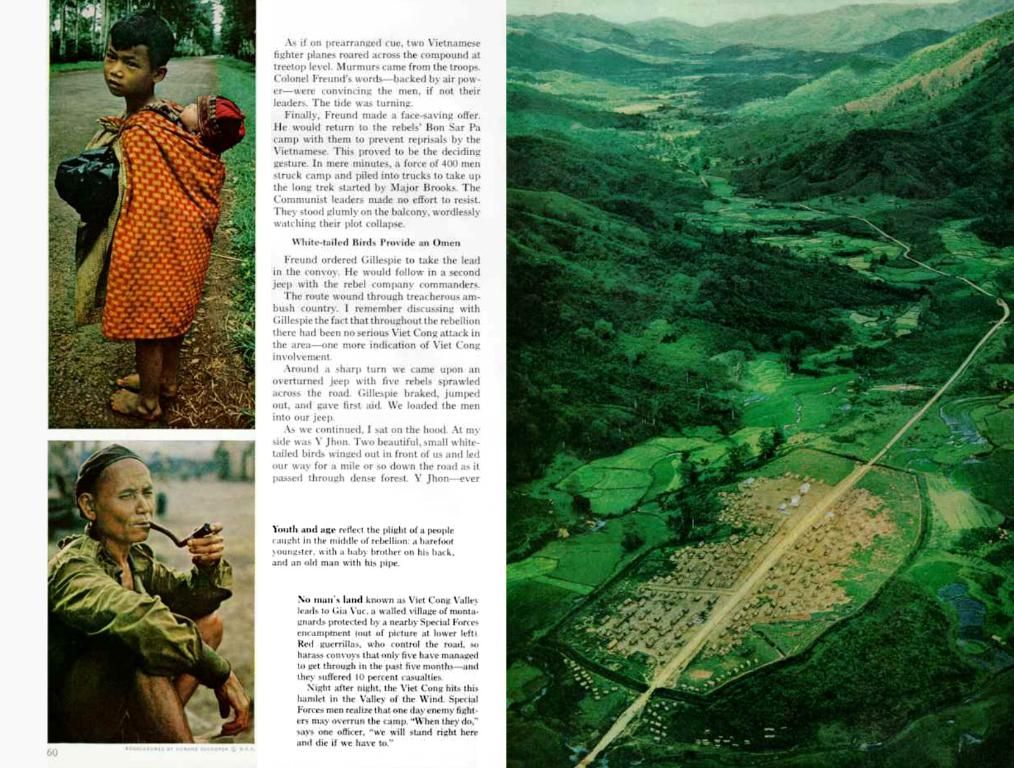

On the consumer side, there were 18,573 insolvencies in Q1, representing a 6.3% jump compared to the same period in 2024.

So, what might be behind this economic storm? Experts point the finger at the phase-out of support measures post-pandemic and energy crisis, economic stagnation, spiraling tariffs, rising expenses, and interest rates. Add a mix of inflation, supply chain disruptions, and reduced consumer spending, and you've got yourself a perfect storm for more business failures throughout 2025.

Want more insight? Brace yourself as the consequences of all these factors start making a dent in our troubled economy. It's business as usual, but definitely not as usual as we'd like it to be. Time to batten down the hatches, folks.

In light of the rising corporate insolvencies, various industries such as transport and logistics, other economic services, and construction are facing a significant challenge. Furthermore, this trend could have a significant impact on the overall business community in finance.