Decentralized Finance (DeFi) platform Gyroscope introduces a yield-producing variant of its GYD stablecoin.

In the rapidly growing world of cryptocurrencies, a new player has entered the stablecoin market, aiming to disrupt the status quo. Gyroscope, a decentralised finance protocol backed by Michael Novogratz's Galaxy Digital, has launched its new stablecoin, Savings GYD (sGYD). This innovative token is designed to offer unique earning opportunities, setting it apart from leading stablecoins like USDT and USDC.

sGYD operates as a decentralised savings and yield-generating token, pegged to the Guyanese dollar (GYD). The business model of sGYD centres on providing holders with a stable and liquid digital asset that accrues interest through embedded yield-generation mechanisms within the Gyroscope ecosystem.

The revenue generated for token holders comes from several sources:

- Interest Accrual: When users hold sGYD, the tokens automatically earn interest over time. This interest comes from Gyroscope’s integrated yield farms and lending protocols where the backing assets are deployed to generate returns.

- Stablecoin Peg with Yield: Unlike typical stablecoins that only maintain price stability, sGYD maintains its peg to the Guyanese dollar while offering a savings-like yield. This dual feature attracts holders seeking both stability and passive income.

- Protocol Revenue Sharing: Gyroscope may distribute a portion of the fees and revenues generated from decentralised finance (DeFi) activities—such as trading fees, staking rewards, or lending interest—back to sGYD holders, effectively sharing the platform’s profits.

- Reinvestment and Tokenomics: The system often reinvests earned yields to compound returns, increasing the value of sGYD over time relative to its peg. This mechanism incentivizes long-term holding.

Users who prefer earning a highly boosted SPIN rate can opt to forgo native yield rates. In the second phase of Gyroscope's points-earning program SPIN, users can choose between earning native yields with a baseline SPIN rate or boosting their rewards and forgoing the yield. The total supply of SPIN is capped at 500 million or less to maintain its scarcity and value.

Meanwhile, Bima Lab has also introduced a new Bitcoin-backed stablecoin USBD, aiming to disrupt the stablecoin market. Bima Lab's USBD offers token holders options for different forms of earnings. The stablecoin market is seeing new entrants like Bima Lab, indicating a shift towards yield-bearing stablecoins that are bringing a new element to the popular vertical of the crypto space.

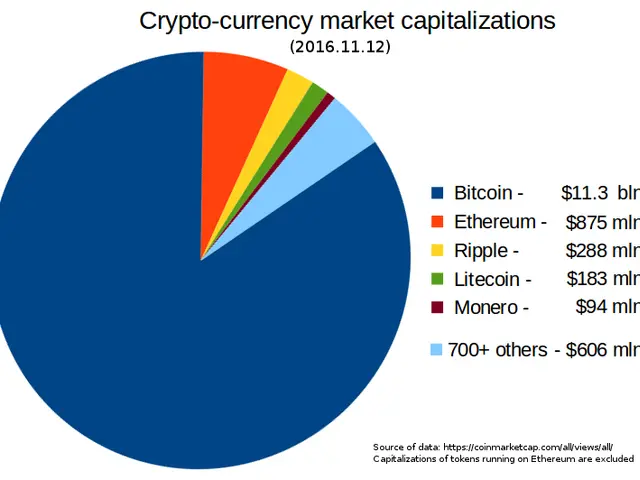

However, Tether and Circle still dominate transactions in the stablecoin category. The stablecoin market is evolving, and it will be interesting to see how these new entrants, such as Gyroscope and Bima Lab, fare against the established players.

Read also:

- A Business Model Explained: Its Purpose and Benefits for Your Venture

- Deep-rooted reinforcement of Walkerhughes' acquisitions through strategic appointment of Alison Heitzman

- Unchecked Management of HP Dams Leads to Environmental Disaster: RTI Reveals

- CDU Hamm: Aim, Chosen Candidate, and Local Election Agenda