Dabur's Q4 Profit Dips, Tackles Challenging Market Conditions

Dabur's Q4 Earnings Show Profit Decline by 8.35% due to Sluggish Demand; Board Approves Final Dividend of Rs 5.25

Catch up on the latest FMCG news In a surprising twist, Dabur India, a major player in the FMCG sector, reported a 8.4% decline in Q4 net profit this year, compared to the same quarter last fiscal. The profit stood at a substantial Rs 312.73 crore, but fell short of the estimated Rs 329 crore[1]. The revenue, however, took a slight uptick, increasing from Rs 2,814.64 crore to Rs 2,830.14 crore[1].

Despite a challenging market environment marked by high food inflation and increased cost of living, Dabur managed to carve out market share gains across 90% of its portfolio, according to a company filing[1]. The FMCG market demand remained subdued during Q4 of fiscal year 2024-25. Despite these obstacles, Dabur recorded a 2.1% revenue growth on a constant currency basis, amounting to Rs 2,830 crore[1]. The full-year revenue came in at Rs 12,563 crore, up from Rs 12,404 crore the previous year. On a constant currency basis, the full-year revenue marked a 3.6% growth[1].

Mohit Malhotra, CEO of Dabur India, stated, "Our international business enabled us to navigate the complex external environment. The fourth quarter saw a 19% growth in our international business, while the full-year registered a 17% increase." He added, "We anticipate a recovery in consumer demand in India across urban and rural markets and are concentrating on beefing up our presence in rural areas and rolling out consumer-centric innovations."

Sector-wise Growth

- Dabur's Foods business saw an impressive 14% growth during the quarter.

- The Skin & Salon business expanded by 8%.

- The Shampoo business ended Q4 with a 4% jump.

- The Badshah portfolio recorded approximately 11% volume growth during the quarter.

Market share also improved across several key categories:

- Juices & Nectars witnessed a 261 bps gain, ending at a commanding 60.6% market share.

- Dabur's market share in the Hair Oils category shot up by 196 bps, reaching an all-time high of 19.1%.

- The toothpaste category saw a 15 bps increase in market share.

- In the air-freshener category, Dabur gained 67 bps.

- Dabur Glucose boosted its market share by 112 bps.

Divided Proposal

The Board of Dabur proposed a final dividend of Rs 5.25 per equity share, bringing the total dividend payout for 2024-25 to a hefty 800%. This move underscores the company's commitment to its payout policy, according to Dabur India Group Director PD Narang[1].

Stay Ahead of the Game with Our Latest FMCG NewsSource: Livemint

Enrichment insights:

- Dabur's Q4 profit drop was largely due to increased input costs, challenging market conditions, and narrowing EBITDA margin[2].

- The company face high input costs due to a rise in the prices of raw materials like oils, sugars, and metals, which offset the price hikes[2].

- The rural market remains a significant segment for Dabur, but the recovery in rural demand was slow, impacting Dabur's profitability[2].

- Although the EBITDA margin decreased slightly, the actual EBITDA grew, showing the company's resilience in the face of adversity[2].

- Amidst a challenging market with high food inflation and increased cost of living, Dabur India managed to carve out market share gains across 90% of its portfolio.

- Despite a 8.4% decline in Q4 net profit compared to the same quarter last fiscal, Dabur's international business saw a 19% growth during the fourth quarter.

- Mohit Malhotra, the CEO of Dabur India, believes that urban and rural markets will recover, and the company is concentrating on beefing up its presence in rural areas and rolling out consumer-centric innovations.

- Dabur's Foods business saw an impressive 14% growth during the quarter, while the Skin & Salon business expanded by 8%.

- The Shampoo business ended Q4 with a 4% jump, and the Badshah portfolio recorded approximately 11% volume growth during the quarter.

- The Board of Dabur proposed a final dividend of Rs 5.25 per equity share, bringing the total dividend payout for 2024-25 to a hefty 800%.

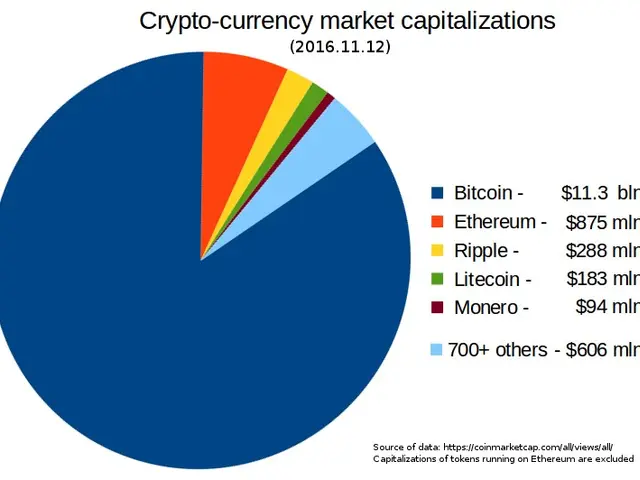

- In the DEFI (Decentralized Finance) sphere, strategic investment in key areas could potentially yield high returns, offering an interesting opportunity for personal-finance management and business expansion.