Cryptocurrency startup Grayscale gets green light for launching its initial mutual fund focused on digital assets.

SEC Approves First Multi-Asset Crypto Exchange-Traded Product and Streamlines Approval Process

In a significant move for the cryptocurrency industry, the U.S. Securities and Exchange Commission (SEC) has approved the Grayscale Digital Large Cap Fund (GDLC), making it the first multi-asset crypto exchange-traded product (ETP) similar to a mutual fund. This approval comes after more than a year of regulatory stalemate for digital asset funds.

The SEC's decision, announced in January 2024, also included the approval of rule changes for generic listing standards for exchange-traded products (ETPs) holding digital assets. These standards will allow exchanges to list commodity-based ETPs and ETFs holding crypto without requiring individual agency reviews for each fund.

Joel Hugentobler, Cryptocurrency Analyst at Javelin Strategy & Research, stated that this move is likely to lead to additional financial products based on ETPs and ETFs, such as options. He also noted that the generic listing standards will reduce barriers to accessing digital asset products in the U.S.

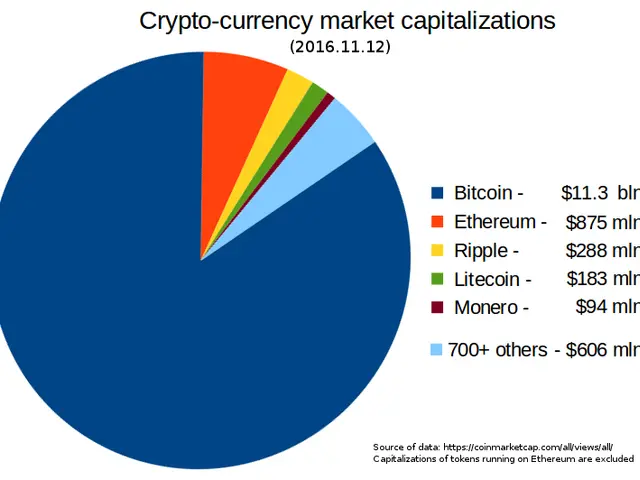

The GDLC fund is diversified across several different assets, including bitcoin and ether. Grayscale, which was part of the inaugural class of vehicles for both bitcoin and ether funds, has included XRP, Solana, and Cardano in its fund's basket of cryptocurrencies.

A few months after the initial approvals, the SEC also approved five ether-based funds. As of last month, 92 different crypto funds are still awaiting SEC approval, including some tied to lesser-known assets like Avalanche and Bonk.

The rule change introducing generic listing standards for exchange-traded products with digital assets was proposed by three national securities exchanges and approved by the SEC on September 17, 2025. The SEC has not specified the shorter duration for the approval process after implementing these generic listing standards.

Hugentobler noted that while this marks a significant milestone for the industry, the success of this fund won't be clear until after the bear market portion of the cycle. Grayscale still hopes to convert its Chainlink Trust into an ETF.

The approval of the GDLC fund is expected to open up the cryptocurrency market to a wider range of investors, making it easier for them to gain exposure to the digital asset class. This development could potentially accelerate the maturation of the concept of crypto mutual funds.

Read also:

- A Business Model Explained: Its Purpose and Benefits for Your Venture

- Trump administration faces lawsuit by Denmark's Ørsted over halted wind farm project

- U.S. takes a pledge of $75 million to foster Ukrainian resources development

- Deep-rooted reinforcement of Walkerhughes' acquisitions through strategic appointment of Alison Heitzman