Costco and AbbVie thrive with contrasting growth and dividend strategies

Two major US companies, Costco Wholesale and AbbVie, have demonstrated strong financial performance through contrasting business models. Both have also built reputations for rewarding shareholders with consistent—and sometimes substantial—dividend payments.

Costco’s latest fiscal results show steady growth, while AbbVie’s pharmaceutical pipeline continues to expand with high-revenue drugs and new acquisitions.

Costco’s revenue for fiscal year 2025 climbed to $275.2 billion, marking an 8.2% rise from the previous year. The company’s profitability relies heavily on predictable, high-margin membership fees rather than product sales alone. Its limited product selection also grants Costco significant purchasing power, allowing it to negotiate better deals with suppliers.

The retailer has raised its regular quarterly dividend annually for over two decades. Currently, the annual payout stands at $5.20 per share, though the yield remains below 1% due to rapid stock price growth. Despite this, Costco maintains a conservative payout ratio of around 27%, leaving room for future increases. On top of regular dividends, the company has occasionally issued large, one-off special dividends to shareholders.

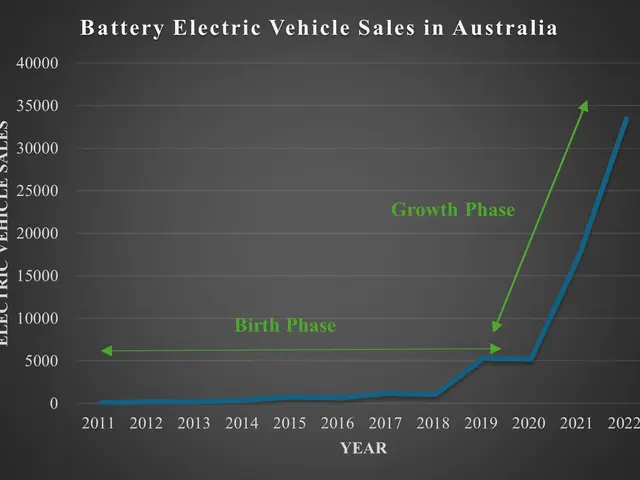

AbbVie, meanwhile, has strengthened its position in immunology with drugs like Skyrizi and Rinvoq, which are projected to generate combined sales exceeding $31 billion by 2027. The pharmaceutical giant also offers a forward annual dividend of $6.92 per share, yielding roughly 3%. Its track record includes 54 consecutive years of dividend increases, earning it the status of a Dividend King.

In 2024, AbbVie expanded its pipeline by acquiring Gilgamesh Pharmaceuticals. The deal added bretisilocin, an investigational psychedelic-derived antidepressant for major depressive disorder, to its development portfolio.

Costco’s membership-driven model and disciplined dividend strategy continue to deliver growth, even with a modest yield. AbbVie’s focus on high-revenue drugs and consistent dividend hikes reinforces its appeal to long-term investors.

Both companies remain committed to shareholder returns, though through different financial approaches and market strategies.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now