Contemplating domestic digital currency release to bypass international sanctions – potential action by Russia

In the world of global finance, stablecoins are rapidly gaining traction as a viable option for cross-border payments. These digital currencies, which are pegged to a stable asset like the US dollar, have been embraced by various fintech and financial institutions worldwide. One such example is Circle's USDC, a stablecoin that's making waves in the financial infrastructure sector.

Recent developments in Russia have seen the country exploring the use of stablecoins for cross-border payments, particularly for imports and exports. The Deputy Director at the Russian Finance Ministry, Osman Kabaloev, suggested the possibility of Russia launching a stablecoin for such purposes. This isn't the first time such a proposal has been made; reports from last August hinted at plans to issue a stablecoin in the Chinese yuan and a stablecoin based on the BRICS basket.

However, it's important to note that as of August 2025, there is no publicly confirmed Russian stablecoin initiative explicitly aimed at bypassing international sanctions, such as the AE Coin or Tether. Russia has been exploring the use of Digital Financial Assets (DFAs) for cross-border payments for over a year now, but there's no direct evidence that a state-backed or sanctioned-purpose stablecoin has been planned or launched in this context.

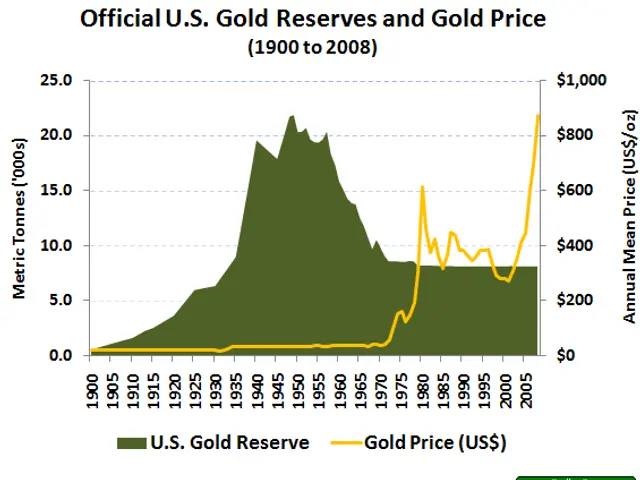

Russia's interest in stablecoins isn't confined to sanctions evasion. The country is also working on a digital ruble central bank digital currency (CBDC) and has two experimental programs for cross-border payments: DFA issuance and a regulated tokenization regime. The latter supports assets like tokenized gold or oil.

Interestingly, a significant proportion of Russia's cross-border payments have now shifted to the Chinese currency. Pilot transactions for the use of cryptocurrencies for imports and exports were conducted at the end of December, and the mechanism is gaining momentum. However, the specifics of Russia's use of stablecoins in international trade aren't detailed in the available data.

One potential contender for the Russian stablecoin could be Tether, a popular stablecoin currently in use. However, it's worth mentioning that Tether froze $28.5 million in funds belonging to sanctioned Russian crypto exchange Garantex, causing it to suspend services. This raises questions about the potential frictions foreign DFA holders might face when onboarding with Russian banks.

As the global stablecoin landscape continues to shape up under clearer regulatory frameworks like the US GENIUS Act, it's exciting to see countries like Russia exploring this technology. However, it's crucial to remember that while stablecoins are projected to become a major vehicle for cross-border payments by 2030, the regulatory progress is primarily US and Europe-focused, with no equivalent Russian framework or initiative referenced as of now.

Meanwhile, Russia's trade with China continues robustly despite sanctions and tariff pressures. There have also been reports of Russia working with Iran on using tokenized assets for payments. The BRICS Bridge, a planned cross-border CBDC payment system for local currency payments amongst the ten BRICS member states, is another interesting development to watch out for.

In summary, while Russia is exploring the use of stablecoins for cross-border payments, there's no confirmed initiative aimed at sanctions evasion as of August 2025. The global regulatory landscape for stablecoins is evolving, and it will be interesting to see how Russia navigates this space in the coming years.

Read also:

- A Business Model Explained: Its Purpose and Benefits for Your Venture

- Discussion on WardsAuto Podcast: Tariffs, Failed Merger, and Ford's Quality Issues

- High-Priced 2026 Corvette ZR1X Emerges as Budget Option in Supercar Sphere

- Top racer claims Corvette ZR1 might have shaved an additional 10 seconds off its record-setting lap time at Nurburgring