Consumer staples surge 12.7% as tech tumbles—is a market correction coming?

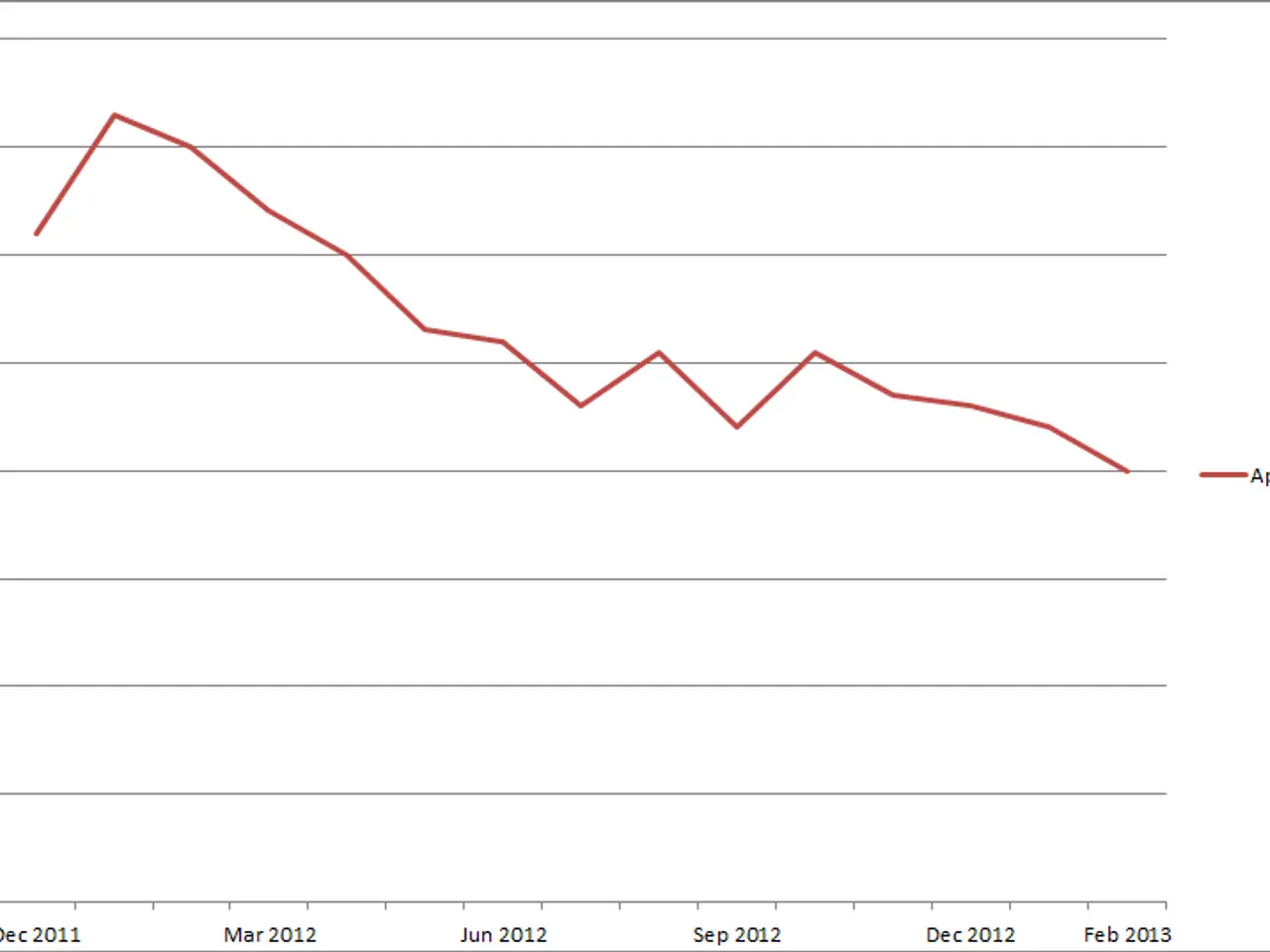

The first 32 trading sessions of 2026 have revealed a striking shift in market leadership. While the S&P 500 has barely moved, gaining just 0.1%, consumer staples stocks surged by 12.7%, with energy and industrials also climbing sharply. This unusual divergence has raised concerns about potential corrections ahead, particularly as midterm election uncertainty looms.

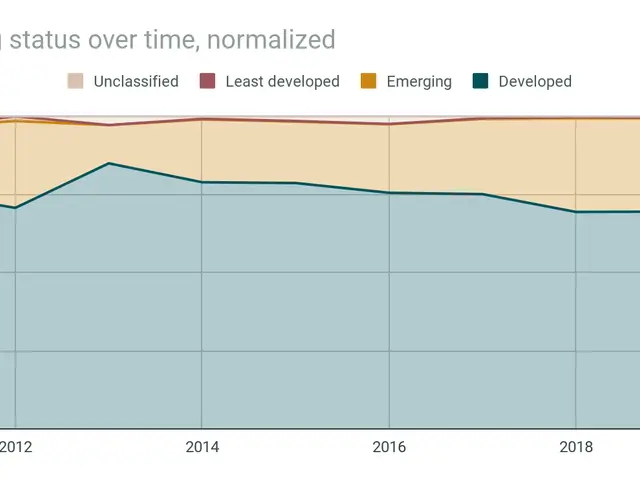

Between 2023 and 2025, tech and growth stocks drove the bull market. But in 2026, the trend has reversed sharply. Tech is now among the worst-performing sectors, down 4.5%, while consumer staples, energy, industrials, materials, and utilities lead the gains.

Historically, when consumer staples outperform the S&P 500 by this margin, a correction often follows. Every major spike in the consumer staples-to-S&P 500 ratio has preceded a 10% or deeper drop in the index. The sector's current strength—without a corresponding market pullback—suggests either staples must retreat or the broader index will face a downturn.

Consumer staples have typically thrived during downturns, such as the tech bubble, the 2008 financial crisis, and the 2022 bear market. Their recent dominance, alongside utilities, signals investor caution. With questions over tech spending, stretched valuations, and labour market stability, the S&P 500 appears increasingly vulnerable.

The equal-weighted S&P 500 has risen 5.5% this year, but the gap between consumer staples and the broader market is unsustainable. If past patterns hold, a correction is likely. Investors are now watching for signs of whether staples will retreat or the S&P 500 will adjust downward.