Connecticut enacts law: Prohibition of Cryptocurrencies in State Funds

Connecticut's newest law, Public Act No. 25-66, is making waves as the most extensive state-level restriction on government crypto activities. This law effectively shuts the door on any future state-supported crypto initiatives in the state.

Bid Adieu to State-Backed Crypto Projects

Connecticut government entities are now barred from establishing cryptocurrency reserves or accepting digital assets as payment for taxes, fees, or any financial obligations. This comprehensive ban effectively halts any state-supported crypto projects in the state.

In addition to the investment prohibition, the legislation lays out consumer protection guidelines for virtual currency service providers. These providers must display clear warnings about irreversible transactions and potential unrecoverable losses from fraud or errors. They are also obligated to disclose all substantial risks to customers and verify the identity of minors under 18.

The new law revamps the state's broader financial oversight laws and introduces new definitions for key digital finance terms such as digital wallets, kiosks, and control persons. Connecticut-licensed crypto businesses are compelled to implement robust compliance programs to meet the new state standards.

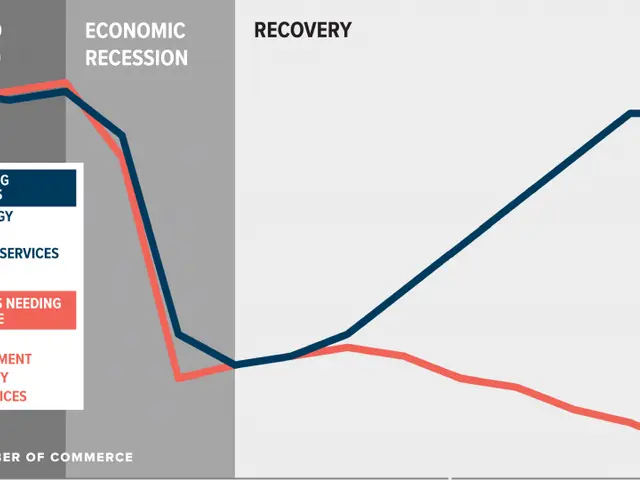

While this hardline stance contrasts with the growing trend of states considering digital asset adoption, 31 states are currently mulling Bitcoin reserve bills. Connecticut's legislation stands out for its breadth and decisiveness in restricting cryptocurrency activities.

Leading the Resistance

Last month, New Hampshire made headlines as the first US state to establish a strategic Bitcoin reserve with House Bill 302. The law allows the state treasury to invest up to 5% of its funds in Bitcoin and other digital assets with a market capitalization over $500 billion, with only Bitcoin currently qualifying.

The law, inspired by Satoshi Action's policy framework, aims to diversify the reserves while maintaining fiscal responsibility, with secure, US-regulated custody.

Exclusive Offers

Get $600 for free on Binance: Sign up using this link to open a new account and receive $600 exclusive welcome offer!

Free $500 position on Bybit: Register and open a position on any coin using this link!

[1] Connecticut General Assembly. (2022). Public Act No. 25-66 Section 1. Available at: https://www.cga.ct.gov/2022/rpb/pdf/2022HB-07082-R00HB-07082-R00-PA.pdf

[2] Department of Banking Connecticut. (2022). Virtual Currency Guidance, Bulletin No. 2022-10. Available at: https://www.ctdob.gov/sites/ctdob/files/attachments/2022_10_21.pdf

[3] Connecticut's General Statutes. (2022). Definitions Relating to Digital Currencies, Section 36a-485hh. Available at: https://www.cga.ct.gov/2016/pub/chap1131a.htm

[4] Office of the Comptroller of the Currency. (2020). Virtual Currency Resource Center. Available at: https://www.occ.gov/topic-channels/virtual-currency/

[5] Blockchain Association. (n.d.). Connecticut. Available at: https://www.theblockchainassociation.org/policy-action/state-policy/connecticut/

- Connecticut's ban on government crypto activities encompasses the prohibition of establishing cryptocurrency reserves and accepting digital assets as tax or fee payments, effectively halting state-supported crypto projects.

- The legislation also lays out consumer protection guidelines for virtual currency service providers, who must disclose substantial risks and verify the identity of minors under 18.

- In contrast, New Hampshire has recently created a strategic Bitcoin reserve, allowing its state treasury to invest up to 5% of funds in Bitcoin and other digital assets with a market capitalization over $500 billion.

- This move, inspired by Satoshi Action's policy framework, is aimed at diversifying reserves while maintaining fiscal responsibility with US-regulated custody.