Companies Boost Liquidity Reserves Amid Economic Uncertainty

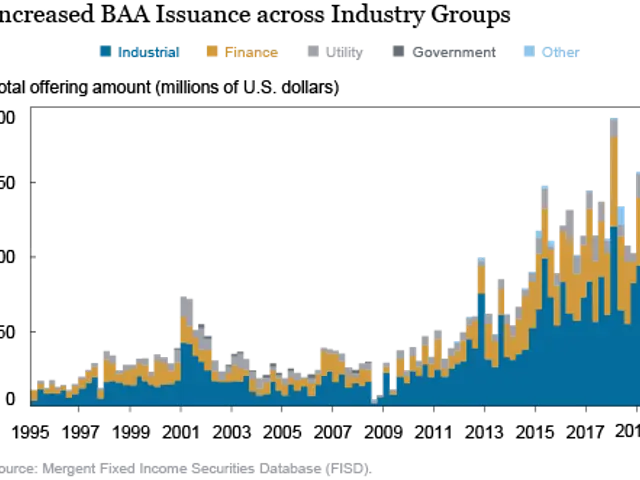

Businesses worldwide are bolstering their liquidity reserves in anticipation of potential economic downturns, a strategy seen post the 2008 financial crisis. However, managing liquidity is a delicate balance, as both insufficient and excessive reserves can hinder corporate growth.

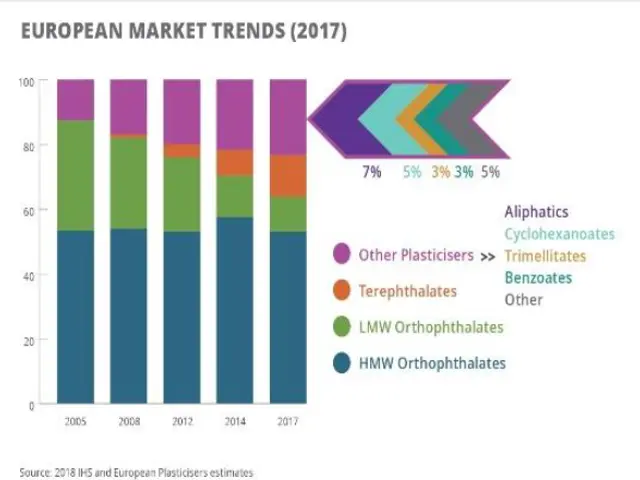

Each industry and company has unique liquidity needs due to seasonal variations and individual circumstances. Maintaining optimal liquidity levels is crucial. Too little can leave companies vulnerable, while too much can erode profits and delay vital investments.

Liquidity can be categorized into operational (for daily expenses), strategic (for mid-term plans), and surplus (freely investable funds). Continuous monitoring and planning are key to managing these reserves effectively. Short-term liquidity reserves act as a safety net for paying wages and supplier invoices during tough times. However, unexpected financial shortfalls can occur even during strong order activity, due to factors like customer payment defaults or unplanned investments.

Companies are investing their strategic and surplus liquidity in secure, interest-bearing instruments with varying maturities. This not only helps manage risks but also generates returns. Sound corporate governance ensures careful management of these liquid assets.

Companies are preparing for potential economic downturns by building up their liquidity reserves. However, balancing these reserves is vital to avoid hindering corporate growth. Effective management of liquid assets, through continuous monitoring and strategic investment, is crucial for navigating uncertain economic times.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting