Coinbase bets on copper and platinum futures amid stock market slump

Coinbase has expanded its derivatives trading by adding copper and platinum futures to its platform. The move comes as the company faces ongoing stock market declines and broader market uncertainty. Despite this, Bitcoin has held steady above $88,000 in recent trading.

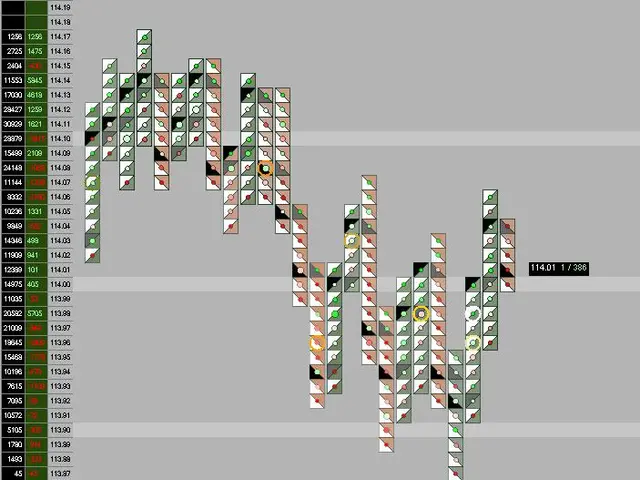

The exchange's shares dropped 1.24% to $208 on Tuesday before recovering slightly to close at $210. This continues a downward trend, with a 10% fall in the stock market today and a 46% decline from its July 2022 peak. The stock has now reached its lowest level since May 2022, reflecting investor caution around high-risk assets.

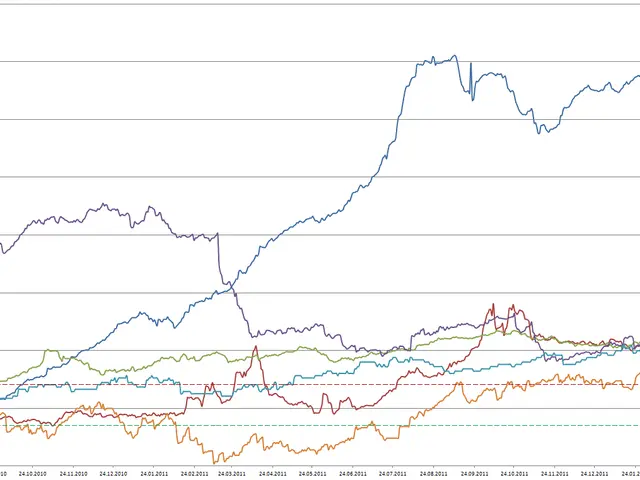

Analysts suggest the latest stock dip mirrors wider unease in crypto markets. Meanwhile, a recent report from Coinbase Institutional and Glassnode indicates the market may be stabilising. Excess leverage has reportedly been cleared out, and macroeconomic conditions appear more supportive.

The introduction of copper and platinum futures follows earlier gold and silver contracts. However, experts argue this expansion is not a direct hedge against crypto volatility. Instead, it aims to strengthen Coinbase's position as a derivatives trading platform and improve user retention.

As of January 28, 2026, no successor has been named for Steven Wu, the former COO of Clearpool.

Coinbase's stock struggles persist amid broader stock market hesitation, though Bitcoin remains stable. The addition of metals futures signals a strategic push into derivatives, even if it offers limited short-term protection against crypto swings. The company continues to adapt as investor sentiment evolves.