Coca-Cola Outshines Procter & Gamble as Dividend Kings Diverge in 2026

Two of the world’s most reliable dividend stocks, Coca-Cola and Procter & Gamble, have stood out for income investors in 2026. Both companies hold the rare title of Dividend Kings—each raising payouts for over six decades. Yet their recent performance tells very different stories, with one thriving while the other struggles to keep pace in a tough market for consumer staples.

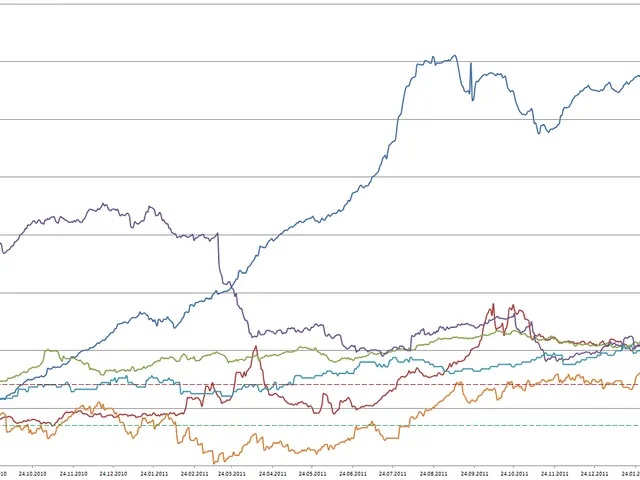

In 2025, consumer staples lagged far behind the broader market, dropping 1.2% while the S&P 500 surged 16.4%. Coca-Cola defied the trend, delivering a 12.3% gain, whereas Procter & Gamble fell by 14.5%. The soft drinks giant also proved better value, holding or growing sales volumes while flexing its pricing power. Its flagship brand alone—Coca-Cola—accounts for 42% of U.S. unit case volume, a far more concentrated portfolio than P&G’s diversified lineup of household names.

Coca-Cola’s global network of bottling partners helps maintain high margins and adaptability across markets. Meanwhile, Procter & Gamble’s scale, elite brands, and worldwide partnerships keep its margins industry-leading. But growth forecasts reveal a gap: Coca-Cola expects 5% to 6% organic revenue growth for 2025, while P&G’s fiscal 2026 guidance sits at just 0% to 4%, following a modest 2% rise in 2025. Both stocks now trade below their historical price-to-earnings ratios, making them attractive for long-term investors. Their dividend records—63 years for Coca-Cola and 69 for Procter & Gamble—reinforce their appeal as steady income sources. Elsewhere, Allianz leads Europe’s dividend rankings with an expected 16.90 EUR per share in 2026, while Verizon tops the Dow with a 6.8% yield.

Coca-Cola’s stronger performance and growth outlook contrast with Procter & Gamble’s recent struggles, though both remain solid choices for dividend-focused portfolios. Their trading valuations and decades of payout increases keep them firmly on investors’ radars. For those prioritising income, the two Dividend Kings still offer reliability in an unpredictable market.