CIMB FlexiPay revolutionizes SME financing with pay-as-you-earn loans

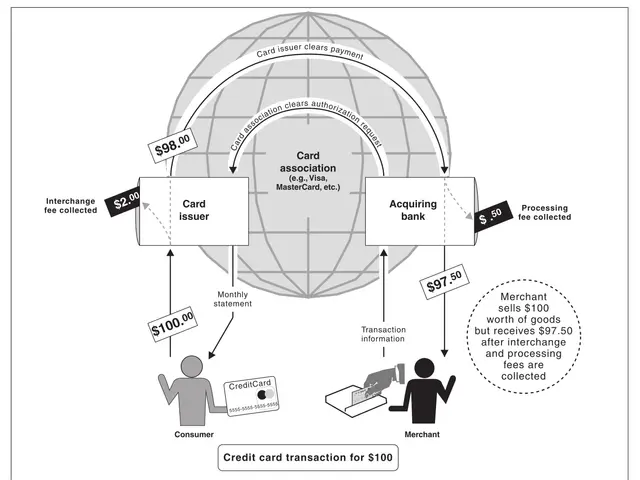

CIMB Singapore has launched an innovative loan scheme for small and medium-sized businesses. Called CIMB FlexiPay, it is the country’s first pay-as-you-earn credit product, offering greater flexibility for struggling or seasonal businesses. The loan was introduced in August 2025 after CIMB partnered with three key firms to create the SME Resilience Circle. This collaboration includes CrediLinq, KPay, and Singlife, each contributing specialised support. CrediLinq provides AI-powered credit checks to assess risk more accurately, while KPay links merchant payment records to financing applications, simplifying access to credit. CIMB FlexiPay removes traditional barriers like fixed monthly repayments and hidden fees. By linking costs to actual earnings, it offers a more adaptable way for SMEs to manage cash flow. The scheme is now available to qualifying businesses across Singapore.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting