Chipotle's 2026 expansion gambit: Can digital growth secure long-term profits?

Chipotle Mexican Grill has reached a critical phase in its expansion by the end of 2026. The company now operates around 2,000 Chipotlane locations, mostly across North America, with plans to include them in 80% of future openings. Investors are now watching closely to see if this rapid growth will actually boost returns and strengthen the business model in the long run.

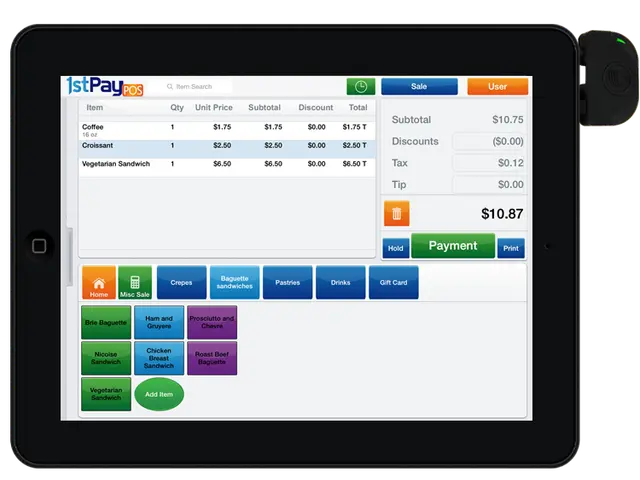

The fast-casual chain has long relied on disciplined growth, balancing speed with sustainability. Its digital ecosystem, which now accounts for over a third of total sales, plays a key role in this strategy. However, higher fulfillment costs from online orders could limit profit margins if not carefully managed.

By 2026, the focus shifts to whether new locations deliver strong returns on investment, maintain healthy margins, and avoid taking sales from existing branches. The company's ability to pick the right sites, control construction costs, and keep unit-level profits steady will determine its success.

For shareholders, the real test is whether Chipotle's digital tools do more than just move orders online. The goal is to increase customer visits, speed up service, and stabilize margins. If these efforts succeed, the brand could remain a reliable long-term performer. But if unit economics weaken or growth fails to translate into shareholder value, the expansion may fall short of expectations.

The coming years will show whether Chipotle's aggressive push into digital-driven growth pays off. Strong unit performance, efficient cost control, and sustained profitability will decide if the company's model remains robust. Without these, larger scale alone may not be enough to secure lasting shareholder benefits.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now