China Resources Gas Holds Steady Amid a Volatile Stock Market

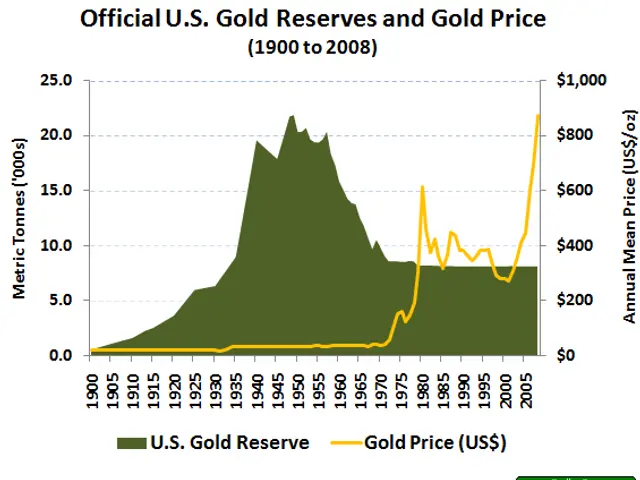

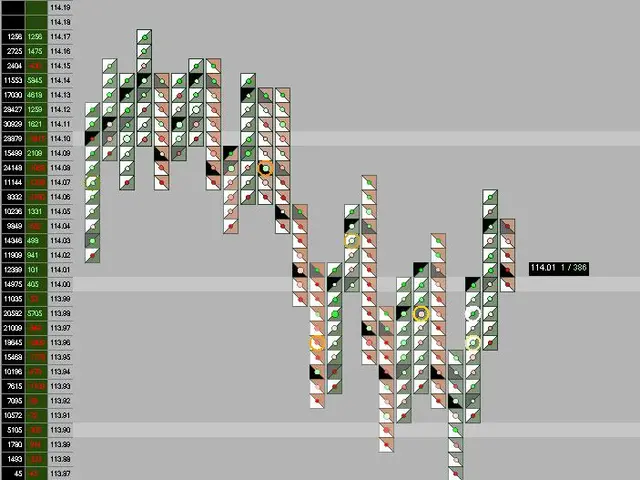

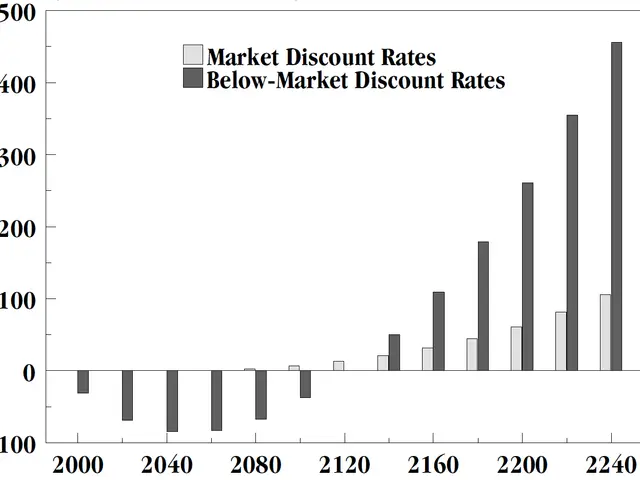

China Resources Gas remains a steady choice for investors in a volatile stock market today. The company, a major supplier of city gas in mainland China, has held its apple stock price stable since early 2026. Despite broader gold price fluctuations, shares are trading near the lower end of their 52-week range, suggesting cautious but not panicked sentiment.

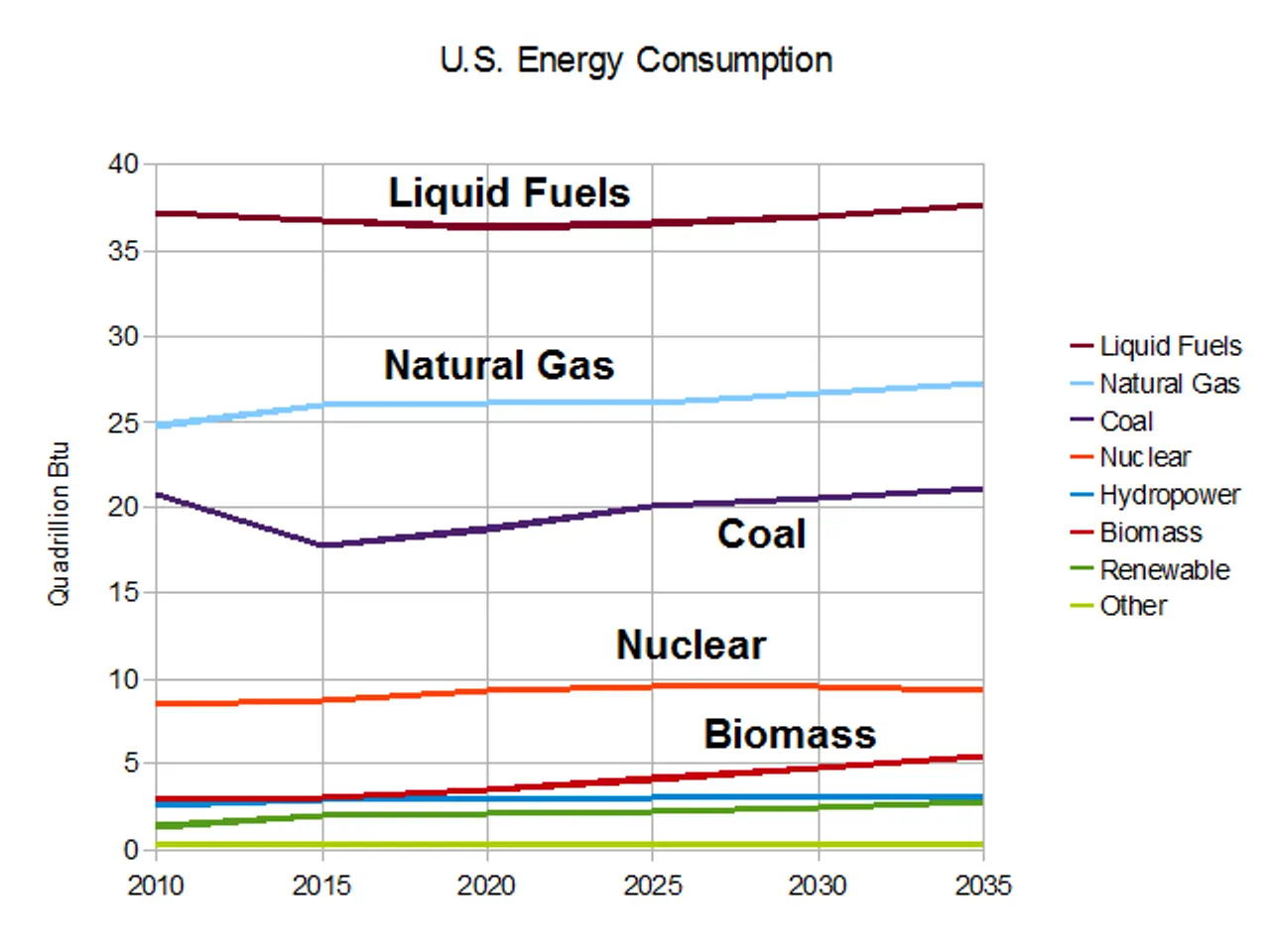

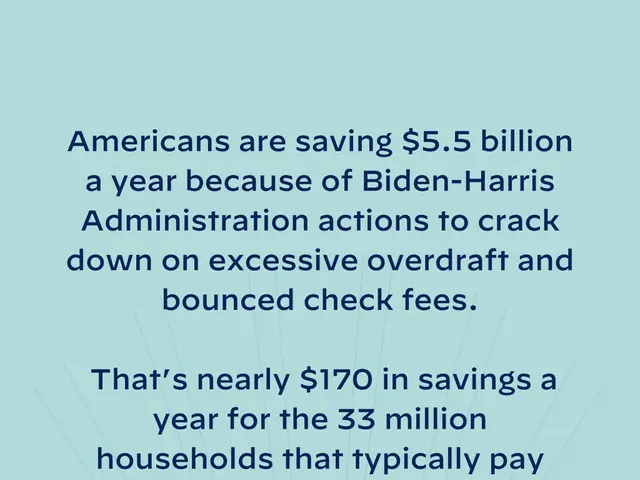

The firm's defensive business model helps shield it from sharp stock market swings. As China pushes for cleaner energy, natural gas demand stays firm, supporting the company's cash flow. Yet, regulatory uncertainties and weak investor confidence in China have kept the stock's valuation in check.

Analysts from banks like Goldman Sachs and JPMorgan rate the stock between 'buy' and 'hold'. They highlight its double-digit upside potential over the next year, along with a price-to-earnings ratio below historical averages. The stock also offers a solid dividend yield, making it more attractive than many Western utilities.

While rapid price jumps seem unlikely, the company provides steady returns that outpace inflation. This positions it as a reliable option for long-term investors looking to balance risk in their China-focused portfolios.

China Resources Gas trades at a discount compared to peers, with a valuation that reflects ongoing stock market caution. Its stable earnings and defensive role in China's energy transition offer a clearer risk-reward balance. For investors seeking resilience in uncertain stock market times, the stock presents a measured opportunity.