Money Matters: ECB's Rate Cut and the Consequences

Central Bank President advocates for flexibility in European Central Bank's interest rate decisions.

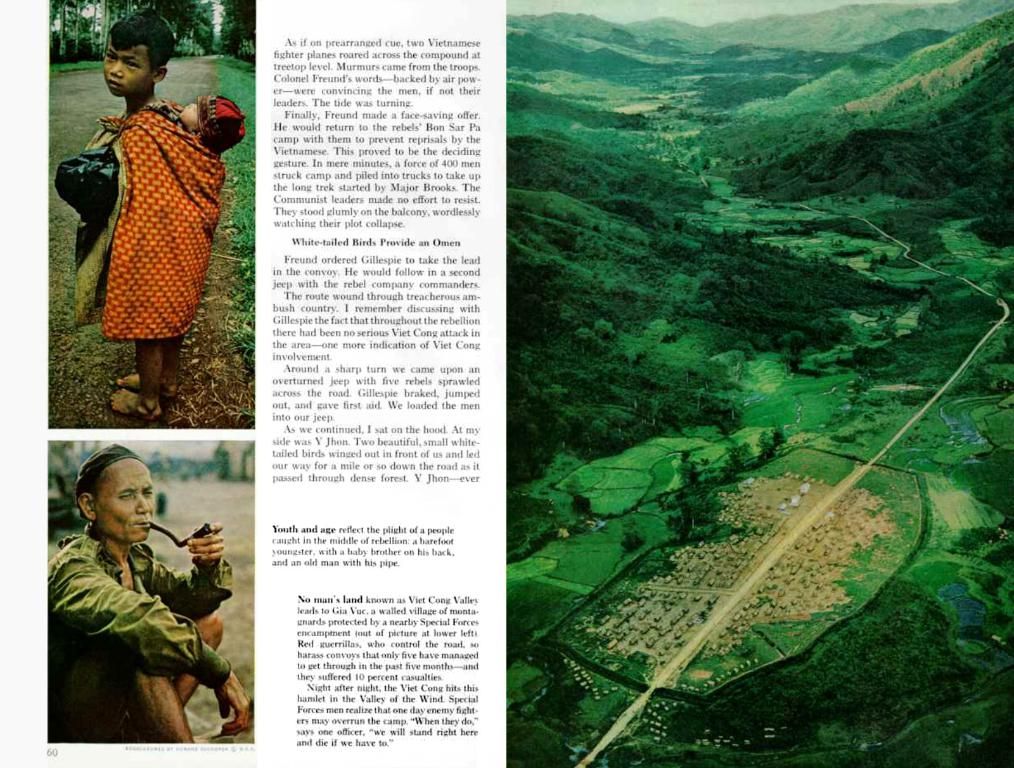

In response to the latest ECB interest rate cut, Bundesbank President Joachim Nagel is urging a cautious approach. As per Nagel, the recent rate cut is "just right," and we've entered the neutral zone. Now, it's time to observe and take our time, he said on Deutschlandfunk. This level gives us maximum flexibility with interest rates at this point.

A neutral zone means that key interest rates neither speed up nor slow down the economy. With Nagel's advice, ECB's pause in July seems increasingly probable- especially since the ramifications of the trade dispute with Trump for the economy and inflation are still uncertain.

Economists expect the ECB to hit the brakes in July, not least because the fallout from the trade war with the US is unclear. Inflation in the eurozone has dipped significantly, erasing an argument for higher interest rates. However, consumers are feeling the pinch of increased prices in their daily lives. May's inflation rate, as per Eurostat's initial estimate, fell to 1.9%- below the ECB's medium-term target.

The Cost of Cheap Loans

With interest rates dropping, loans become more affordable, providing a boost to the struggling eurozone economy. But this doesn't mean good news for savers- they should prepare for lower returns on savings accounts and time deposits.

The Trade Dispute Dance

The US and the EU continue their trade tug-of-war, with Trump threatening tariffs on European cars. This uncertain situation adds to the reasons why the ECB is considering a break from cutting rates. While the outlook is subdued, the ECB seems content with current inflation levels to maintain its 2.0% target in the long run.

Did You Know?- ECB expects headline inflation to average 2.0% in 2025, 1.6% in 2026, and remain at 2.0% in 2027. However, underlying inflation (excluding energy and food) is projected to remain slightly above the headline target[1][4].- The ECB assumes the current economy will grow moderately, averaging 0.9% in 2025, 1.1% in 2026, and 1.3% in 2027[2][3][4].- Growing government investment in defense and infrastructure, rising real incomes, and a strong labor market are expected to offset the impact of the ongoing trade dispute and support medium-term growth[2][4].

Premium Articles

Will Tensions Between Trump and EU Markets Trump's Warning to Musk? Why Sticking to Strong Companies Might Not Guarantee Successful Investments L'Oréal's Exciting Acquisitions: Stock Predictions Moving Forward More Articles

You Might Also Be Interested In

Fueling the Markets: Unpacking the ECB's Policy Shift Tesla's twists and turns: Navigating turbulent waters Will Inflation Figures Push the ECB to Reconsider Its Rate Cut? Trump's Impact on Tesla Stock and the Automotive Market Examining the ECB's Response to the Trade War: Stocks, Bonds, or Biontech? More Articles

In the context of the ECB's rate cut and the economy, the drop in interest rates makes loans more affordable, but it also means lower returns for savers on savings accounts and time deposits. Given the uncertain consequences of the trade dispute with Trump, economists anticipate the ECB to reconsider its rate cut decision due to unclear effects on the economy and inflation.