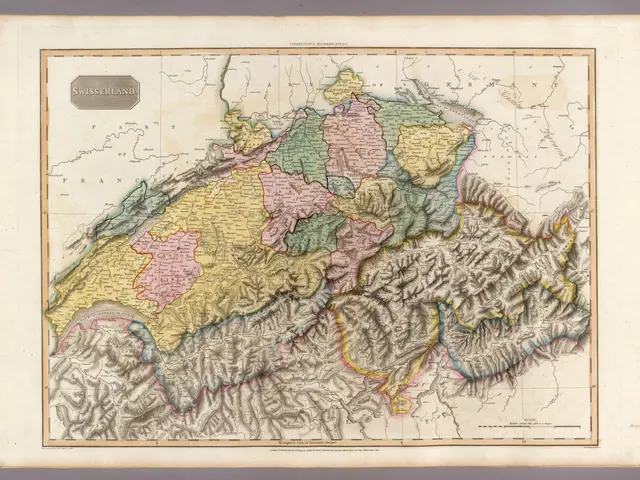

Central Bank of Switzerland Reports Impressive Profit Recovery Following Previous Substantial Losses

The Swiss National Bank Shatters Records with a staggering 80 billion franc profit

Step aside the 2017 record of 54.4 billion francs, because the Swiss National Bank (SNB) just smashed it out of the park! Preliminary numbers indicate a whopping 81 billion franc profit in 2024, thanks to a perfect storm of factors.

The SNB plans to share some of this bounty, as they'll be dishing out 3 billion francs to the Swiss cantons and government. Payments were on ice in 2022 and 2023, when the bank took a nasty tumble. Back then, a record loss of 132.5 billion francs plagued the bank, following a decline in its stock market investments.

Last year wasn't much better, as a loss of 3.2 billion francs greeted the bank after raising interest rates to combat inflation. But 2024 stepped up to the plate, just as the analysts from UBS predicted. Gold prices, the Swiss franc's strengthening against the dollar, and a buoyant stock market all contributed to the SNB's impressive profits.

Gold was the standout performer, with its price hike padding the SNB's gold reserves substantially. In Q1 2025, gold alone added a hefty 12.8 billion francs to the bank's profits[1][4]. The depreciation of the Swiss franc against other currencies led to hefty currency gains on the SNB’s foreign exchange reserves, boosting income from foreign currency holdings[5].

Rising stock prices and bond price gains also bolstered the SNB’s portfolio, reflecting the broader financial market's recovery[5]. Private Swiss households joined the party, as they too saw wealth increases due to equity gains early in 2024[3].

The SNB's extra cash came from interest on bonds and dividend payouts from its equity investments as well[5]. Lower expenses associated with monetary policy implementation further boosted the bottom line[5].

The wealth generated allowed the SNB to report a net profit of CHF 16 billion after deducting reserves, making profit distributions possible for the first time in three years[5]. The grand finale? The final figures are set to be unveiled on March 3rd[6]. Lucky for us, it looks like we're in for one heck of a show!

The Swiss National Bank (SNB) is expected to distribute 3 billion francs to the Swiss cantons and government in 2024, marking a return from the record losses experienced in 2022 and 2023. The predicted 81 billion franc profit for the SNB in 2024, a significant increase from the 2017 record, is attributed to a combination of factors, including strengthening of the Swiss franc against the dollar, gold prices, and a buoyant stock market. These factors have contributed to substantial growth in the SNB's gold reserves, gains from foreign exchange reserves, and gains from their equity investments.