Eighth Time's the Charm: ECB Slashes Interest Rate to a Historic Low of 2%

Central Bank Lowers Main Interest Rates to 2 Percent

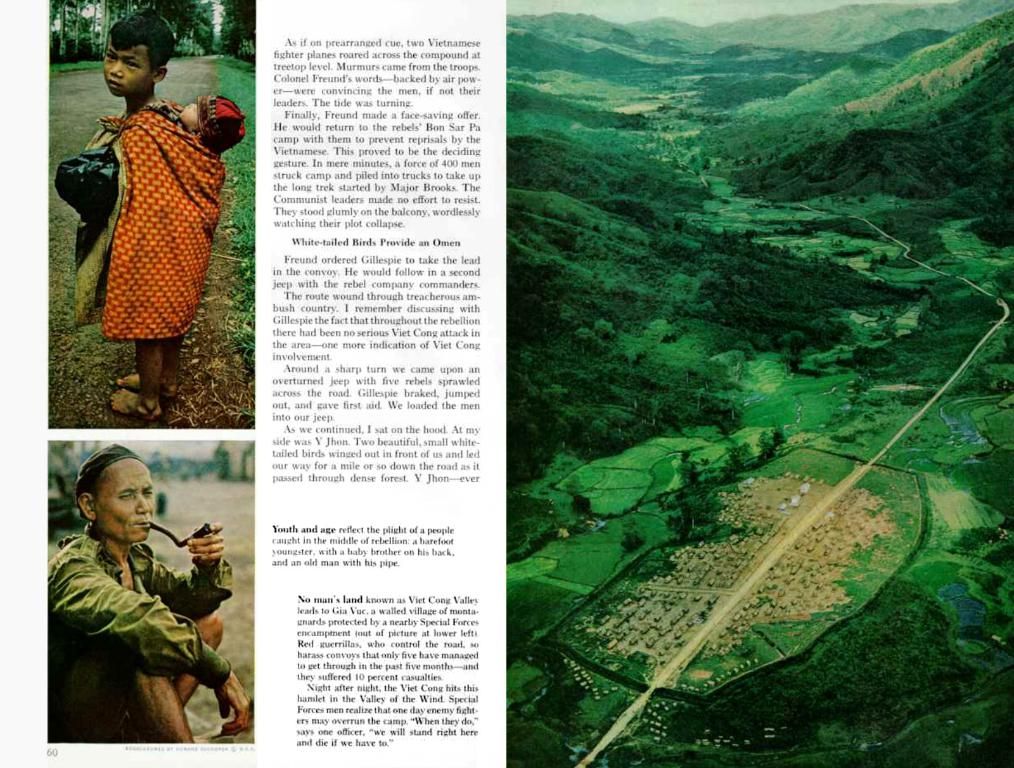

The European Central Bank (ECB) has done it again — lowering interest rates for the eighth consecutive time. The key rate, the deposit rate that banks receive for parking excess liquidity at the central bank, has been cut by a quarter of a percentage point, landing at a historically low 2.0 percent.

This decision was made by the ECB Council, led by President Christine Lagarde, due to a combination of dwindling inflation rates and sluggish economic growth within the eurozone. One council member, however, disagreed with the decision to lower interest rates. "The ECB Council believes the current interest rate level is well-positioned for these uncertain times," declared Lagarde. The ECB has been hesitant to reveal its future plans, stating, "The ECB Council does not commit to a specific interest rate path in advance."

Ulrich Reuter, President of the German Savings and Giro Association, applauded the ECB's decision as appropriate in the face of increasing geopolitical tensions and declining investment readiness. Heiner Herkenhoff, CEO of the German Banking Association, cautioned against further rate cuts during the summer due to the potential risk of driving inflation and the unpredictability of trade and tariff conflicts.

What Does This Mean for You?

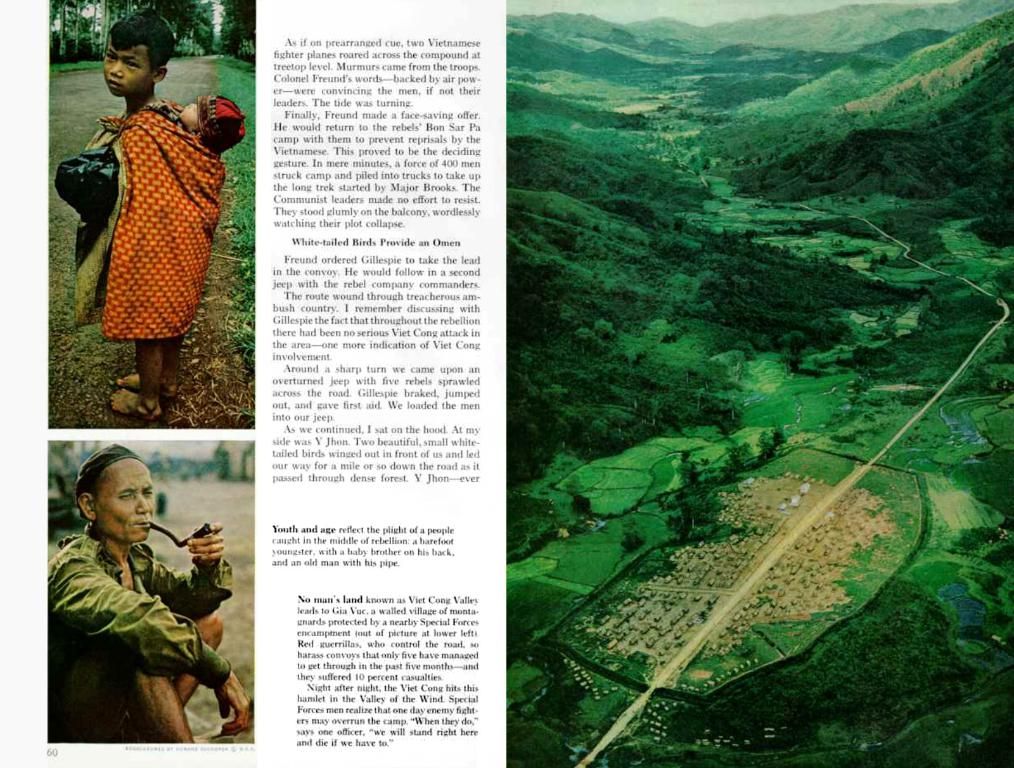

Inflation, which saw a significant increase following the Ukraine war, has now dipped below the ECB's target of 2.0 percent, reaching 1.9 percent in May. Although Lagarde described the inflation outlook as uncertain, economic growth is expected to be sluggish due to the ongoing global trade war stirred up by US President Donald Trump. The European Commission predicts a GDP growth of just 0.9 percent this year.

Struggling economies and the unpredictable back-and-forth in the trade dispute with the US mean the ECB is operating in an environment with significant uncertainty. Companies are hesitant to make large investments in such conditions, but a potential growth driver could be Europe's planned military buildup, as well as the massive financial package recently pushed through in Germany.

While a slowing economy normally leads to decreased inflation, escalating tariffs and disrupted supply chains could potentially boost inflation in the long run. The ECB has been managing its monetary policy on a case-by-case basis, making data-driven decisions from meeting to meeting. There was recent speculation that the ECB might pause rate cuts in July, but the probability of this happening is now estimated to be approximately 70 percent.

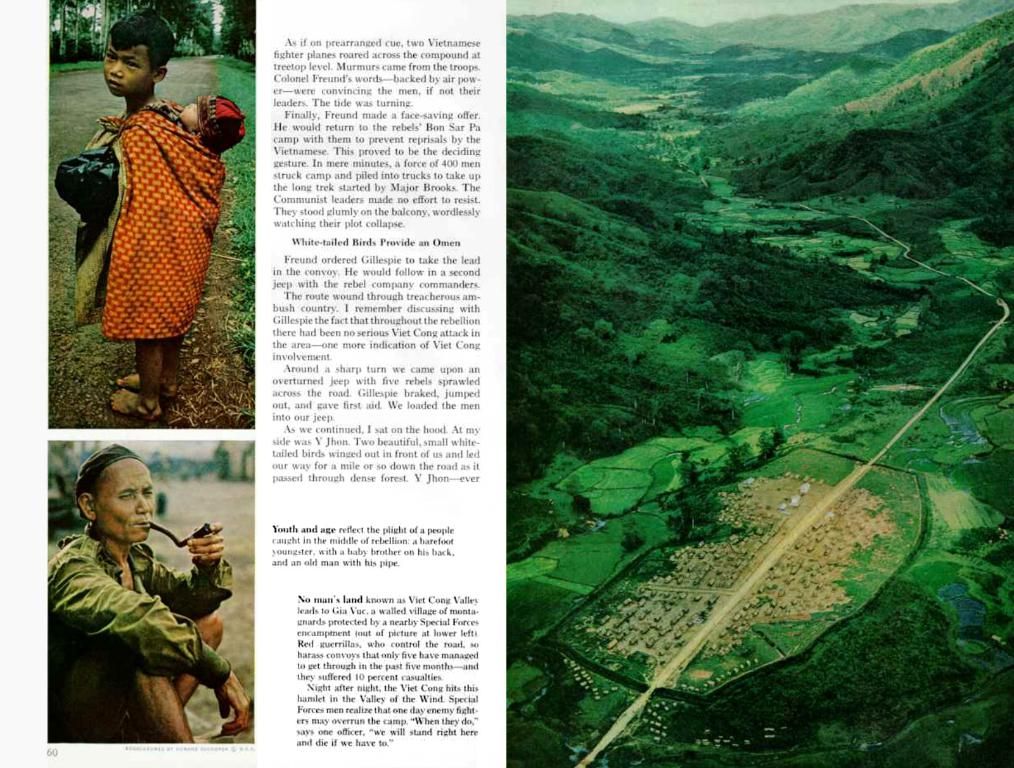

The ECB's Long Game

In addition to current economic conditions, the ECB is mindful of the significant risks to the economy caused by the upheaval of the world order that has existed for decades. "Instead of diplomatic cooperation, we are now witnessing zero-sum thinking and power struggles," Lagarde criticized, without mentioning Trump by name. At the same time, new opportunities are opening up, such as the potential for a greater international role for the euro.

The ECB will continue to monitor economic conditions closely and adjust its monetary policy as necessary to support economic stability and growth.

Source: ntv.de, mpa/rts

- ECB

- Interest rate policy

- Interest rate cuts

- Economic growth

- Inflation

- Trade tensions

- Under the current employment policy, businesses in the community may benefit from lower interest rates due to the ECB's interest rate cuts, which are designed to stimulate economic growth and counteract inflation, particularly in uncertain times.

- The finance minister of the community may need to reassess the existing community policy, considering the ECB's long-term strategy that includes the management of monetary policy and its response to global trade tensions, geopolitical instability, and changes in the world order.