Central Banks' Gold Rush: A New Era for Gold Reserves

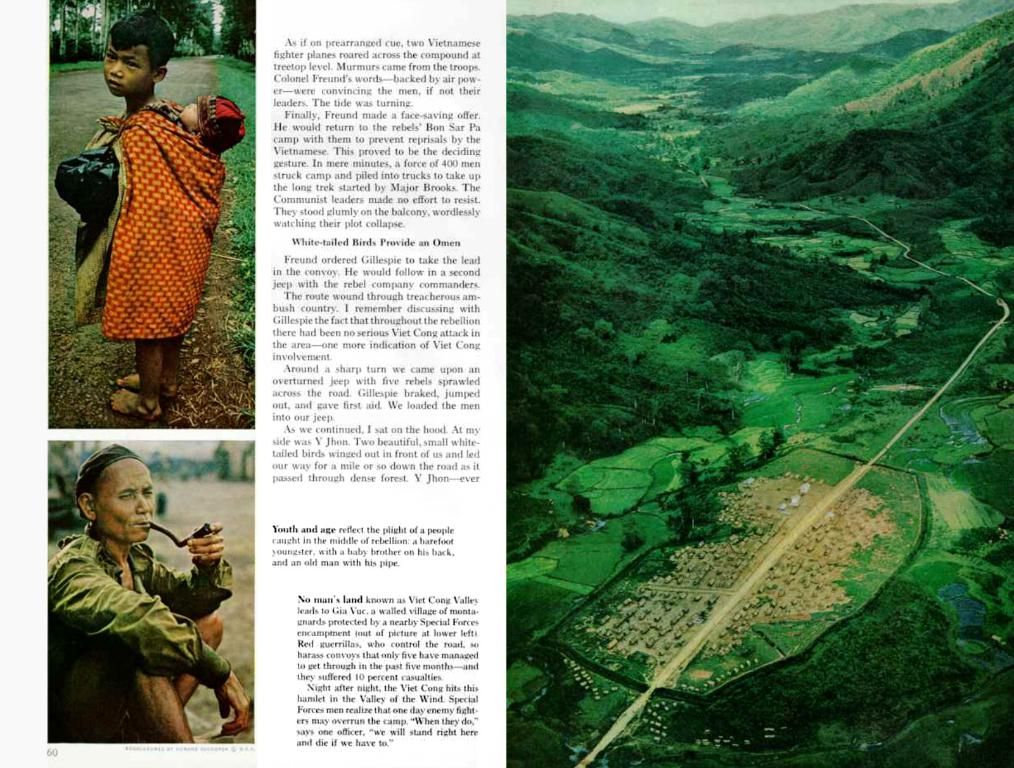

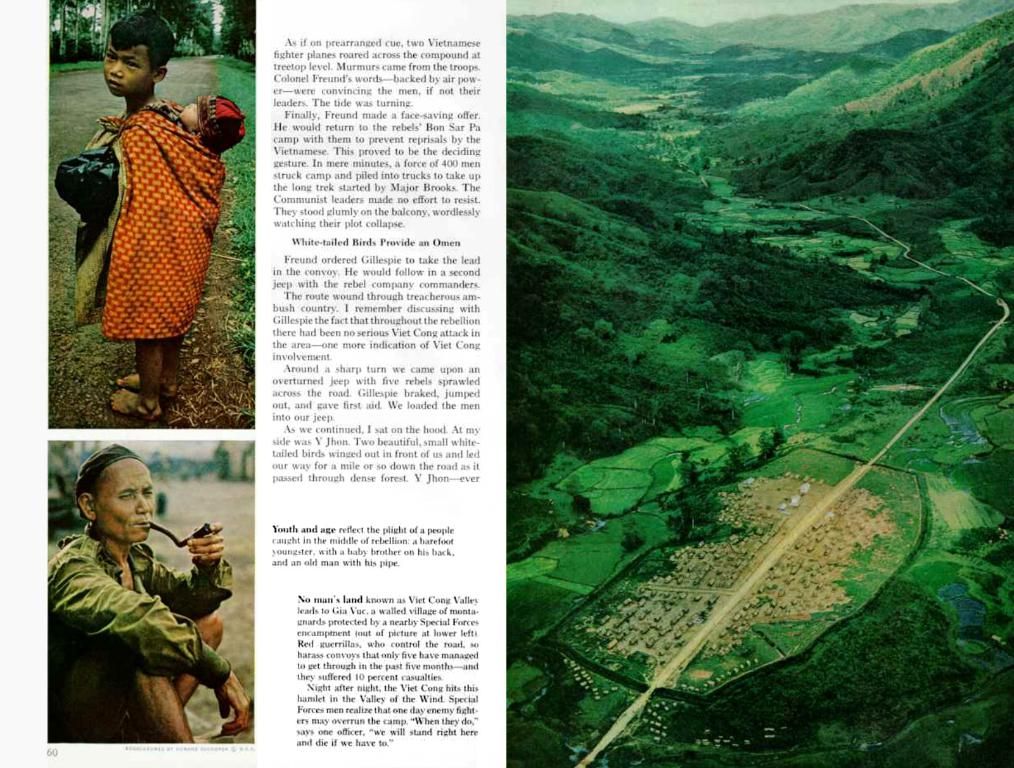

Central authorities fortifying their reserves with precious gold.

Let's dive into the latest trend that's making waves in the financial world: central banks snatching up gold like never before!

In the span of two years, gold prices have skyrocketed, with most of the buzz stemming from central banks' insatiable appetite for the precious metal. It seems these institutions are planning to ramp up their gold hoard even further!

With Russia's invasion of Ukraine, the world has witnessed central banks increasingly flocking to gold. The World Gold Council reports that this trend is likely to continue, with over 95% of surveyed central banks expecting an increase in the global gold reserves within the next year — the highest level since the annual survey's inception in 2018!

Central banks have been lured to gold by a variety of factors:

- Geopolitical Anxiety: Geopolitical uncertainties, sanction risks, and worries over the US dollar's status have fueled central banks' recent gold buying spree. Gold has even surpassed the euro as the world's second most important reserve currency, trailing only the almighty greenback. This year alone, gold prices have surged by 30%, and they've doubled in the past two years.

- Inflation Protection: Central bank purchases are playing a significant role in pushing up gold prices. In 2024, central banks added an impressive 1,000 tons of gold to their reserves for the third year in a row, bring the total global gold holdings to 36,000 tons — dangerously close to the 1965 record high. Central banks purchase gold primarily for inflation protection and the absence of default risk, as opposed to government bonds.

- Currency Diversification: Becoming less dependent on the dollar is another crucial factor driving central banks to gobble up gold. After Russia's invasion of Ukraine, the US froze Russian dollar assets and largely excluded the country from the international payment system. In response, central banks from developing economies are speeding up their diversification away from the US dollar.

Stores on Lockdown

Some central banks are even considering moving parts of their gold reserves back to their home countries. New York and London have traditionally been the most popular storage locations for central banks' gold reserves, as these cities serve as the world's largest trading hubs for the precious metal. In a pinch, central banks can swap their gold for an international reserve currency in these locations. Last year, the Indian central bank withdrew 100 tons of gold from London, and the central bank of Nigeria brought it home.

German Gold: New York or Frankfurt?

German gold is quite the topic of discussion lately. The Bundesbank keeps 37% of its gold reserves — approximately 3,352 tons — in high-security vaults at the New York Fed. The rest is split between Frankfurt (51%) and the Bank of England in London (12%). Despite calls to withdraw some of the gold from New York, fueled by uncertainty over the US Federal Reserve's policies under President Trump, the Bundesbank remains resolute. They believe the New York Fed offers a trustworthy and reliable partner for gold storage.

At a recent press conference, Bundesbank President Joachim Nagel was asked if he still felt comfortable with parts of Germany's gold reserves being stored in New York. His witty response: "No fear of Elon Musk and his interns popping up to collect NATO debts!" Nothing can rattle the Bundesbank, it seems. Vice President Sabine Mauderer added that the Bundesbank regularly inspects its holdings in New York to put everyone's minds at ease.

In an era of continuous global uncertainty, central banks see gold as a reliable anchor in the storm, providing a hedge against inflation and a buffer against currency risks. This renewed interest in gold is certain to keep the precious metal glittering brightly on the global financial stage.

- The current trend in central banks' financial strategies involves an increased focus on acquiring gold, serving as an employment policy for miners, finance investors, and technology companies involved in gold mining and processing.

- As central banks continue to invest in gold reserves, businesses specializing in personal-finance advisory may find opportunities to educate clients on the benefits of diversifying their portfolios to include gold, driven by factors such as inflation protection, geopolitical anxiety, and currency diversification.

- A potential shift in storage policies by some central banks, bringing parts of their gold reserves back to their home countries, could spark employment opportunities in the construction and security sectors as new high-security vaults are built or upgraded to accommodate the influx of gold.