Caution Before Making this Incontestable Investment in Shares

Anyone can't deny the great success of Chipotle Mexican Grill (CMG), as its shares have significantly increased in the recent years due to its impressive financial performance. This company has shown its potential to boost shareholder capital, so it's worth considering for your investment portfolio.

However, it's essential to be aware of one significant warning before investing in this seemingly unstoppable restaurant stock.

Chipotle's staggering valuation

Over the past five years, Chipotle stock has surged by an impressive 307%. This growth easily outpaces the S&P 500's performance, which has given a total return of 111%. Even in this year, Chipotle has outperformed the broader index.

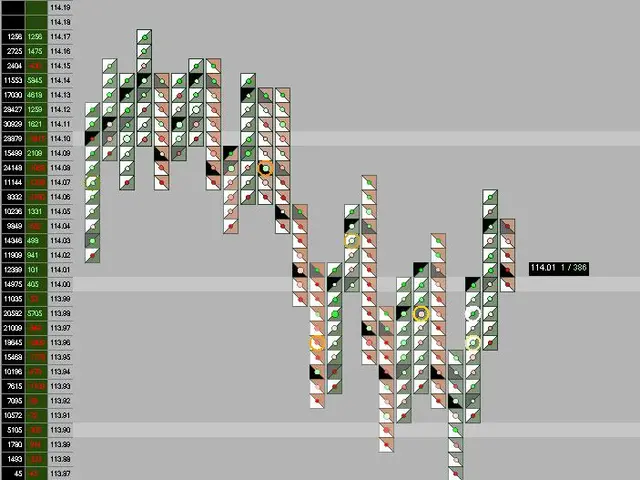

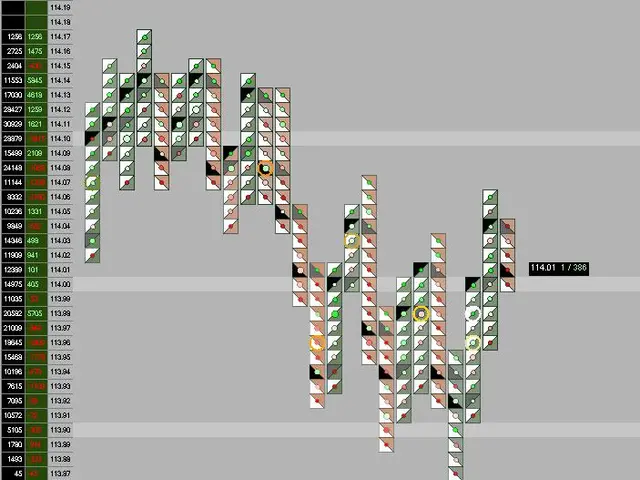

But the warning that investors need to pay attention to is its sky-high valuation. As of Nov. 12, its stock costs a price-to-earnings (P/E) ratio of 56.3.

Although this valuation is lower than the P/E ratio of 72.6 that the shares reached at their all-time high in June this year, some investors may see it as a smart buying opportunity. However, I disagree.

Chipotle's inflated valuation translates to a lack of security for potential investors, in my opinion. It highlights the strong optimism and excitement that the market has towards the business's potential. Given Chipotle's financial performance over the past few years, this optimistic outlook is reasonable.

However, investors should be aware that a high P/E multiple creates a significant barrier to achieving significant returns. In other words, Chipotle might be overpriced at the moment. If same-store sales and margins fall below what the market anticipates in any given quarter, the shares will suffer.

This raises the question: At what valuation is the stock an attractive investment opportunity? I'd need to see the P/E ratio fall below 30 before I take interest. I'm not sure if this will happen. But I'll keep an eye on Chipotle's business and stock performance, hunting for the perfect moment to invest.

Chipotle is an exceptional business

It's crucial to separate the stock's valuation from the solid business that lies beneath. While the former isn't appealing today, the latter points to an exceptional company.

Chipotle has demonstrated consistent growth between Q3 2019 and 2024, with its revenue doubling during that period. This growth can be attributed to solid same-store sales gains and an expanding store base.

Since 2019, Chipotle has opened 1,069 net new locations, many of which include drive-through lanes. Moreover, there's still room for expansion. The forecast predicts 7,000 stores in North America eventually, which would nearly double the current count.

Each Chipotle location generates increasingly higher sales each year. Therefore, it's easy to understand why the management team is so focused on expanding the store base, considering they also boast a restaurant-level margin of 25.5%.

This is a highly profitable organization. Since Q3 2019, net income has grown by an annualized rate of 31.5%. Chipotle has demonstrated that it can excel, even as it scales up and maximizes efficiency by better managing its expenses.

According to Wall Street's consensus estimates, earnings per share are expected to rise at a compound annual rate of 18.9% between 2024 and 2026. Although this represents a drop, it remains a positive outlook. However, it doesn't justify the current P/E ratio.

Without a doubt, Chipotle is a high-quality enterprise. However, its valuation is not currently compelling. It's better to keep an eye on this business in the hopes of a substantial pullback.

Despite Chipotle's impressive financial performance and anticipation of future earnings growth, the high price-to-earnings ratio makes investing in the company at the current moment a questionable finance decision for some investors. Regardless, keeping a close eye on Chipotle's financials and stock performance could provide potential opportunities for future investing in this exceptional business.

Investors might want to consider diversifying their portfolio by allocating some funds towards money management strategies, such as investing in a mix of stocks, bonds, and other asset classes, to balance risk and potential returns. This approach, often referred to as asset allocation, can help provide financial stability and long-term returns, considering the volatile nature of the stock market.