Canopy Growth's Stock Plunge Deepens as Penny-Stock Risks Mount in 2026

Canopy Growth, a well-established name in the cannabis industry, continues to grapple with financial hurdles. The company has yet to report a profit, and its recent moves—including a new acquisition—have sparked concerns about its future stability. Shareholders have witnessed its stock price decline further in early 2026, mirroring ongoing struggles in the stock market.

The company's latest transaction involves acquiring MTL Cannabis in an all-stock deal. This move will increase the total number of shares, resulting in greater dilution for existing investors. Such dilution often makes it more challenging for companies to achieve profitability, especially when stock prices are already low.

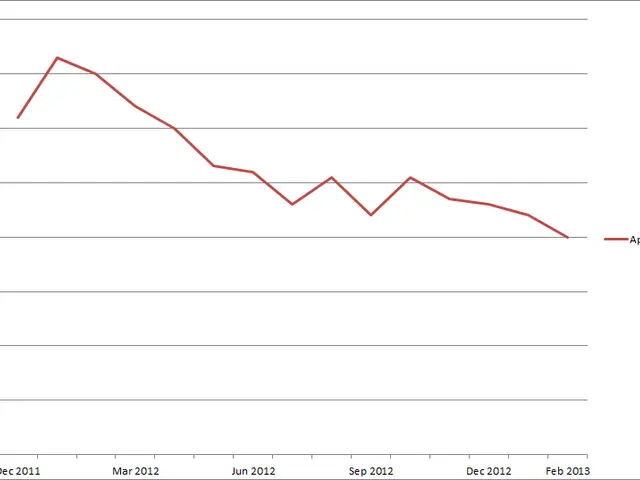

Canopy Growth's stock has been trading near penny-stock levels, a category known for high risk and volatility. After recapitalizing in January 2026, the share price stood at around 1.08 CAD following its Q3 earnings report on February 6. By mid-February, it had dropped further to between 0.85 and 0.92 CAD, nearing its 52-week low of 0.77 CAD.

The recapitalization earlier this year allowed the company to extend debt deadlines, but it came at a cost. To secure the deal, Canopy Growth had to offer additional incentives, including warrants. Such measures often indicate financial strain, as companies must sweeten terms to attract much-needed capital.

Despite efforts to reduce losses, the company remains unprofitable. While the magnitude of its deficits has decreased, sustainability is still elusive. Penny stocks like Canopy Growth frequently encounter steep hurdles when raising funds, as investors demand higher returns for the added risk.

The acquisition of MTL Cannabis adds to Canopy Growth's financial pressures, with share dilution complicating its path to profitability. With its stock hovering near historic lows, the company's ability to stabilize will depend on reversing its long-standing trend of losses. Investors are now closely monitoring to see if further strategic moves can turn its fortunes around.