Businesses Set to Increase Expenditure on Climate Change Adaptation Strategies: Timeline Unveiled

Laidback Take on Climate Adaptation Investments

Welcome back to our Moral Money newsletter, premium subscribers! If you haven't yet signed up, now's the time to do so here. Others can easily upgrade to Premium or explore our other FT newsletters here.

Recent numbers from the EU's Copernicus service show that the average global temperature has surpassed the 1.5°C threshold in 21 out of the last 22 months. You can say that's a sign for companies to get on the right track when it comes to investing in climate resilience. But who's looking to make a buck from these changes? Let's dive in!

Climate Puzzle: Less Action, More Words

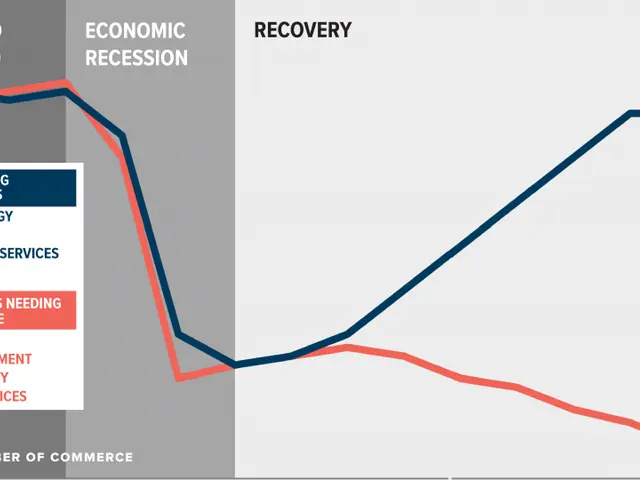

For years, many global companies have been touting the risks of climate change, yet their efforts to tackle these risks have been surprisingly limited. Take, for instance, the European Investment Bank's survey of EU businesses, which revealed that 66% recognize the physical impacts of climate change on their business, but only 22% of them have a dedicated adaptation strategy.

Why is that? A behavioral economist might attribute it to our innate tendencies. One reason is the "status quo bias" - we stick with what's familiar because it's comfortable. Another is "herding behavior" - we're more likely to invest in climate adaptation if our peers do. Lastly, there's the "optimism bias" – even if we're aware of the risks, we tend to underestimate the chances of those risks affecting us personally.

Climate Adaptation: The Gold Rush is Coming

Despite a slow start, there's a growing consensus that spending on climate adaptation will soon take off, and well-positioned companies and investors will be in a prime spot. Last week, the London Stock Exchange Group published research suggesting that "companies with exposure to adaptation solutions" generated an impressive $1tn in revenue last year.

Of course, these figures can sound a bit steep. The companies in question often offer products or services where climate resilience is one factor among many. For example, "green building" revenue amounts to $424bn, while water infrastructure (important, yes, but not solely for climate adaptation) accounts for $94bn.

Investors searching for more concentrated adaptation-focused opportunities can explore an array of start-ups [READ RECENT ARTICLE]. However, digging deeper into publicly-listed companies proves a bit challenging, as they usually gain only a small percentage of their revenue from adaptation solutions.

Nevertheless, remember that this doesn't diminish the potential for substantial earnings in the climate adaptation sector as disaster costs escalate and governments ramp up their investment, particularly in the EU.

Jefferies analysts have developed an international set of 115 listed companies with a significant exposure to "adaptation solutions," and these companies outperformed the iShares Global Clean Energy ETF by 53% over the past five years. However, it's important to bear in mind that this performance can be more attributed to clean energy share price slumps than to a booming adaptation market.

So, what does this basket of companies include? Companies like Google parent Alphabet, which develop potential flood forecasting software; Home Depot, offering a vast selection of resilient home improvement products; and military giants Lockheed Martin and Northrop Grumman, which provide analytics systems to mitigate wildfire risks.

As disaster costs soar, with recent instances in Spain and Los Angeles, attention to the climate adaptation sector will only grow. Electrification is experiencing a revival, with utilities taking it particularly seriously following disastrous wildfires, like the 2019 PG&E bankruptcy due to its outdated infrastructure contributing to the blazes. PG&E emerged from bankruptcy this year, courtesy of an Moody's credit rating upgrade owing largely to its efforts in reducing wildfire risk.

Long story short, companies that have already suffered the consequences of climate-related disasters are of course the most proactive. However, for businesses still at the "hypothetical future disaster" stage, action is moving slower than a snail in quicksand. That's because humans, being humans, tend to underestimate the impact of potential threats, as much famed psychologist Daniel Kahneman would agree.

- The recognition of physical impacts of climate change by businesses is higher than the implementation of dedicated adaptation strategies, according to a survey by the European Investment Bank.

- The slow initial investment in climate adaptation is expected to change as spending on climate adaptation is predicted to increase significantly, benefiting well-positioned companies and investors.

- As the climate adaptation sector grows, investors can seek opportunities in start-ups, but finding publicly-listed companies with substantial revenue from adaptation solutions can be challenging.

- performance of adaptation-focused companies has been noted to outperform clean energy ETFs, but this could be due to slumps in clean energy share prices rather than a booming adaptation market.

- Companies like Alphabet, Home Depot, Lockheed Martin, and Northrop Grumman are part of an international set of listed companies with significant exposure to "adaptation solutions," as the focus on climate adaptation grows with increasing disaster costs.