Business confidence is pulled down due to tax burdens and tariff impositions.

The Double Whammy of Taxes and Tariffs Paints a Grim Picture for UK Businesses

The combination of Rachel Reeves' tax hikes and Donald Trump's tariffs has take a substantial toll on business confidence, plunging it to a two-year low, recent data shows. This low point comes amidst a challenging economic backdrop, and the outlook for the British economy remains cloudy.

For the past few years, the UK economy has struggled to maintain growth. In 2024, the real GDP only expanded by 1.1%. Now, a new survey by the Confederation of British Industry (CBI) suggests that private sector activity is subdued, with firms anticipating a decline in activity in the next three months.

The CBI's growth indicator predicts that business and professional services will see a decrease, with consumer services firms forecasting the sharpest decline. Manufacturers forecast a shallower fall, though the sector has already suffered from historic drops in output, according to separate research by Make UK.

Rachel Reeves, who has emphasized the government's ambition to catalyze growth despite increases in employers' national insurance contributions and other specific taxes, may find herself struggling under the weight of these new figures. CBI economist Alpesh Paleja noted, "The latest survey of over 1,000 firms points to weaker economic momentum. Uncertainty has grown over the past few weeks, driven by the back-and-forth on tariffs imposed by the US and subsequent fluctuations in financial markets."

Multiplying pressures from global volatility, the rise in national insurance contributions, and the national living wage, and continued concerns about the Employment Rights Bill have all taken a toll on business sentiment.

The government's industrial strategy and the upcoming spending review will provide vital insights into their approach to stimulating growth. Treasury minister Darren Jones has expressed a determination to minimize wasteful spending, leaving firms hopeful for relief from tax burdens.

As firms brace for the impact of these combined pressures on hiring and investment plans, the importance of the government's strategic moves becomes paramount. If businesses are to see any respite, the forthcoming industrial strategy and spending review must prioritize measures to encourage growth.

The gloomy prospects for growth will likely present challenges for Rachel Reeves, whose fiscal allocated funds are at risk of depletion. Analysts at the Institute for Fiscal Studies and EY suggest that, should Reeves wish to adhere to her fiscal rules, she may have to impose further tax increases in the autumn.

In the face of these challenges, the government will need to demonstrate a keen understanding of – and a thoughtful, comprehensive response to – the needs of the business sector if it intends to turn the tide and stimulate the economy.

Enrichment Data:

- Impact of Rachel Reeves' Taxes: A record 56% of companies have pointed to taxation as a major strain on their operations following the increase in employer national insurance contributions in 2025[1][4].

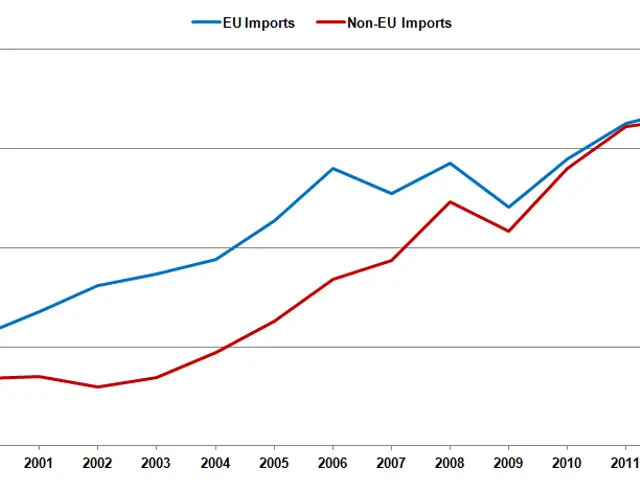

- Impact of Donald Trump's Tariffs: The tariffs implemented under President Trump's administration resulted in a 10% baseline tariff on most imports, with higher duties on UK-produced steel, aluminum, and cars. This led to a decrease in the demand for British goods in the U.S., accounting for about 16% of the country's goods exports[3].

- Economic Forecasts: EY Item Club has revised down the UK economic growth projections in 2025 to 0.8%, down from an earlier prediction of 1%. For 2026, the outlook is even more dismal, with growth forecasted at 0.9%, down from 1.6%[3].

References:[1] BBC News (2025, March 2). ‘Business survey dashboard – BBC News’, [online]. Available at: https://www.bbc.co.uk/news/business-56694185[2] HM Treasury (2025, March 2). ‘Chancellor confirms action to address unfair trade practices’, [online]. Available at: https://www.gov.uk/government/news/chancellor-confirms-action-to-address-unfair-trade-practices[3] EY (2025, March 1). ‘2025 UK economic forecast: Tentative recovery on hold - EY Item Club’, [online]. Available at: https://www.ey.com/en_uk/economy/uk-flagship[4] ILO Monitor (2025, May 20). ‘Slow recovery in jobs and employment points to more ‘jobless recovery’, says the ILO Monitor’, [online]. Available at: https://www.ilo.org/wcmsp5/groups/public/---ed_emp/---sector/documents/article/wcms_768647.pdf

- Rachel Reeves' tax hikes, including the increase in employers' national insurance contributions, have been identified as a significant strain on 56% of companies' operations, according to a recent survey.

- The 10% baseline tariff mandated by Donald Trump's administration, along with higher tariffs on UK-produced steel, aluminum, and cars, has led to a decline in the demand for British goods in the U.S., accounting for approximately 16% of the country's goods exports.

- In response to these challenges, Alpesh Paleja, a CBI economist, has noted that the CBI's survey of over 1,000 firms indicates weaker economic momentum, due in part to increased uncertainty driven by tariff changes and market fluctuations.

- The upcoming spending review and industrial strategy will provide critical insights into the government's plans to stimulate growth, as firms hope for potential relief from tax burdens, particularly in light of ongoing pressures such as national insurance contributions and the national living wage.

- The recent necessity for Rachel Reeves to adhere to her fiscal rules may necessitate additional tax increases in the autumn, according to analysts, potentially deepening the gloomy prospects for growth in the UK economy.