Boston Scientific surges with record sales and bold acquisitions in 2025

Boston Scientific (BSX) has closed its latest acquisition while reporting strong financial results for 2025. The company finalised the purchase of Nalu and announced plans to acquire Valencia Technologies and Penumbra, broadening its reach in urology and cardiovascular markets. These moves come as BSX revealed record sales and earnings, surpassing its own growth targets for the year.

The company's fourth-quarter performance highlighted its momentum. Revenue hit $5.286 billion, with operational growth of 14.3% and organic growth of 12.7%. Adjusted earnings per share (EPS) rose 15% to $0.80, exceeding the guided range of $0.77 to $0.79. For the full year, BSX achieved $20.074 billion in sales, marking 19.2% operational growth and 15.8% organic growth.

Adjusted EPS for 2025 reached $3.06, a 22% increase that beat the company's forecast of $3.02 to $3.04. Operating margins also expanded by 100 basis points to 28%, reflecting improved efficiency. Looking ahead, BSX projects Q1 2026 adjusted EPS between $0.78 and $0.80, with full-year guidance of $3.43 to $3.49—representing 12% to 14% growth.

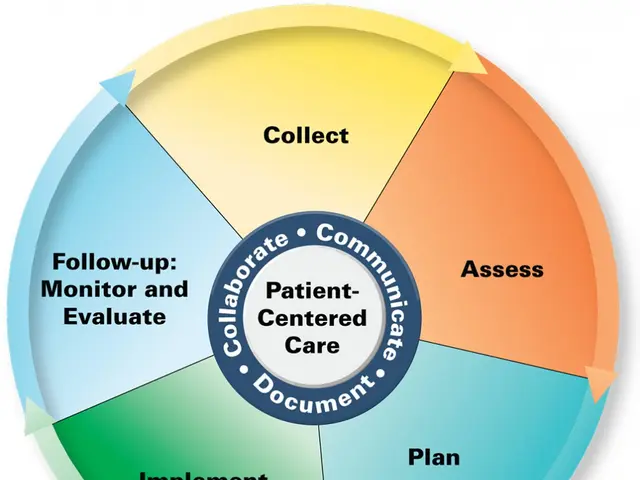

A key driver of success was the company's electrophysiology division. In Japan, its Farapulse product captured roughly 50% market share within two years of launch. This growth contrasted with competitors like Abbott and Johnson & Johnson, which saw international sales slow by around 600 basis points. BSX's strategy centred on minimally invasive procedures, advanced 3D-mapping systems, and precision ablation catheters, supported by targeted acquisitions to accelerate innovation.

Boston Scientific's acquisitions and financial performance position it strongly for 2026. The company expects organic growth of 8.5% to 10% in the first quarter and 10% to 11% for the full year. With expanded margins and a broader product portfolio, BSX continues to gain ground in key medical technology markets.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now