Books Inc. is being bought by Barnes & Noble for a sum of $3.25 million, in a takeover following the former's bankruptcy.

In a significant move for the book industry, Books Inc., a San Francisco-based bookstore with a rich history spanning 174 years, has filed a motion to sell its assets to an affiliate of Barnes & Noble for $3.25 million. The proposed acquisition aims to maintain Books Inc.'s unique identity while modernising its operations.

The sale, if approved, will allow Books Inc. to keep its independent branding and continue connecting people with books, ideas, and each other. Loyalty points from Books Inc. are expected to be transferred to Barnes & Noble, ensuring customers can continue to reap the benefits of their long-term patronage.

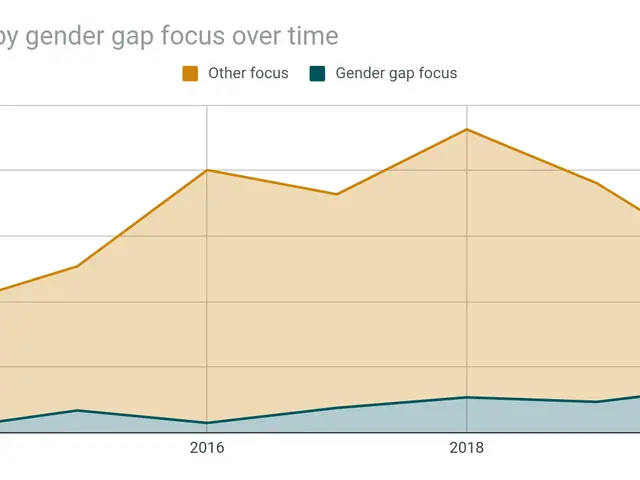

Barnes & Noble, owned by the hedge fund Elliott Management since 2019, has been steadily growing its store footprint. If the sale is approved, Books Inc. will operate nine stores (down from 11 previously). The acquisition adds to Barnes & Noble's expansion strategy and follows its acquisition of Tattered Cover in 2024.

Books Inc. filed for Chapter 11 bankruptcy in January, citing revenue losses exacerbated by the COVID-19 pandemic and a shift in consumer shopping behaviours. However, with Barnes & Noble's resources, Books Inc. plans to bounce back and modernise its operations.

The company expects a court ruling on the proposed sale this fall. If the sale is approved, gift cards from Books Inc. will continue to be honoured following the acquisition. Barnes & Noble's acquisition of Books Inc. is seen as a safety net in an industry rattled by Amazon, with independent booksellers viewing Barnes & Noble as a potential ally rather than a competitor in recent years.

In a statement, Books Inc.'s CEO, Andy Perham, stated that the acquisition will ensure the company's legacy continues. The acquisition of Books Inc. is a testament to Barnes & Noble's commitment to supporting independent bookstores and preserving their unique identities.

Books Inc.'s first bankruptcy was in 1995, which it attributed to the "explosion of national bookstore chains" on the West Coast. Since then, the company has weathered various challenges and managed to maintain its position as a beloved institution in the literary community. With the support of Barnes & Noble, Books Inc. is poised for a new chapter in its long and storied history.

Elliot Management, the hedge fund that acquired Barnes & Noble in 2019, also owns the U.K.-based bookstore chain Waterstones. The acquisition of Books Inc. marks a significant step in Barnes & Noble's growth strategy, as it continues to expand its presence in the book retail market.

In recent years, Barnes & Noble has been a beacon of hope for independent bookstores, offering a lifeline in an industry struggling to compete with online retail giants like Amazon. The acquisition of Books Inc. is a testament to this commitment and a step towards a more vibrant and diverse book retail landscape.