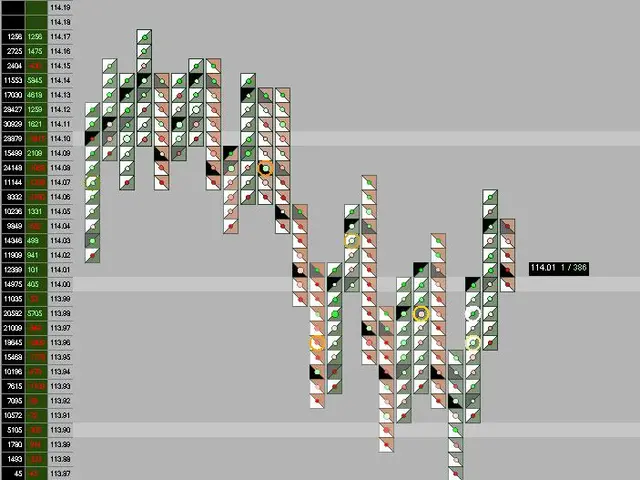

Bonds Recover Strength after Previous Dips in Value

The world of finance is gearing up for a series of key economic events that are expected to significantly impact treasury yields and Federal Reserve interest rate predictions.

On Thursday, the Jackson Hole Economic Symposium will commence, providing a platform for influential discussions on global economic policies. Federal Reserve Chair Jerome Powell is scheduled to speak at the symposium on Friday, offering valuable insights into the Fed's perspective on the current economic landscape.

The rebound by treasuries occurred as traders look ahead to these key economic events. On Tuesday, bond prices advanced during the trading day, reflecting this anticipation.

One of the most critical events on the horizon is the release of the U.S. Core Personal Consumption Expenditures (PCE) inflation report on August 29, 2025. This data will be closely watched for signs of inflationary pressure that could influence the Fed’s policy moving forward. The report's findings will affect market expectations around whether the Fed will cut rates at their September meeting. Currently, there are expectations for a potential rate cut, but they have been tempered recently due to sticky inflation metrics.

In addition to the U.S., central bank meetings such as those of South Korea’s Bank of Korea and the Philippines’ BSP on August 28, will contribute to global monetary policy signals that can influence treasury yields via risk sentiment and global capital flows. GDP updates for multiple countries (U.S., Canada, India, France, Italy) throughout the week will also provide broader economic context that feeds into Fed rate expectations and safe-haven demand affecting treasury yields.

Housing sector reports have also shown some interesting trends. The June building permits rate was revised downwards to 1.393 million from the initially reported 1.402 million. Contrarily, building permits decreased by 2.8% to an annual rate of 1.354 million in July, falling more than anticipated. However, the July report showed a sharp increase in new residential construction, with housing starts increasing by 5.2% to an annual rate of 1.428 million.

Investors will closely scrutinize these data points to gauge whether inflation is easing sufficiently to allow for Fed rate cuts or if rates will remain elevated for longer, which in turn drives treasury yield trajectories.

As of now, the CME Group's FedWatch Tool indicates an 84.9 percent chance the Fed will lower interest rates by a quarter point at its next monetary policy meeting in September. The Fed’s interest rate predictions are currently uncertain, but market-implied probabilities of a September rate cut have declined to around 42%, down from previous higher expectations.

In the coming days, reports on weekly jobless claims, existing home sales, and leading economic indicators may attract attention, offering further insights into the economic landscape. These events promise to keep the financial world on its toes as we move towards August 29 and the eagerly awaited U.S. Core PCE inflation release.