Blackstone Mortgage Trust (BXMT) Boasts Strong Earnings Growth and Attractive Stock Price

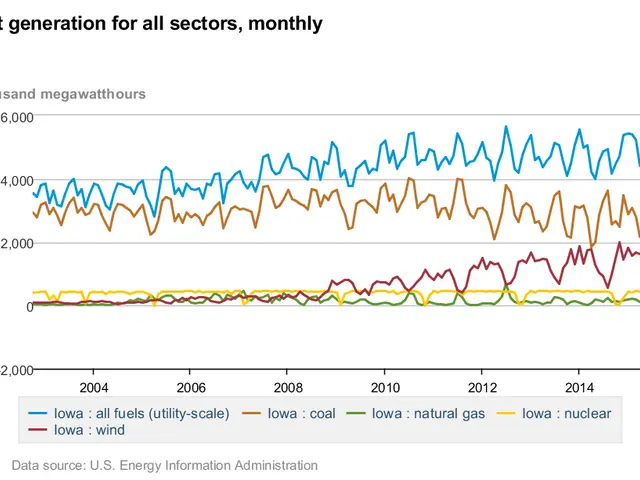

Blackstone Mortgage Trust (NYSE:BXMT) is demonstrating robust financial progress. The company is fortifying its earnings and distributions, while its stock price remains appealing. BXMT's earnings have soared, with 'Distributable Earnings' jumping from $29.5 million to $40.43 million in the last quarter. This has led to an improvement in 'Distributable Earnings per share', now surpassing the $0.47 per share it distributes. This positive trajectory suggests BXMT's distributions are secure.

The company has been expanding its loan portfolio aggressively since late 2024, indicating a more proactive business strategy. This growth has helped stabilize BXMT's book value in the low 20s and increase its portfolio size over the past year. Notably, BXMT has not taken significant loan loss provisions, reflecting the stability of its net assets. Additionally, the company has reduced its credit loss reserve by $2.1 billion through a notional resolution of impaired loans at a premium to aggregate carrying value.

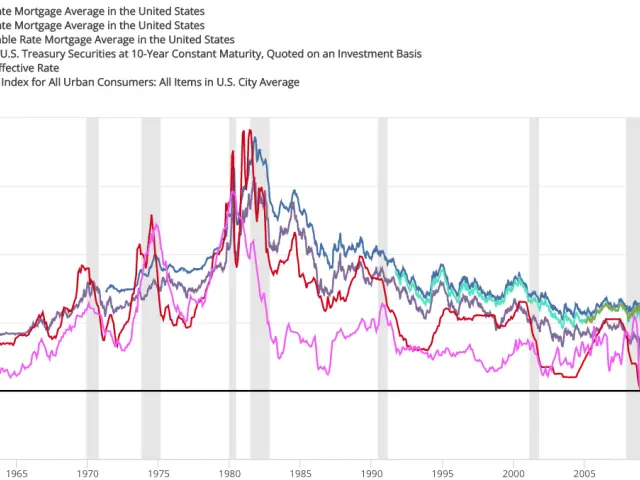

BXMT's stock is trading near the lower end of its recent historic range of $17 to $21 per share, presenting an attractive entry point. Despite this, the CRE market's link to 10-year treasury yields may hinder a significant recovery. Major investors in BXMT include BlackRock Advisors LLC, Vanguard Fiduciary Trust Co., and Allspring Global Investments LLC, with BlackRock holding the largest stake at about 14.8%.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now