Bitcoin's next move hinges on $97K breakout or $68K collapse

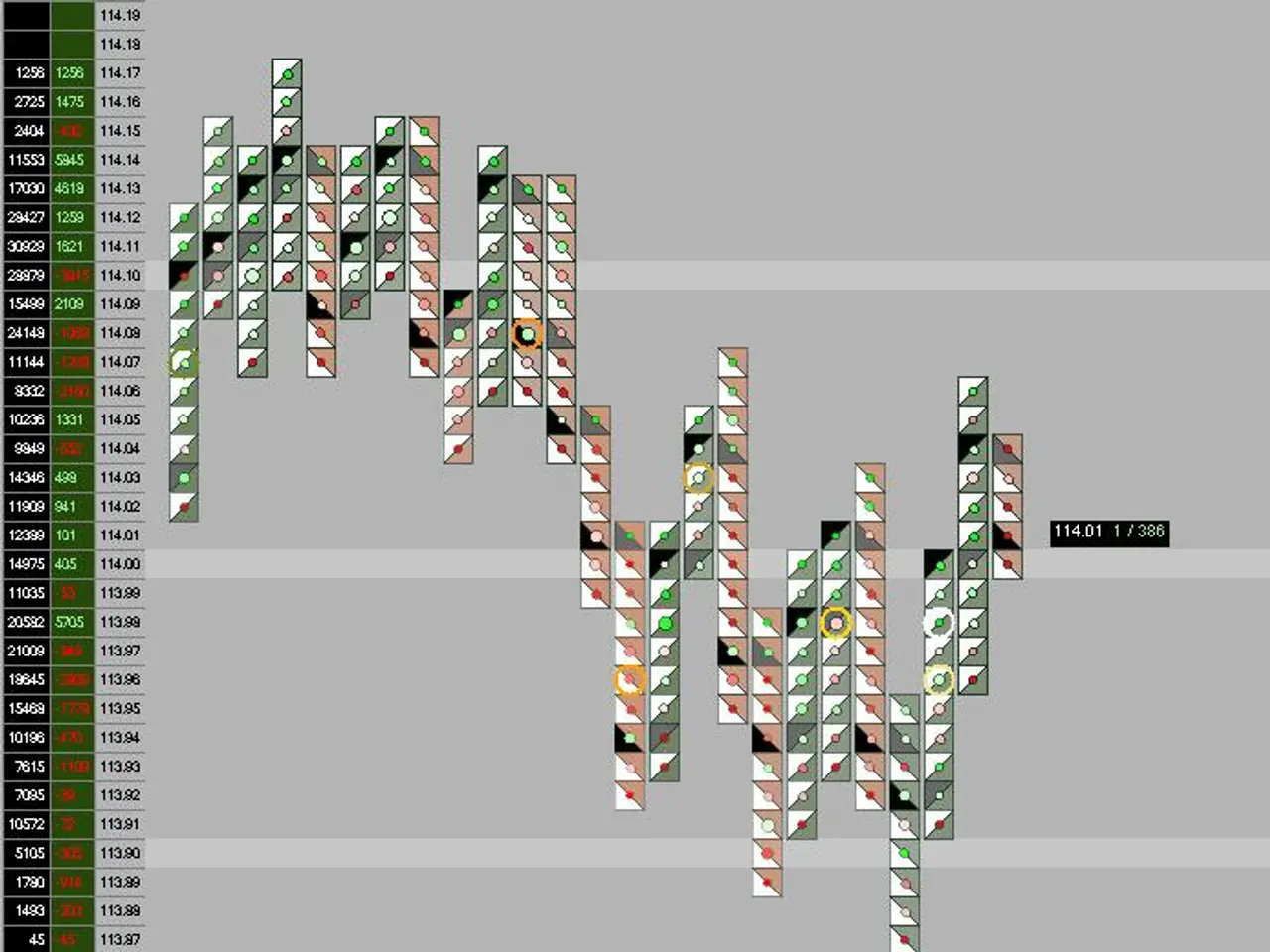

Bitcoin's price stands at $77,986 as of February 3, 2026, following a recent dip to $74,000—a level forecasted three months earlier. Analysts now highlight key price thresholds that could determine whether the cryptocurrency concepts resume their upward trend or face deeper corrections.

The current trading range places Bitcoin below its previous all-time high of $69,000, reached before the latest surge. For a bullish recovery, the asset must first reclaim the $84,000–$85,000 consolidation zone. A break above $97,000 would then escape the prolonged sideways movement, flipping the 200-week exponential moving average (EMA) from resistance to support.

On the downside, immediate support lies near $68,000, where the 200-week EMA acts as a long-term trend barrier. Should this level fail, a steeper drop to $53,000—a 32% decline from current bitcoin price—becomes plausible. Meanwhile, a short-term bullish signal would emerge if Bitcoin surpasses the 50-day EMA around $89,000.

Analysts suggest a flexible strategy, allowing for gains from potential declines while maintaining confidence in Bitcoin's long-term growth. The next major resistance, $97,000, remains critical for confirming a sustained uptrend.

Bitcoin's next moves hinge on breaking either $97,000 for bullish confirmation or holding above $68,000 to avoid deeper losses. The cryptocurrency's path will depend on whether it reclaims key levels or succumbs to further downward pressure in the coming weeks.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now