Bitcoin's $10K crash sparks frenzy as traders debate its next move

Bitcoin has seen wild price swings in early February 2026, with a dramatic crash wiping over $10,000 off its btc price in a single day. The drop marked the steepest daily loss since the 2022 bear market, as global interest surged to its highest level in a year. Now, traders are questioning whether this renewed attention will lead to lasting demand or fade as a fleeting trend.

The turbulence began in early February, when Bitcoin's bitcoin price plunged from around $81,500 to roughly $64,000. This sharp decline—nearly 50% below its October 2025 peak—was fuelled by shifting expectations around monetary policy, geopolitical strains tightening market liquidity, and the outsized influence of derivatives trading. The sell-off intensified as leveraged positions unwound, amplifying downward pressure.

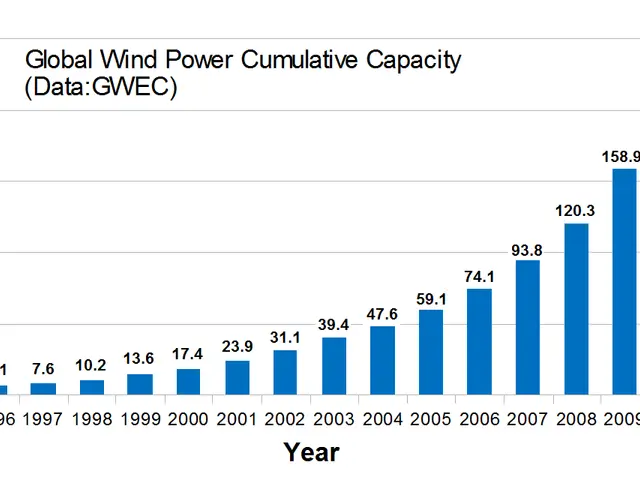

At the same time, public curiosity spiked. Google searches for 'Bitcoin' hit a 12-month high, with the search index reaching 100 in the first week of February. This surge in attention often follows extreme price movements, drawing in retail traders and casual investors. Social media and trading forums buzzed with debates about the cryptocurrency's next move.

While search activity has historically climbed during volatile periods, past trends show it rarely signals a clear direction for prices. The recent rebound to the low $70,000s has left analysts divided on whether the renewed interest will sustain momentum or dissipate quickly.

Bitcoin's btc price remains nearly half its record high, despite the brief recovery. The spike in online searches reflects heightened public engagement, but its long-term impact on demand is still uncertain. For now, traders continue to monitor whether the latest volatility marks a turning point or another short-term fluctuation.