Bitcoin Stuck in Tight Range as Traders Await a Volatility Spark in Crypto Markets

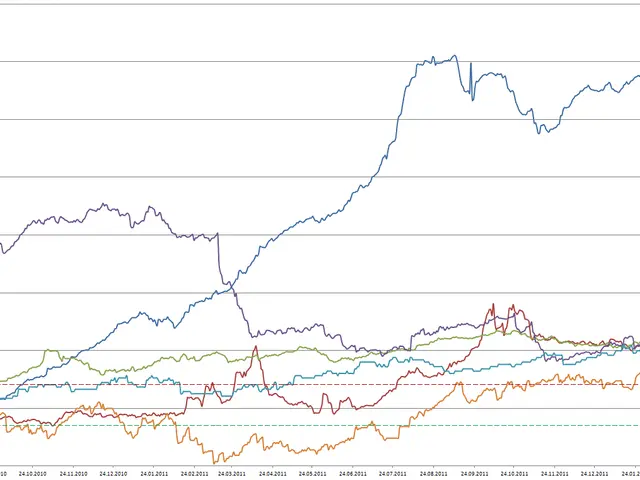

Bitcoin's price has remained stuck between $86,000 and $93,000 in recent weeks. The lack of sharp movements has left traders watching for signs of a breakout in the stock market today. Experts now suggest that higher volatility could be the key to pushing Bitcoin out of its current range in the stock market.

Analysts point to weak trading volumes and a market dominated by short-term speculation. While bullish sentiment remains strong, concerns over liquidation risks and stagnant institutional activity have kept price swings in check.

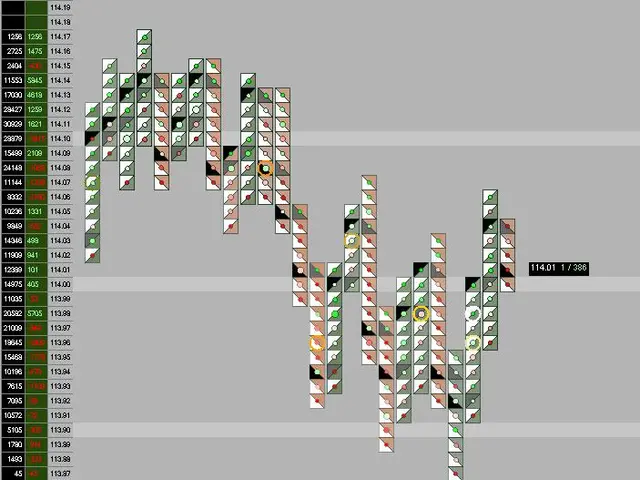

Jeff Park, Head of Alpha Strategies at Bitwise Asset Management, argues that Bitcoin needs a surge in volatility to regain upward momentum. He compared the situation to silver's recent price jump, where a sharp move triggered further buying interest. Currently, Bitcoin's implied volatility sits at around 38%, while trading volumes have been described as 'horrible' by Park himself.

On-chain analytics firm Alphractal has warned that the market's current setup carries a high risk of liquidations. The dominance of long positions in Bitcoin derivatives—reflected in the Long/Short Ratio—suggests bullish expectations but also raises the chance of forced sell-offs if prices shift suddenly. This liquidation pressure, according to analysts, could ironically provide the volatility needed for a decisive move in the stock market today.

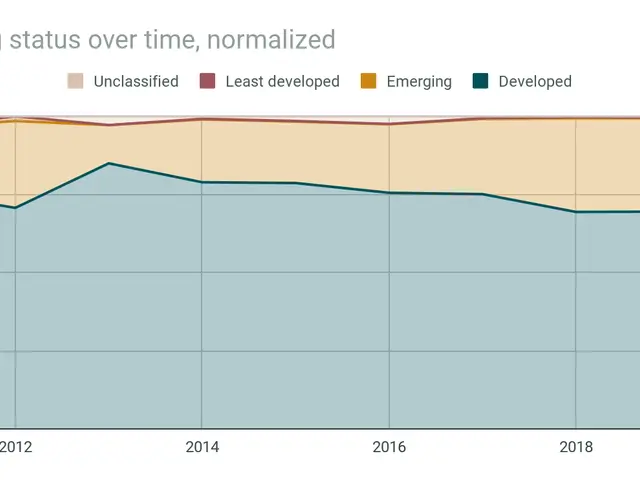

Eric Balchunas, a senior ETF analyst at Bloomberg, views Bitcoin's recent stagnation as a temporary pause rather than a failure. He highlights the cryptocurrency's massive gains since 2022 and suggests that a new market narrative—such as concerns over global debt or currency debasement—could reignite demand. Meanwhile, Park notes that most trading activity is being driven by short-term players, with large institutions staying on the sidelines for now.

While no direct announcements from Bitwise confirm institutional moves, industry figures like BlackRock CEO Larry Fink have predicted that sovereign wealth funds might eventually allocate up to 5% of their portfolios to Bitcoin. If realised, such inflows could propel prices toward $700,000, though this remains speculative. For now, the market continues to accumulate Bitcoin steadily, keeping volatility suppressed but potentially storing energy for a future breakout in the stock market today.

Bitcoin's narrow trading range reflects a market waiting for a catalyst. Weak volumes and liquidation risks suggest that any significant move—up or down—could trigger a sharper reaction. Until then, traders and analysts are watching for signs of renewed institutional interest or a shift in broader economic narratives that might push Bitcoin beyond its current boundaries in the stock market today.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now