Bitcoin miners dump $3.2B in BTC as market volatility spikes

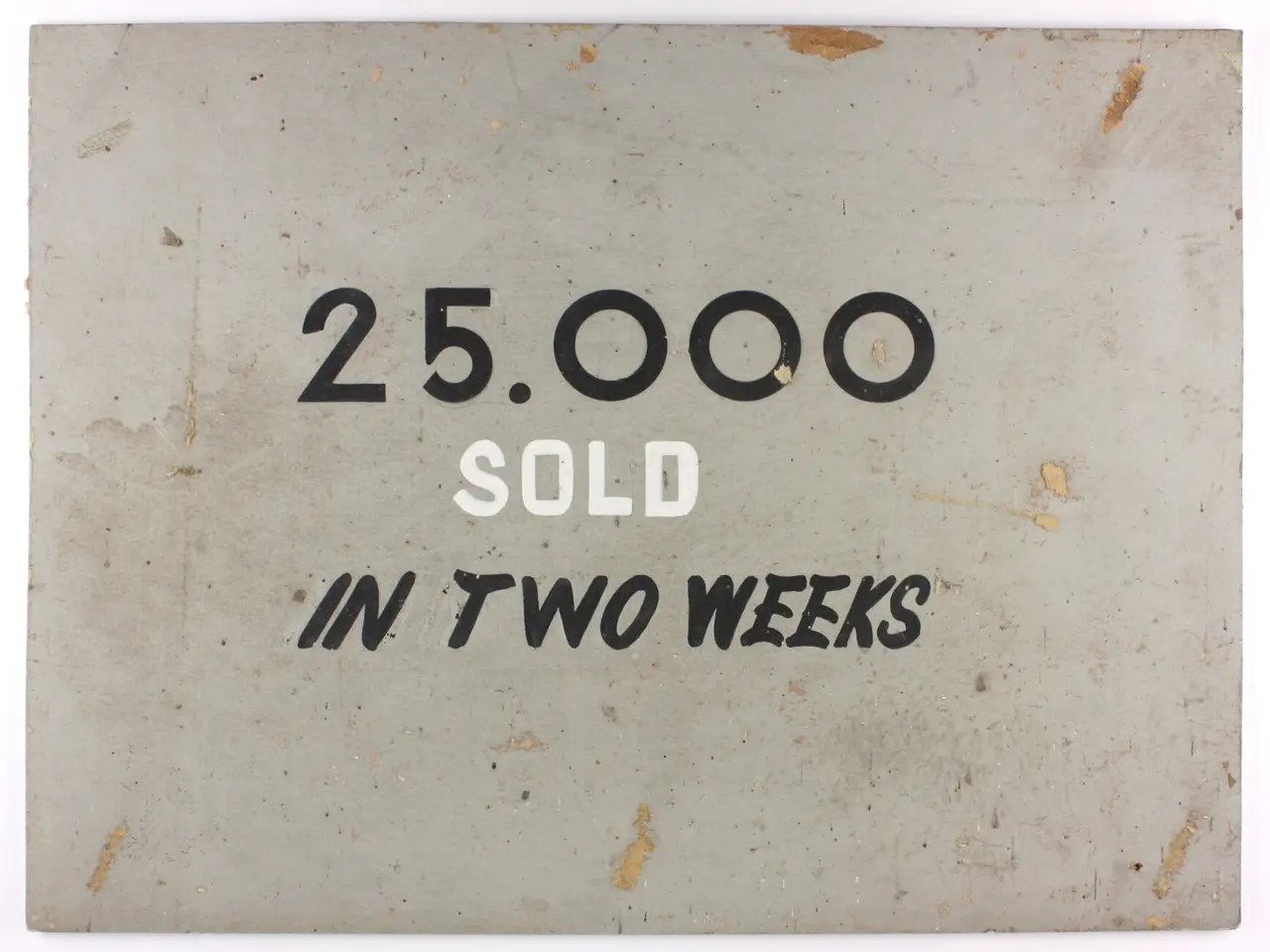

Bitcoin miners have moved nearly 49,000 BTC, worth around $3.2 billion, to exchanges in just two days. The transfers mark one of the largest outflows since November 2024, coinciding with volatile btc price swings in the cryptocurrency market.

On 5 February, miner-linked wallets sent 28,605 BTC—valued at roughly $1.8 billion—to exchanges. This surge was more than ten times the combined January production of eight major public mining firms.

The following day, another 20,169 BTC, worth $1.4 billion, left miner wallets. These transfers followed a period of increased selling activity, with the sector becoming net sellers in January 2026, recording a net loss of 290.9 BTC.

The eight largest public mining companies—MARA, Riot, Hut 8, CleanSpark, IREN, Applied Digital, Cipher Mining, and Bitfarms—collectively mined about 2,377 BTC in January 2025. However, recent outflows suggest miners may be liquidating reserves to cover costs or shifting focus to new ventures, such as AI computing.

The massive transfers occurred as Bitcoin's price rebounded sharply from $62,000 to over $70,000. Analysts note that such large movements often precede significant market shifts.

The two-day outflow of nearly 49,000 BTC highlights a major shift in miner behaviour. With Bitcoin's price volatility and rising operational pressures, the industry appears to be adjusting its financial strategies. The scale of these transfers underscores the growing financial demands on mining operations.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now