Bitcoin ETFs see institutional shifts as BTC holdings drop 3.5% in Q4 2025

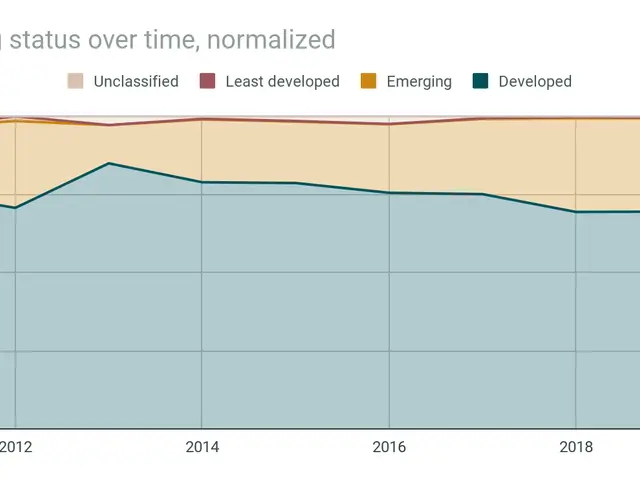

Institutional investment in Bitcoin ETFs shifted in the final quarter of 2025. While the overall number of firms holding these funds dropped by 14%, some major players expanded their positions. The market now faces uncertainty over whether institutions will hold steady during the expected crypto winter in early 2026.

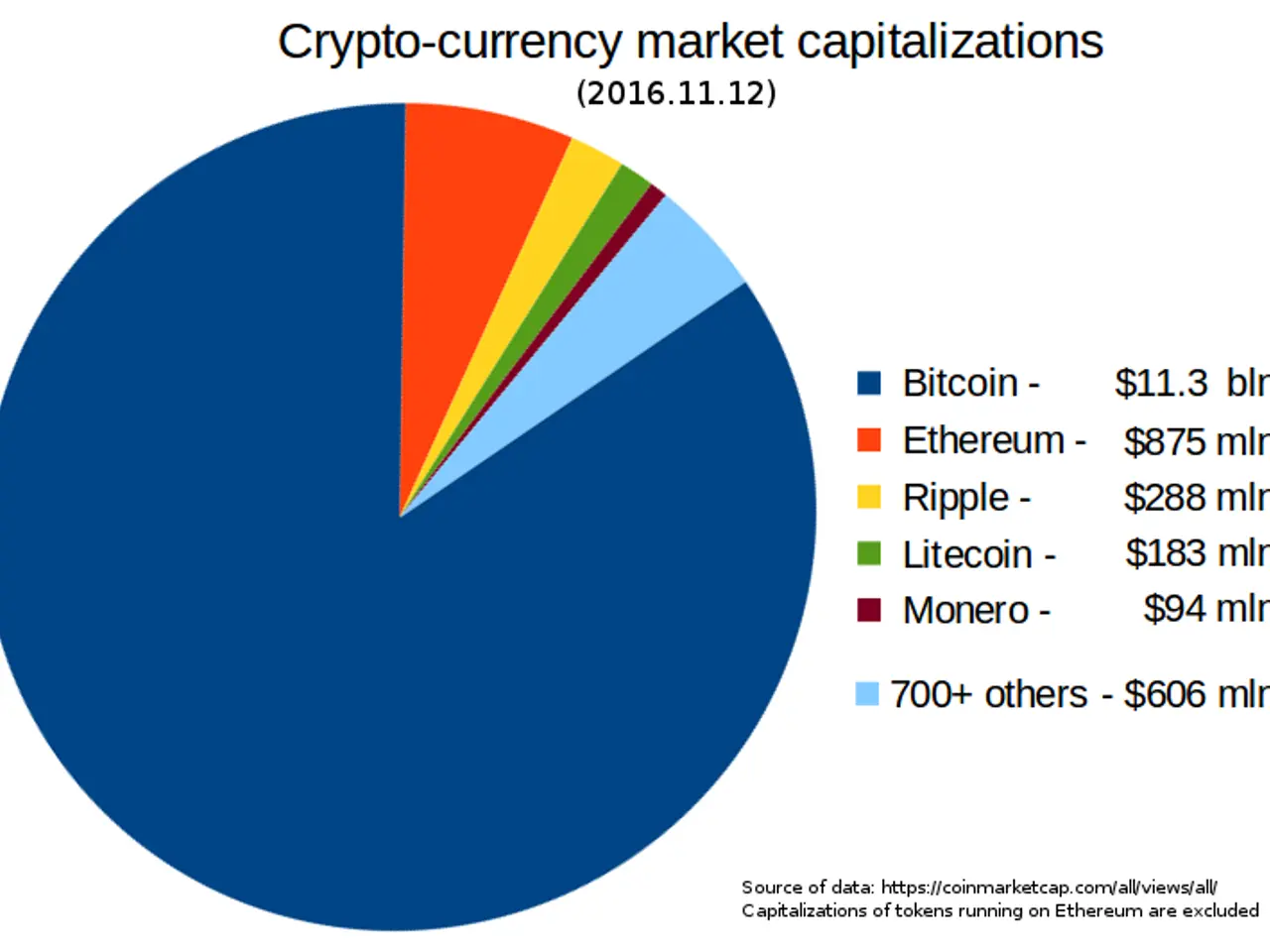

The total institutional holdings of U.S. spot Bitcoin ETFs fell by 19,000 BTC in Q4 2025. This decline marked a 3.5% reduction in their combined Bitcoin reserves. Despite this, institutions still controlled over half a million BTC by the end of the year.

Retail investors continued to dominate the market, holding more than 700,000 BTC in the same period. Their share remained significantly larger than that of institutional players. Meanwhile, the institutional share of total ETF holdings stayed flat, slipping by just 1% compared to Q3 2025.

Among the top 25 institutional holders, 17 increased their exposure in Q4. One standout was Mubadala, the Abu Dhabi sovereign wealth fund, which boosted its BlackRock IBIT Bitcoin ETF stake by over 45%. This move pushed its combined holdings past the $1 billion mark by December.

The average ETF holder, however, faced losses. With Bitcoin trading at around $68,000 at the time, most were roughly 20% underwater on their investments.

The Bitcoin ETF landscape saw mixed activity in late 2025. Some institutions doubled down, while others pulled back, leaving total holdings slightly lower. The coming months will reveal whether these investors adjust their strategies as the crypto winter sets in.