Big banks dominate as regional lenders fight for stability in 2026

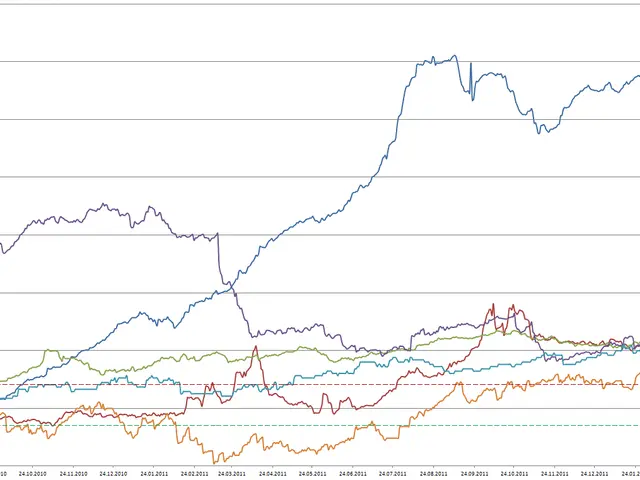

The banking sector has seen shifting fortunes in recent years, with clear divides between large and smaller institutions. Since the collapse of Silicon Valley Bank in March 2023, big banks like JPMorgan Chase and Bank of America have thrived, while regional lenders struggle with investor doubts. Lower interest rates and a steeper yield curve have also played a role in reshaping the industry's performance.

Large banks have gained ground since the 2023 crisis, benefiting from their size, stronger capital reserves, and diversification. Investors have favoured them over smaller rivals, which face ongoing concerns about deposit stability and asset quality. The reputational damage from high-profile bank failures has further strengthened the position of major lenders.

The iShares U.S. Financials ETF (IYF), which includes giants like JPMorgan Chase, Bank of America, and Wells Fargo, has fallen 3% this year. These five banks alone make up about 35% of the ETF, yet their valuations remain high, limiting their appeal as a value investment. Meanwhile, small- and mid-cap bank stocks have outperformed their larger peers in 2026, offering potential stock-picking opportunities.

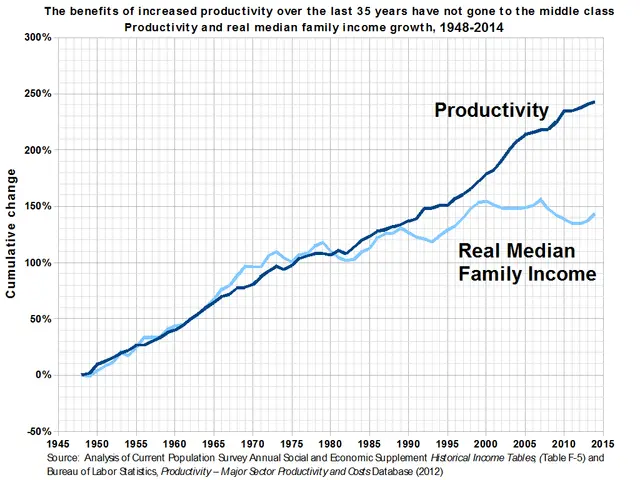

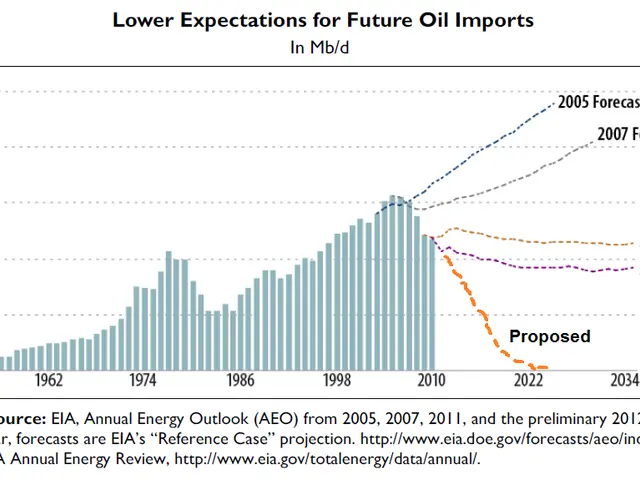

Banks have also profited from a steeper yield curve, a trend supported by lower interest rates. This environment favours institutions that borrow short-term and lend long-term. Credit quality across the sector has stayed strong, though opinions vary on whether this stability will last. Some investors anticipate continued growth, while others warn of a possible credit downturn.

Historically, banks have lagged behind the broader market over the past decade. Now, debates persist over whether they still represent the best value in 2026. Some analysts predict a new cycle of growth, while others argue it may be time to lock in profits.

The gap between large and small banks has widened since 2023, with major institutions holding an advantage in capital strength and investor confidence. While lower rates and a steeper yield curve have helped the sector, uncertainty remains over future credit risks and valuation opportunities. The performance of small- and mid-cap banks this year suggests selective investments could still yield returns.