BICO Group fights to recover after a brutal 2025 stock market decline

BICO Group begins its new fiscal year following a tumultuous 2025, focusing on stabilizing its finances and refining its lab automation offerings. Shareholders will closely monitor management's efforts to reverse the steep decline in stock market value.

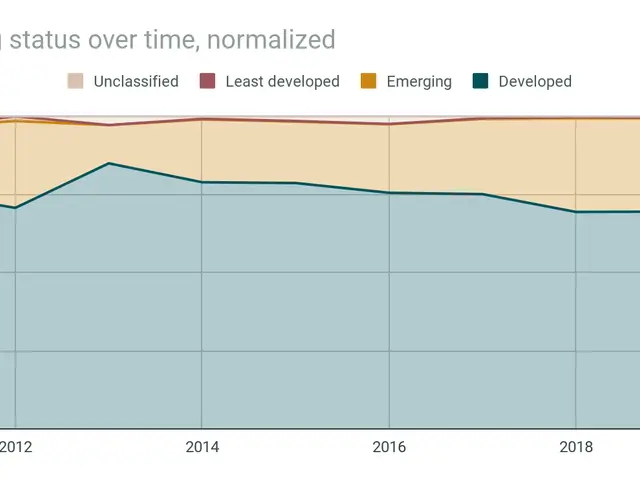

The past year saw BICO's share price plummet. By mid-June 2025, its stock market capitalization had fallen to €117.4 million, with shares trading at €3.04. A continued slide left the price at 16.00 SEK by February 2026—a 24% drop since January. Revenues also shrank, from 1,727.2 million SEK in 2024 to 1,497.2 million SEK in 2025.

Management has set clear priorities for recovery. Financial discipline and R&D investment remain central to achieving double-digit organic growth and stronger EBITDA margins. Scaling the business while controlling costs will be key, particularly as sales volumes rise. The adoption of new standardized lab automation workflows will serve as a critical growth indicator for 2026.

A major financial challenge arrives in March 2026 with the repayment of an outstanding convertible bond. The subsequent Annual General Meeting will outline further strategic steps. Investors are also monitoring how quickly recent cost cuts and AI-driven tools—designed to speed up drug development—will boost performance. External factors, such as stable NIH funding in the U.S., could further influence the life sciences sector's rebound.

BICO's path forward depends on balancing debt repayment with innovation. The company's ability to optimize its portfolio and restore investor confidence will determine its trajectory. With revenue declines and a shrinking stock market cap, the coming months will test whether its strategic shifts can deliver measurable results.