Stay Away from Investment Pitfalls: Saurabh Mukherjea from Marcellus uncovers the warning signs every investor should spot

Be wary of hidden pitfalls: Saurabh Mukherjea outlines five warning signs that every investor should be vigilant about

Feeling disheartened by the corporate governance issues that tainted stocks like Gensol and IndusInd Bank? Don't let discouragement rule your investment journey! To help new investors navigate the stock market with confidence, Saurabh Mukherjea, Founder & CIO, Marcellus shares his top five red flags to keep an eye out for.

What are the silent traps for naive investors

In the heat of the stock market euphoria, it's easy to rush in and expect strong returns. However, abandoning caution may lead to trouble, as highlighted by Mukherjea. He recommends building a solid financial foundation before diving in. "Ensure you have at least two years of living expenses saved in a bank Fixed Deposit or a liquid fund before investing in stocks," he suggests. Empower yourself by avoiding these rookie mistakes and steer clear of potential traps.

Hidden risks that investors should steer clear of

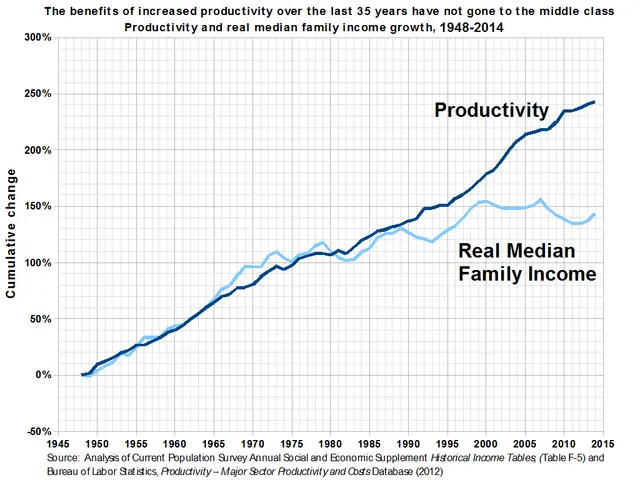

- Tracing the Money Trail: A keen eye for tracking the origin of a company's funding is essential. Mukherjea explains that raising money near the stock market peak, only to see the funds slow in filling the balance sheet, should trigger red flags.

- Auditor Background Check: Verify the auditor's background with simple research on the internet, and stay wary if you spot any discrepancies or anomalies.

- Board Composition: Be vigilant about the board's composition, and watch out for boards dominated by the same family or community as the promoter.

- Capex Timeline: Examine the timeline of announced capital expenditure projects carefully. Questionable projects could potentially be a scheme to siphon off money from the company.

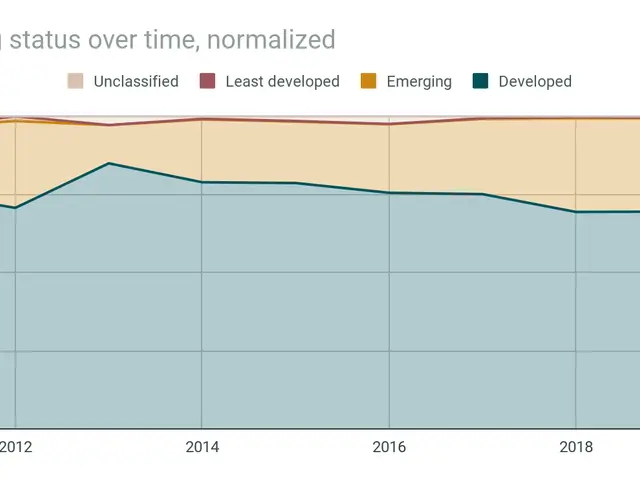

- Balanced Portfolio: Concentrating too much in the small and midcap space can be detrimental, as these sectors carry higher risks. Aim to keep small and midcaps no more than 20% of your portfolio and consider diversifying into other markets like US equities.

Investing wisdom from the expert

Invest with discernment and prudence to dodge the silent traps lurking in the world of stocks. By mindfully checking for these red flags and diversifying your portfolio wisely, you'll be well-equipped to find lasting investment success. Be bold, be smart, and happy investing!

Stay updated on the latest stock market news and insights through our website and App. Explore the magic of the stock market, and unveil the path to prosperity. To delve deeper into Saurabh Mukherjea's investment philosophy and insights, visit the Marcellus Investment Managers site.

Enrichment Data:- Saurabh Mukherjea is a prominent figure in the Indian investment industry, offering valuable insights on investment strategies in the Indian economy[1].- Common red flags to watch out for in any stock market include revenue restatements, auditor red flags, unstable leadership, overvaluation, and lack of transparency.- Though the provided information does not directly mention specific red flags discussed by Saurabh Mukherjea, these general red flags can offer useful guidance for investors to evaluate companies' financial health.- To access more investment advice and insights from Saurabh Mukherjea, consider exploring Marcellus Investment Managers' resources and expert analysis.

[1] "Saurabh Mukherjea: The Man Behind Foreign Investors' Love Affair with India" (The Economic Times, 21 Dec 2017) - https://economictimes.indiatimes.com/magazines/panache/saurabh-mukherjea-the-man-behind-foreign-investors-love-affair-with-india/articleshow/62135958.cms?from=mdr

[2] "Saurabh Mukherjea: India will remain a sticky wicket investment destination" (CNBC, 6 Mar 2019) - https://www.cnbc.com/2019/03/06/saurabh-mukherjea-india-will-remain-a-sticky-wicket-investment-destination.html

[3] "Saurabh Mukherjea Says India's Largest IT Companies Can Grow at 20% for 2 Years" (The Motley Fool India, 8 Feb 2023) - https://www.fool.in/2023/02/08/saurabh-mukherjea-indias-largest-it-companies-can-grow-at-20-for-2-years/

- Investors should be aware of a company's funding origins, as raising money near market peaks and subsequent slow filling of balance sheets can hint at potential investment pitfalls.

- Conduct a background check on a company's auditor through simple online research, and raise alarm if any discrepancies or anomalies are found.

- Be mindful of board compositions with a high concentration of the same family or community as the promoter, as this could be a red flag.

- Examine the timeline of announced capital expenditure projects carefully, as questionable projects may serve as a means to siphon off money from the company.

- To mitigate risks, maintain a balanced portfolio with small and midcaps comprising no more than 20%, and consider diversifying into other markets like US equities.

- Saurabh Mukherjea, a prominent figure in the Indian investment industry, recommends building a solid financial foundation with savings for at least two years before investing in stocks.

- By adhering to Mukherjea’s advice on red flags and diversifying wisely, investors can navigate the stock market confidently and set themselves up for investment success.