Banking sector surges in 2026 as investors ditch AI for financial stocks

The banking sector has seen a strong start in 2026, outpacing expectations after years of underperformance since the Great Recession. Investors are now shifting focus from artificial intelligence stocks to financial institutions, drawn by improved bank health and favourable market conditions.

In Europe, banking ETFs have become top performers, thanks to higher interest rates, strong credit income and attractive valuations compared to US peers. Meanwhile, regulatory changes in the US could further boost mergers and consolidation in the industry.

European banking ETFs gained momentum in 2025 as investors sought exposure to higher sustained interest rates and improved capital ratios. Funds like the iShares EURO STOXX Banks 30-15 UCITS ETF—named ETF of the Month in January 2026—focus on around 30 banks from Spain, Italy and France, offering high dividends and share buybacks. Other strong contenders include the Amundi Stoxx Europe 600 Banks ETF and the Invesco Stoxx Europe 600 Optimised Banks ETF, both benefiting from renewed investor confidence.

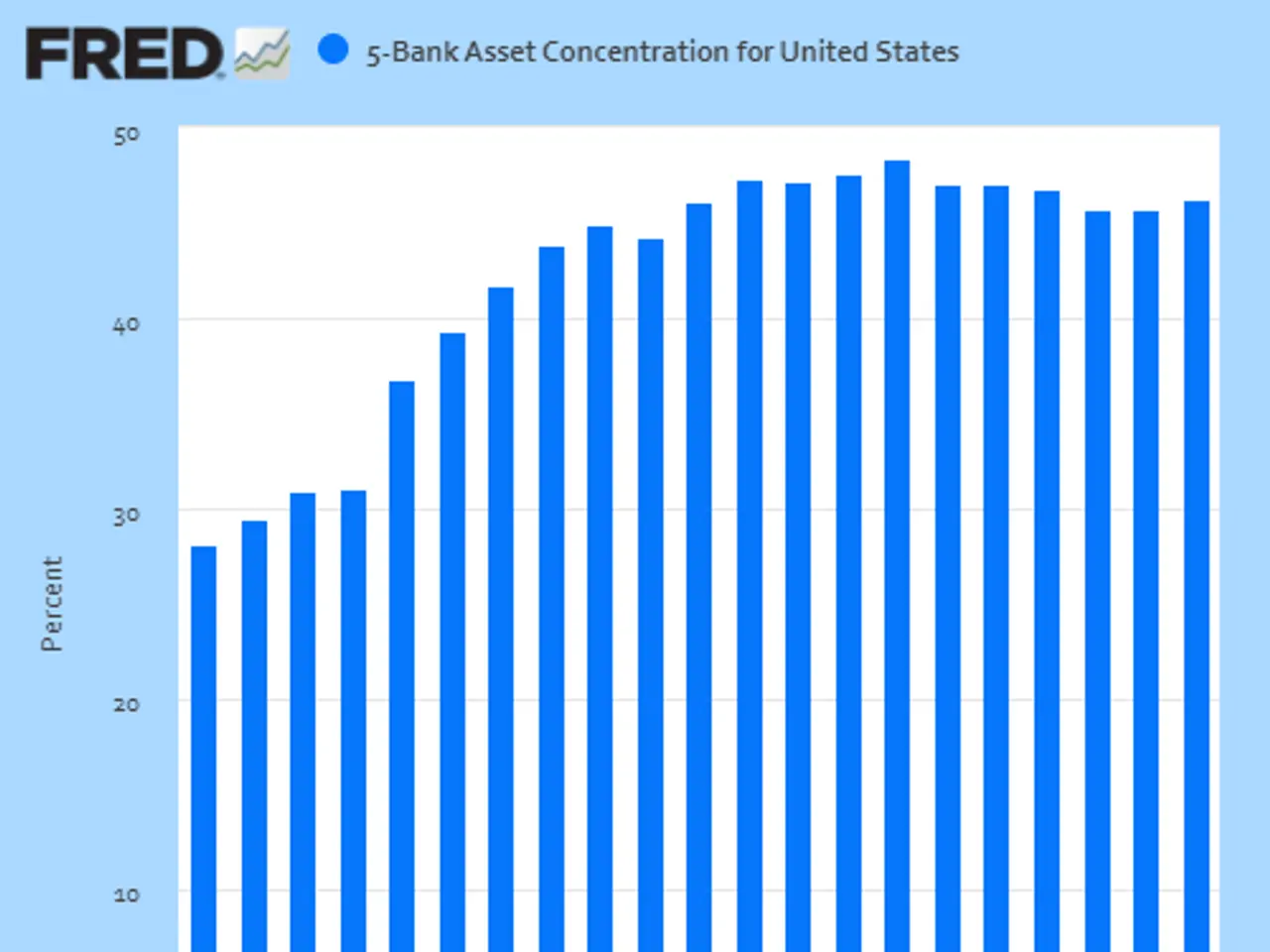

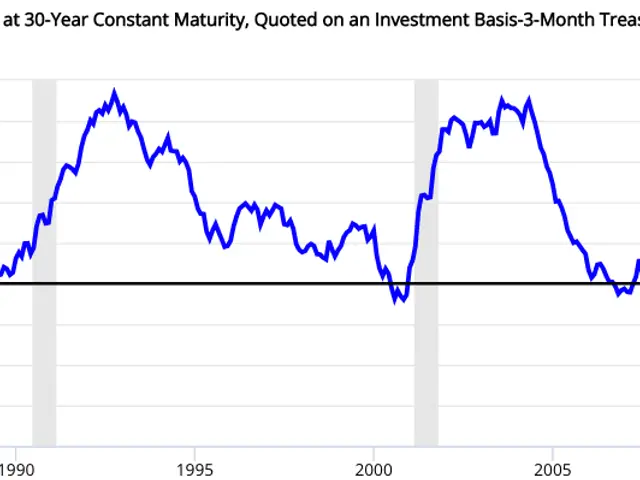

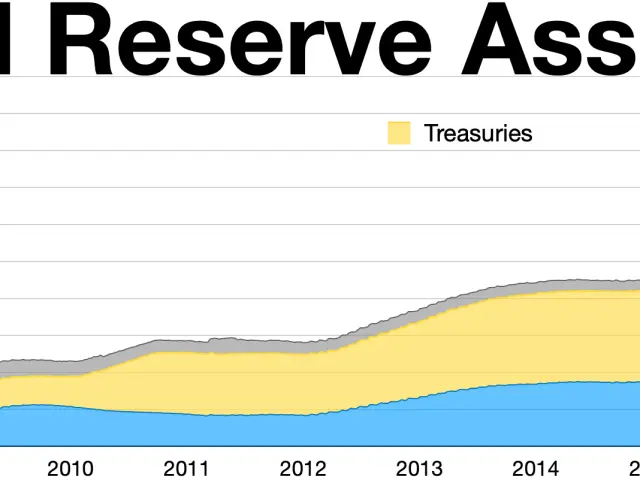

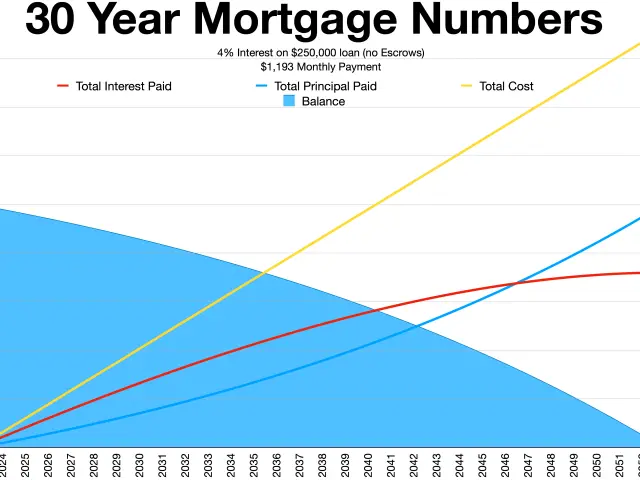

Across the Atlantic, the Trump administration has eased restrictions on bank mergers and acquisitions. Regulatory capital requirements may also be lowered, potentially encouraging further consolidation. This comes as the broader stock market remains volatile due to geopolitical tensions, pushing investors toward overlooked small- and mid-cap pnc bank and td bank stocks. A steep yield curve could further support bank profitability, allowing them to borrow at lower short-term rates while lending at higher long-term mortgage rates. However, analysts warn that a recession or sudden shift in economic conditions could disrupt this positive trend. Despite risks, the sector’s momentum appears strong for now.

The banking sector’s recovery has been driven by higher interest rates, regulatory tailwinds and investor rotation from AI stocks. European banking ETFs, in particular, have thrived due to robust credit performance and attractive valuations. While risks remain, current conditions suggest continued growth—especially if consolidation and favourable lending environments persist.